EIA: Venezuela's heavy crude oil production gains limited after US lifts sanctions

The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) effectively lifted most US sanctions on Venezuela’s energy sector on Oct. 18 for 6 months, facilitating increased exports of the heavy, sour crude oil the country produces (OGJ Online, Oct. 19, 2023). Despite this shift, the energy sector in Venezuela has had years of underinvestment and mismanagement and these long-standing issues will likely limit the country’s crude oil production growth to less than 200,000 b/d by end-2024, according to the US Energy Information Administration (EIA).

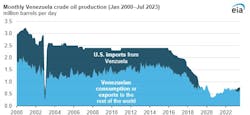

US crude oil imports from Venezuela totaled 510,000 b/d in 2018, much less than the 1.3 million b/d in 2001. The US stopped importing crude oil from Venezuela shortly after it imposed sanctions on Petróleos de Venezuela SA (PdVSA) in January 2019. The US eased those sanctions in November 2022 when OFAC granted Chevron waivers to resume exports of crude oil from its joint venture in Venezuela to US Gulf Coast refineries, which restarted in January 2023. US crude oil imports from Venezuela then increased to 153,000 b/d in July 2023.

Refineries on the US Gulf Coast are well-suited to take the kind of heavy crude oil Venezuela produces. PdVSA’s subsidiary in the US, Citgo, has three refineries—Lemont, Lake Charles, and Corpus Christi—which have a combined capacity of over 800,000 b/d and are designed to process heavy oil. These assets will change ownership later this month through a scheduled Oct. 23 sale of Citgo’s assets to satisfy creditor claims against Venezuela and PdVSA.

Venezuela’s crude oil production has fallen from about 3.2 million b/d in 2000 to 735,000 b/d in September 2023, making it the 10th-largest producer in OPEC despite its significant oil reserves. The country's crude oil production fell in September from a recent high of 790,000 b/d in July 2023. Shortages of diluent, which is necessary to process Venezuela’s heavy oil, reduced output. The lifting of sanctions will allow for increased diluent imports, which could boost production slightly.

“We expect the bulk of near-term production growth to come from Chevron’s joint ventures. The earlier exemption for Chevron led its share of production to increase to 135,000 b/d in 2023, and we expect Chevron’s output in Venezuela to increase to 200,000 b/d by the end of 2024. Ventures operated by ENI, Repsol, and Maurel & Prom could increase production by an additional 50,000 b/d in the near term, according to IPD Latin America. As a result, we asses that these ventures could raise Venezuela’s total output to about 900,000 b/d by the end of 2024.” EIA said.

“Further increases in Venezuela’s crude oil production will take longer. Much of Venezuela’s crude oil production capacity and infrastructure has suffered from prolonged lack of access to capital and regular maintenance The potential for further growth remains highly uncertain at this time because significant new investment would be required for additional production.”