WoodMac: European gas price to fall in summer 2024 on low demand

European gas prices are expected to fall 20% by mid-2024 compared with the current forward price curve despite the recent market tightening due to extensions in gas field maintenance schedules in Norway and strikes at key Australian LNG fields, according to a Wood Mackenzie report.

Despite prevailing market challenges, the European gas sector looks set to see a fall in gas demand that will have a knock-on effect on prices in the upcoming year. With storage levels reaching as high as 96% by end-October and reduced demand for gas in the power sector, prices could fall 20%, or $4/MMbtu, by next summer, compared with market expectations in the current forward price curve, the report said.

“The Norwegian maintenance schedule being extended could have had a serious impact if storage levels were not so high,” said Mauro Chavez, research director, European Gas and LNG markets at Wood Mackenzie. “And while the strikes in Australia will ripple across the global LNG market, it is more likely they will be short-lived, limiting the implications on Asian and European market balances.”

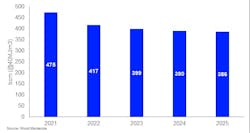

A continued decrease of 9 billion cu m (bcm) in total gas demand is expected for 2024, a y-o-y reduction of 2.2%, mainly materializing in the power sector, Wood Mackenzie said in the report. Gas in power is expected to decline by 12% y-o-y in 2024, a similar decline to 2023, caused by an increase in renewable capacity, improved nuclear performance, and relatively weak electricity demand. The anticipated rebound in industrial and residential demand is not expected to fully materialize, given challenging economic factors, according to the report.

The view of a well-balanced European market and downward pressure on prices for 2024 relies on a normal-weather assumption for winter 2023-24 and summer 2024, the report noted.

Weather will play a key role in how markets will balance, as an extremely cold winter in Europe would result in additional demand of more than 20 bcm and cause gas storage levels to fall to 26% by March 2024. With that, Europe would rail to reach its 90% storage target, resulting in substantial upward pressure on prices, Wood Mackenzie said. However, forecasts of an El-Niño year suggest a higher chance of a warmer-than-average winter across Asia and Europe, which could put further downward pressure on prices.

In 2025, however, the market is forecast to tighten once again, the report showed.

“In 2025, the European gas balance will get tighter due to Russian imports through Ukraine stopping as the transit agreement expires,” Chavez said. The market, “anticipates a big drop in prices in 2025 on the expectations that more LNG supply will be available,” he continued. “However, we think this is overplayed as it will take time for supply to ramp up, while LNG demand in Asia will increase.”

The report anticipates less LNG availability for Europe in 2025 compared with 2023-24, with storage levels reaching 90%, a lower level compared with the previous year, putting pressure on prices.