Demand recovery-industrial or heating-needed to offset looming record gas surplus

Will industrial demand recovery come in time to rescue US gas markets from the specter of a record storage surplus looming on the horizon?

Or will the market's "white knight" be an arctic express sustained over much of the heating season's remainder?

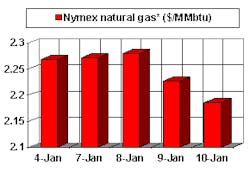

It may take either or both circumstances to prevent gas prices from piercing the $2.00/MMbtu floor in the second quarter.

There were signs of both prospects this week to help buoy gas markets for the moment. But longer term, the market may face a longer wait, for the deliverability decline to absorb the market glut, meaning recovery won't be seen before the second half.

A respite

This week's respite from 2 weeks of colder than normal temperatures only exacerbated what has been a heating season that is still, on average, warmer than normal.

That isn't likely to be reversed even with current forecasts calling for temperatures to remain normal or colder than normal throughout most of the US for the next week or so. That's because the season to date as of the week ended Jan. 5 has averaged 16% warmer than normal and 29% warmer than a year ago.

What the cold snap did accomplish was to break an 8-week string of increases in the year-to-year storage surplus, at least for the time being. UBS Warburg's Ron Barone now projects that the year-to-year surplus will fall to less than 1 tcf by February.

But that's still a lot of overhanging gas. At the end of last week, according to American Gas Association data, the industry withdrew 190 bcf from stoarge, compared with withdrawals of 124 bcf the prior week and 167 bcf the same week a year ago. It also exceeded market expectations of a 165-175 bcf withdrawal, Barone notes.

That leaves current storage levels at 2.67 tcf vs. 1.56 tcf a year ago, a prior 3-year average of 2.18 tcf, and a prior 7-year average of 2.14 tcf. But it's also diminished greatly from the record storage level the industry posted the week of Nov. 23, 2001, when storage hit 3.14 tcf.

Recall that, at this time last year, the year-to-year change in gas inventories was actually a deficit. That fact says it all when comparing gas prices today with a year ago. Spot prices for January have struggled to average a little over $2.50/MMbtu on average across the US, up from $2.25/MMbtu last month. But comparable year-ago spot gas prices averaged nearly $10/MMbtu for January.

Hanging heavy

The storage surplus is likely to hang heavy for weeks to come, perhaps through the first half of the year.

CIBC World Markets is projecting a record surplus for the end of the heating season.

Based on expectations of normal winter heating demand in the first quarter, CIBC analyst Christopher Teal pegged the surplus at 1.136 tcf last week and forecast that storage would end the winter heating season at a record 1.5 tcf. This is 60% higher than the prior 8-year average end-season winter storage level.

Theal is betting on a resuscitation of demand driving any recovery in gas prices in the near term, with industrial gas consumption, fuel-switching in the wake of higher oil prices (owing to the recent OPEC-non-OPEC accord), and nuclear power plant maintenance turnaround outages the most likely indicators of a recovery.

But a sustained recovery isn't likely before the second half, says Teal.

In fact, some factors could accelerate the downward trend in gas prices. According to Energy Security Analysis Inc. Senior Analyst Mary Menino, noting ESAI's prediction of a generally downward trend in gas prices over the next 6 months, "If a move to dump storage begins earlier than February, the downturn could occur more rapidly than we have predicted."

ESAI contends that while late February is the traditional time for cleaning out inventories, but with this year's buildup, the Boston-ara consulting group projects heavy draws during the first 2 weeks of February: "Once the heavy draws begin, there tends to be a rush for the door," Menino said. "No one wants to be caught with low-valued stocks at the end of the season."

The fact that some storage owners have clauses in their contracts that require them to withdraw their gas by a certain end-of-season date will only reinforce the stampeded, ESAI says.

That leaves the group projecting a gas price 30-50¢/MMbtu lower than current prices.

Which means skirting awfully close to that $2 threshold-and in turn just steepening the angle for recovery in the second half, when increased cooling load, economic recovery-induced demand revival, and declining deliverability kick in to start the rollercoaster all over again.

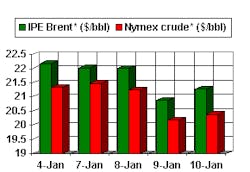

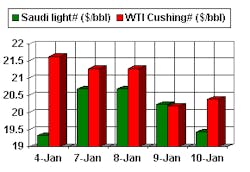

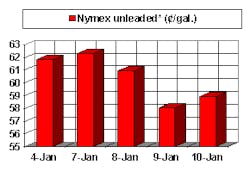

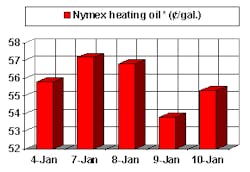

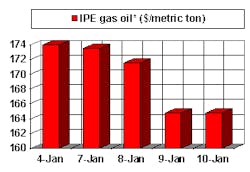

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.

null

null

null

null

null

null