US remained largest LNG supplier to Europe in 2023

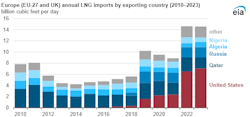

In 2023, the US maintained its position as the largest supplier of LNG to Europe (EU-27 and the UK), supplying nearly half of the total LNG imports, according to data from CEDIGAZ. This marks the third consecutive year that the US has led in LNG supply to Europe, accounting for 27% (2.4 bcfd) of total European LNG imports in 2021, 44% (6.5 bcfd) in 2022, and 48% (7.1 bcfd) in 2023.

Following the US, Qatar and Russia remained the second and third largest LNG suppliers to Europe in 2023. Qatar contributed 14% (2.0 bcfd), while Russia contributed 13% (1.8 bcfd). Combined, the US, Qatar, and Russia supplied three-quarters of Europe’s LNG imports in both 2022 and 2023.

Europe’s LNG import capacity (regasification capacity) is projected to expand to 29.3 bcfd in 2024, marking an increase of over one-third compared with 2021. This growth, reported by the International Group of Liquefied Natural Gas Importers (GIIGNL) and trade press, has been accelerated by the full-scale invasion of Ukraine by Russia in February 2022. The invasion prompted European countries to reduce imports of natural gas from Russia via pipeline, leading to the reactivation of previously dormant regasification projects and the initiation of new ones.

Germany is leading the expansion in LNG regasification capacity in Europe, with developers adding 1.8 bcfd in 2023 and plans to add 1.6 bcfd in 2024. Additionally, in 2022 and 2023, the Netherlands, Spain, Italy, Finland, and France collectively increased their regasification capacity by 3.2 bcfd. In 2024, Belgium, Greece, Poland, the Netherlands, and Cyprus are expected to add a combined 1.8 bcfd of new capacity.

Despite an estimated 4.2 bcfd increase in regasification capacity, Europe's LNG imports averaged 14.7 bcfd in 2023, remaining relatively unchanged from 2022. This stability was influenced by mild winter weather in the Northern Hemisphere during 2022–23, which reduced heating demand and resulted in record-high natural gas storage levels in Europe.

From June 2022 to April 2023, Europe experienced peak LNG imports, reaching 18.1 bcfd. However, imports declined in subsequent months due to full storage inventories, high international LNG prices, and energy conservation measures that significantly reduced natural gas consumption.

In 2023, France, Spain, the Netherlands, and the UK combined accounted for almost two-thirds (9.3 bcfd) of Europe’s total LNG imports. Germany imported its first LNG in January 2023 and ended the year accounting for 4% (0.6 bcfd) of Europe’s total imports. The US supplied more than 80% of Germany’s LNG imports.