OGJ Newsletter

Europe seeks alternatives to Russian energy supplies

The European Union should improve access to gas from the Caspian region, coordinate supply problems among member states, and keep a closer watch on oil stocks, according to a report by the European Commission.

“A southern gas corridor must be developed for the supply of gas from Caspian and Middle Eastern sources—this is identified as one of the EU’s highest energy security priorities,” said a draft of the EU’s Second Strategic Energy Review.

The 27-member bloc is seeking to reduce its reliance on Russian gas after pricing disputes between Russia and transit states disrupted supplies in recent years and Russia’s invasion of Georgia in August increased tensions.

Russia already supplies 42% of the EU’s gas, and Moscow—seeking to increase its sway over the EU—is competing hard to buy up volumes in North Africa and Central Asia.

European Energy Commissioner Andris Piebalgs last week visited Turkey and Azerbaijan, seeking to smooth the way for supplies of Caspian and Central Asian gas to reach Europe directly instead of passing through Russia (OGJ Online, Nov. 10, 2008).

The EC will seek firm gas supply commitments from Azerbaijan and Turkmenistan, and will look at creating a consortium for buying Caspian gas, said the review, which will be published Nov. 13.

Although the EU has a variety of gas suppliers, including Russia, Norway, Algeria, and other countries, some individual member states are particularly dependent on a single supplier, such as the Baltic countries’ dependence on Russia.

“Strategies to share and spread risk and to make the best use of the combined weight of the EU in world affairs can be more effective than dispersed national actions,” the draft report said.

In the commission’s view, EU nations also could improve the security of their supplies by strengthening infrastructure.

“Connecting the remaining isolated energy markets in Europe is a priority,” the report said, adding that the commission would develop plans next year for linking the Baltic countries’ energy infrastructure with the rest of the bloc.

The commission also plans to draft an action plan for LNG infrastructure, study the possibility of an offshore wind park in the North Sea, and look into methods for improving links between Europe and countries along the southern Mediterranean shore.

The EC draft report also recommended that both strategic and commercial oil stocks be better managed.

Nigeria to streamline energy ministry

Nigerian President Umaru Yar’Adua is replacing his gas and power ministers in a cabinet reshuffle that builds on other restructuring within the country’s petroleum sector.

Emmanuel Olatunde Odusina, Nigeria’s Minister of State for Energy (Gas) has been ousted as has Alhaja Fatima Ibrahim, Minister of State for Energy (Power).

The Ministry of Petroleum Resources was split earlier this year into power, gas, and petroleum, with separate ministers heading each strand. At the same time it was renamed the Energy Ministry.

However, Yar’Adua has again consolidated the three divisions to streamline them under the name of the Ministry of Petroleum Resources, and he will appoint one minister to head it. He is compiling a list of ministerial nominees to send to the Senate in the coming days.

Other reforms include the creation of a new, separate ministry for the Niger Delta to coordinate a response to the crises in that area, where militants continue to attack oil company pipelines and installations.

Bakassi kidnappers release oil service vessel crew

Kidnappers on Nov. 11 released the 10 crew members of the oil service vessel Bourbon Sagitta, who were abducted Oct. 31 off the Bakassi peninsula between Nigeria and Cameroon (OGJ Online, Nov. 3, 2008). The French Foreign Ministry, which made the announcement, described their release as a “100% Cameroon operation.” It said there was no violence involved and no ransom paid.

The politically motivated kidnapping was carried out by a Bakassi group called the Niger Delta Defense and Security Council, which disputed an International Court ruling handing over the Bakassi peninsula to Nigeria.

The crew included six Frenchmen, one Franco-Senegalese, a Tunisian, and two Cameroonians. All were said to be in good health, and they are expected to return home to their respective countries by Nov. 12.

The vessel belonged to Bourbon Offshore Surf, which expressed gratitude to the Cameroon authorities, the French Foreign Ministry, and others who contributed to the crew’s release.

French president Nicolas Sarkozy said Cameroon President Paul Biya was instrumental in freeing the hostages, and Foreign Minister Bernard Kouchner credited the Nigerian authorities, with whom contact had been maintained throughout.

