IEA revises up slightly 2024 oil demand forecast

Global oil demand is projected to increase by a higher-than-expected 1.7 million b/d in first-quarter 2024, driven by an improved outlook for the US and increased bunkering activities, according to the International Energy Agency (IEA)'s March 2024 Oil Market Report (OMR).

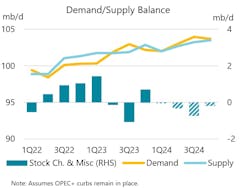

Although growth for 2024 has been adjusted upward by 110,000 b/d compared with the previous month's report, the pace of expansion is on track to slow to 1.3 million b/d from 2.3 million b/d in 2023. This slowdown aligns with the return of demand growth to its historical trend, alongside efficiency improvements and the adoption of electric vehicles (EVs) leading to reduced oil consumption. The agency also said that it assumes OPEC+'s production cuts to continue until the second half of this year, so the global oil market will face a supply shortage throughout 2024 instead of the previously expected oversupply.

“The slowdown in growth, already apparent in recent data, means that oil consumption reverts towards its historical trend after several years of volatility from the post-pandemic rebound. A weaker economic outlook further tempers oil use, as do efficiency improvements and surging electric vehicle sales. Growth will continue to be heavily skewed towards non-OECD countries, even as China’s dominance gradually fades. The latter’s oil demand growth slows from 1.7 million b/d in 2023 to 620,000 b/d in 2024, or from roughly three-quarters to half of the global total, under the gathering weight of a challenging economic environment and slower expansion in its petrochemical sector,” IEA said.

World oil production is projected to fall by 870,000 b/d in first-quarter 2024 vs fourth-quarter 2023 due to heavy weather-related shut-ins and new curbs from the OPEC+ bloc. From this year’s second quarter, non-OPEC+ is set to dominate gains after some OPEC+ members announced they would extend extra voluntary cuts to support market stability. Global supply for 2024 is forecast to increase 800,000 b/d to 102.9 million b/d, including a downward adjustment to OPEC+ output.

“Iran, which last year ranked as the world’s second largest source of supply growth after the US, is expected to increase production by a further 280,000 b/d this year. Output policy for the remainder of the OPEC+ bloc will be revisited when ministers meet in Vienna on 1 June to review market conditions. In this [OMR] report, we are now holding OPEC+ voluntary cuts in place through 2024 – unwinding them only when such a move is confirmed by the producer alliance. On that basis, our balance for the year shifts from a surplus to a slight deficit, but oil tanks may get some relief as the massive volumes of oil on water reach their final destination,” IEA noted.

Global refinery crude runs are forecast to rise to a summer peak of 85.6 million b/d in August from a February low of 81.4 million b/d. For the year as a whole, throughputs are projected to increase by 1.2 million b/d to average 83.5 million b/d, driven by the Middle East, Africa, and Asia. Refining margins improved through mid-February before receding, with the US Midcontinent and Gulf Coast as well as Europe leading the gains.

Global observed oil inventories surged by 47.1 million bbl in February. Offshore stocks dominated gains as seaborne exports reached an all-time high and shipping disruptions through the Red Sea tied up significant volumes of oil on water while onshore inventories declined.

Global stocks plunged by 48.1 million bbl in January, with OECD industry stocks at a 16-month low.

ICE Brent futures rose by $2/bbl in February as ongoing Houthi shipping attacks in the Red Sea kept a firm bid under crude prices. With oil tankers taking the longer route around Africa, more oil was kept on water, further tightening the Atlantic Basin market and sending crude’s forward price structure deeper into backwardation.