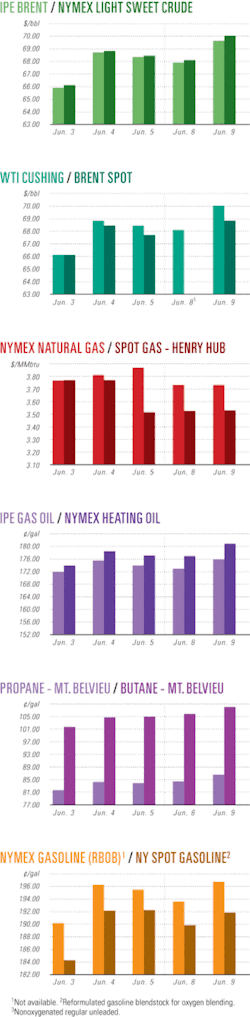

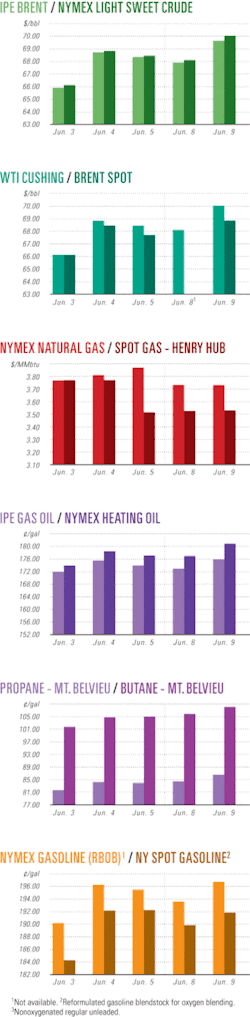

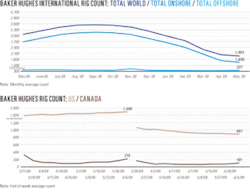

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesStatoilHydro, Chesapeake join in E&P pact

StatoilHydro has ventured into unconventional gas opportunities and gas shale development under an agreement signed with Chesapeake Energy Corp., the largest US natural gas producer.

The companies have committed to jointly look for gas in China, Romania, and Ukraine, said Statoil Executive Vice-Pres. Peter Mellbye in a conference call with analysts and investors.

StatoilHydro has agreed to spend $3.38 billion for a 32.5% in Chesapeake’s gas assets in the Marcellus shale region in Pennsylvania, West Virginia, and New York. StatoilHydro said $1.25 billion would be paid in cash, and the outstanding $2.125 billion would constitute a 75% carry on drilling and completion of wells during 2009-12.

“In order to earn this carry, Chesapeake is required to maintain a significant level of drilling activity,” the Stavanger-based major added.

The acreage covers 7,300 sq km and will add future recoverable equity resources of 2.5-3 billion boe. StatoilHydro’s equity production from the Marcellus shale gas play is expected to increase to a minimum 50,000 boe/d in 2012 and at least 200,000 boe/d after 2020, with net positive cash flow from 2013. Chesapeake plans to build upon its leases in the Marcellus shale play with StatoilHydro having a right to a 32.5% interest in them.

“The agreement we have entered into with Chesapeake provides us with a solid position in an attractive long-term resource base at competitive terms,” said Helge Lund, president and chief executive officer of StatoilHydro. “This is a significant step in strengthening our US gas position, building on our existing capacity rights for the Cove Point LNG terminal, our gas trading and marketing organization, and the gas producing assets in the US Gulf of Mexico.”

The development program could support the drilling of 13,500-17,000 horizontal wells over the next 20 years, using up to 50 drilling rigs. The expected cost is estimated at $3.5 million/well, with an ultimate recovery of 560,000 boe/well.

The transaction is expected to close by yearend.

This announcement follows other recent deals that Chesapeake has struck with Plains Exploration & Production Co. and BP America to raise funds and develop its natural-gas holdings: Plains bought a 20% working interest in its assets in the Haynesville shale in north Louisiana and East Texas for $3.3 billion, and BP America acquired a 25% stake in its assets in the Fayetteville shale for $1.9 billion.

Ithaca Energy to develop Jacky field

Ithaca Energy (UK) Ltd. expects to produce 7,500 b/d of oil from one well on Jacky field in the UK North Sea under its development plan, which the UK government has just approved.

The field, which is expected to come on stream in early 2009, will require a small wellhead platform and downhole pumping to assist the production well. The platform will be installed when the weather has improved. Pipelines are scheduled to be laid in December.

The company will work with partner North Sea Energy (UK) Ltd. on Jacky, which holds 5.2 million bbl of proved and probable reserves, some 10 km northeast of Beatrice field in the Inner Moray Firth area of the UK continental shelf.

Oil from Jacky will be processed at the company’s nearby Beatrice oil facilities and exported via the Beatrice pipeline to the Nigg oil terminal, which Ithaca also leases, for storage and offloading to tankers.

“Ithaca intends to invest in enhancing production from Beatrice, and as part of this, the pipeline from Jacky to Beatrice will also be used to restore production from the Beatrice Bravo facility, which was shut in last year by Talisman,” the company said.

Lawrie Payne, Ithaca chief executive, said Jacky would provide large cash flow and would help develop the Beatrice area and other projects.

Ithaca holds a 90% share in Jacky, and North Sea Energy (UK) 10%.

Circle Oil tests Ouled N’Zala gas well in Morocco

Circle Oil PLC has tested 3.32 MMscfd of natural gas from an exploration well on the Ouled N’Zala permit in Morocco.

Exploration well ONZ6, which is the first successful well for the company in the country, struck gas in the Upper Ouled formation. It will now undergo an extended production test.

Circle Oil is evaluating the results to determine the size of the resource, including carrying out an extended well test. It has not completed a full assessment of the reserves.

“The field test results are in line with our expectations for this area,” said Circle Oil Chief Executive David Hough. “We look forward to the results of the next well, which will be the first in the Sebou permit where Circle holds a 75% interest.”

Circle Oil will now drill on the Sebou permit, which is the second of the six-well drilling program.

The Ouled N’Zala permit lies northeast of Rabat in the Rharb basin in Morocco. The Rharb basin is a foredeep basin in the external zone of the Rif folded belt.

Circle Oil can convert the concession agreement to a production license of 30 years, plus extensions, if it has commercial discoveries.

Norway offers 79 blocks in latest licensing round

Norway, in its 20th licensing round, has invited operators to bid for 79 blocks or parts of blocks on the Norwegian continental shelf.

Operators can apply for 51 blocks in the Norwegian Sea and 28 blocks in the Barents Sea. In this—one of the country’s largest licensing rounds ever—Norway hopes that companies will make new discoveries and enhance production, particularly in the Barents Sea where successful wells may open new exploration areas.

“However, this [development] must be balanced against environmental and fishery interests,” said Terje Riis-Johansen, Minister of Petroleum and Energy.

Several blocks are in the deep waters of the Voring basin, which is a relatively underexplored area of the Norwegian Shelf.

Interest has been strong from small and medium sized oil companies as they seek to build their asset bases.

The deadline for operators to submit bids is Nov. 7. Winners will be announced next spring.

Drilling & Production Quick TakesVaalco restarts production off Gabon

Vaalco Energy Inc., Houston, has successfully upgraded its floating production, storage, and offloading vessel off Gabon and restored production from its oil fields sooner than expected.

The vessel, the Petroleo Nautipa FPSO, which gathers oil from Etame and Avouma/Tchibala fields, was operating at full production within 31/2 days, instead of the 5-7 days schedule originally quoted. It has a 1.1 million bbl of oil storage capacity and recent debottlenecking increased its processing capacity to 25,000 b/d.

The company installed an expanded flare system and increased the water processing capacity at the FPSO to accommodate production from its planned development well in Ebouri.

This area has the potential to produce 5,000 b/d of oil and its development well is expected to come onstream in January 2009. Vaalco plans to drill on Ebouri in mid-November using the Adriatic 6 jack up drilling rig. Once this starts production, Vaalco’s total production will reach 25,000 b/d.

Last January, Avouma started production from two wells, which currently deliver 10,000 b/d.

On the Etame block off Gabon, Vaalco will drill three exploration wells back to back using the Pride Cabinda jack up drilling rig, Pride Cabinda. This area already produces 12,000 b/d.

Italian Castello gas field development approved

Italy has granted Sydney-headquartered producer Po Valley Energy Ltd. a 20-year production concession for Castello gas field near Milan.

It is the first concession grant in the Po Valley region since the country’s gas sector was deregulated in 1998.

Po Valley Energy has completed construction of a surface plant for Castello, and connection of the pipeline to the Italian national gas grid 500 m away will begin in December to be completed early in 2009. Gas production is scheduled to begin in second-quarter 2009.

The field will be produced from a single well at an initial production rate of about 2.7 MMcfd of gas. The field’s remaining proved gas reserves are put at 4.6 bcf of gas.

Some 12 bcf of gas was first produced from Castello field by Italian state company Eni over a period of 8 years during the 1980s.

ConocoPhillips lets contract for Greater Ekofisk

ConocoPhillips has awarded the front-end engineering and design for its Greater Ekofisk area development’s 2/4 Z wellhead platform in the Norwegian North Sea to two John Wood Group PLC companies, Mustang Engineering and JP Kenny.

Mustang will design the 7,400-tonne jacket and topsides for the 40-slot wellhead platform, which will be installed in 70-75 m of water.

JP Kenny will provide design services for subsea flow lines and pipelines across the Greater Ekofisk area, “building upon a prior contract to provide services associated with the subsea water injection,” John Wood Group reported.

The FEED project is expected to be complete by yearend 2009.

Pemex can ‘triple’ drilling program says official

Petroleos Mexicanos could triple the amount of its exploratory drilling to an average of 1,800 wells/year from the current 600 as the result of new contracting arrangements approved under reform legislation, according to a senior company official.

Pemex Exploration & Production (PEP) director Carlos Morales Gil told Mexico’s El Financero newspaper that the new contracts provided for in the Pemex law—Regulating Article 27 of the Constitution—and to its amendments “are going to allow us to quicken the pace and build a stronger Pemex.”

In this regard, Morales told the paper that, with the substantial improvement in Pemex’s ability to execute projects on land and offshore, the state-owned firm will be able to replenish 100% of its reserves by 2012 and begin developing deepwater deposits in 2014-15.

The boost in exploration capacity will increase output in the medium term, so that it is back to more than 3 million b/d, the level of Pemex production until 2007.

“We’re going to be able to generate more value and more oil revenue,” Gil said, explaining that the new legislation will enable Pemex to offer incentives that will improve services from contractors.

In particular, Morales said the new contracting arrangements would provide an additional incentive for companies to work hard, improve, and be more efficient, creating more value for the Mexican people.

Morales said the new legislation empowers PEP to award contracts directly under certain conditions, as when safety and protection of the environment are involved or in the case of risk or emergency.

All other contracts will be awarded under the traditional arrangement of competitive bidding, he said.

Morales emphasized that Pemex will be able to reach its targets of higher production and reserves because it also will have greater flexibility and capacity to manage its budget more independently.

He added, however, that greater accountability and transparency would also be required of it.

He said the country would likely not have to import crude oil to meet its needs.

“We don’t see the possibility of Mexico becoming an importer. Pemex is producing 2.8 million b/d, which is far more than we consume—1.3 million b/d on average.”

Morales’ views largely echoed those of Energy Secretary Georgina Kessel Martinez, who told delegates at a conference: “As a result of the reform that has been approved, the country would reverse the decline in crude oil production that we have seen in recent years.”

Kessel said that, due to the new legislation, Pemex “will be able to develop highly complex deposits, such as Chicontepec and the deep waters in the Gulf of Mexico, in an effort to boost output, the rate of reserve replenishment, and the rate of recovery at our deposits.”

Processing Quick TakesDow, Sabic start up ‘world’s largest’ PP train

Dow Technology Licensing and Saudi European Petrochemical Co. (Ibn Zahr)—a Saudi Basic Industries Corp. (Sabic) joint venture—have started up what they say is the world’s largest single polypropylene (PP) train at Al Jubail industrial city on the Persian Gulf coast. Nameplate capacity is 500,000 tonnes/year of PP resins, the companies say.

To manufacture homopolymers and random copolymers, the facility uses the Unipol PP process technology, a gas-phase process that requires no equipment for handling, separating, or recycling solvents in producing the PP resins.

“When this plant and others currently in the execution stage enter service, Unipol PP process technology will be used to produce nearly 11 million tonnes/year of [PP], which will represent more than 16% of total global capacity,” the companies reported.

PetroSA’s $11 billion Coega refinery moves ahead

South Africa’s Department of Minerals and Energy in early October granted a manufacturing license to PetroSA for its Project Mthombo—an $11 billion, 400,000 b/d refinery to be built in the Coega industrial development zone outside Port Elizabeth.

KBR has completed a prefeasibility study for the project, and PetroSA has received about 30 bids for the feasibility and the front-end engineering and design phases. These are expected to be awarded shortly, according to PetroSA Chief Executive Sipho Mkhize.

PetroSA said that a strong focus will be given to “maximum black economic-empowerment participation,” and emphasized that “proven experience in projects of the planned refinery’s size and nature” was a primary consideration.

PetroSA more recently named UK-based KBC Process Technology Ltd. as technical and commercial services advisor for the development.

HSBC, London, is project financial adviser for the refinery. HSBC will provide fiscal guidance and manage project investment funding and structuring arrangements for PetroSA.

A final decision on constructing the project will be made, possibly in 2010, after the feasibility and FEED studies are completed. The refinery is expected to be operational in 2014.

Transportation Quick TakesVopak pursues new Turkish storage terminal

Royal Vopak plans to construct an oil products storage terminal on the coast of the Sea of Marmara in the vicinity of Yalova, Turkey.

The company has bought GY Elyaf ve Iplik Sanayi Ticaret Anonim Sirketi from Global Yatirim Holding AS, the Turkish public natural gas and power generation company, for an undisclosed sum. It will submit applications to secure necessary permits and prepare marketing, technical, and economic plans. “Thereafter a final investment decision to construct the terminal can be taken,” Vopak said.

The 26-ha industrial plot of land will serve the greater Istanbul area and store liquid bulk chemical, oil, and vegetable oil products.

Vopak said its customers were interested in using independent storage facilities around the Sea of Marmara because of its major development.

Oman sells its 7% stake in CPc to Russia

Oman has sold Russia its stake in the Chevron Corp.-led Caspian Pipeline Consortium (CPc), which owns and operates the 1,580-km Tengiz-Novorossiisk oil pipeline.

“Rosimushchestvo (Russia’s federal property agency) has finalized the deal to buy Oman’s 7% stake in CPc,” confirmed Igor Dyomin, a spokesman for Russia’s state pipeline monopoly OAO Transneft.

In early October, an Omani official said the Arab country would consider selling its stake, but that no firm offer had been made.

“If the offer is right, then why not? We have had a few interested parties but nobody put in a firm proposal,” said an Omani finance ministry official.

The Omani government gave no reason for selling its stake, but industry sources said Muscat had grown frustrated over protracted disagreements among the consortium members about funding expansion of the pipeline.

Russia had long opposed the plan to double the capacity, saying the pipeline yielded low returns and that its expansion would add pressure to the already congested Turkish Straits shipping route.

But Russian objections ended when most of the partners agreed to raise the shipping tariff to $38/tonne from last year’s $30.24/tonne and when investors agreed to reduce interest rates by 50% on a $5 billion loan to CPc.

BP PLC, however, still opposes the expansion plan and said it might also sell its 6.6% stake—held through Lukarco and Kazakhstan Pipeline Ventures—if the CPc partners do not reach a compromise.

Russia owns a 31% stake in CPc through Russian crude pipeline monopoly OAO Transneft, while the Kazakh government has a stake of 19%.

Other CPc shareholders are Chevron 15%, Lukarco 12.5%, a Rosneft-Shell joint venture 7.5%, ExxonMobil 7.5%, Eni 2%, BG 2%, Kazakhstan Pipeline Ventures 1.75%, and Oryx Caspian Pipeline 1.75%.

Enbridge announces open season on Midla pipeline

Enbridge Energy Partners LP announced a nonbinding open season for additional firm capacity on its Enbridge Pipelines (Midla) LLC subsidiary’s interstate natural gas pipeline system. Enbridge said the proposed expansion will allow Midla shippers improved access from the Perryville hub to the ANR Pipeline in Franklin Parish, La., the Transco Pipeline in West Feliciana Parish, and industrial facilities in the Baton Rouge area.

Each of the connections will receive an additional 25 MMcfd on the system by virtue of new compression. Enbridge anticipates project completion in third-quarter 2009.

The open season will begin Dec. 1 and end Feb. 28, 2009.

Imports from Northeast Texas into the Southeast US-Gulf Coast region via Carthage-to-Perryville shipment were up an average of 1.8 bcfd as of July compared with the same period in 2007, including a 1 bcfd gain on CenterPoint’s CP Line and a 700 MMcfd increase on Gulf South’s East Texas-to-Mississippi expansion (OGJ, July 7, 2008, p. 74).

The Midla pipeline consists of 170 miles of 22-in. OD low-pressure pipeline running across Louisiana and Mississippi from Perryville to Baton Rouge.