IEA: Offshore rig market enters new growth cycle

The offshore rig market is experiencing a period of rapid growth, driven by notable advancements in Guyana, Brazil, and the Middle East, infill drilling activities in West Africa, and renewed exploration in Namibia, India, and the Eastern Mediterranean, according to the International Energy Agency (IEA).

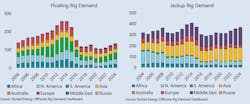

“The last offshore activity cycle peaked in 2014 and declined through 2021. But after working through the disruptive effects of COVID-19, the offshore rig market – split between floating and jackup rigs – is back on an upward trajectory,” IEA said.

More than 65 licensing rounds and over $200 billion in deepwater project final investment decisions have been scheduled from 2022-25, with 85% having a breakeven price of less than $50/bbl, consultants Wood Mackenzie recently noted. This, combined with barrels that tend to be low cost and low carbon intensity with technology-led efficiencies, is bolstering the offshore sector.

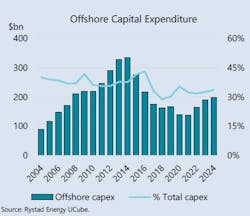

“Global offshore spending dropped from over $330 billion in 2014 to around $140 billion in 2021. At the same time, rig utilization rates fell from approximately 100% to 70%. But investment is now approaching $200 billion thanks mostly to a strong recovery in floating rigs, including semisubmersibles and drillships that can drill in depths of up to 3,050 m (10,000 ft) and 3,660 m (12,000 ft), respectively,” IEA said.

“Since the 2014 peak, the offshore fleet has been rationalized and consolidated from 270 floating rigs to 146, with 124 floaters now active. Utilization has recovered to 87% with 22 rigs idled, of which 20 may enter service in the coming years.”

Demand for floating rigs dropped to 107 in 2021 from 257 in 2014 while day rates for the non-harsh ultra-deepwater segment declined to less than $200,000/day from peaks of over $500,000/day. Current new contract day rates are back to around $450,000/day, having increased roughly 30% y-o-y. High-spec ultra-deepwater and harsh environment rigs are fully booked for the first time since 2014. Petrobras, Shell, and ExxonMobil are the top three customers in the floating rig market, accounting for one-third among them.

Commercial interest for shallow water jackup rigs that are supported by the ocean floor has been lagging the floating rig market, but a rebound is under way with utilization rates currently at 92%. Differing from floating rigs, the harsh and ultra-harsh jackup rig demand is looser than the total market, with respective utilization rates of 89% and 81%. Saudi Arabia, China, the UAE, and India drive the segment’s demand this year and next, with combined market share of 55%. Saudi Arabia and the UAE are seeking rigs mainly for development wells. India’s needs are for exploration and appraisal (E&A) and development work while China is primarily focused on E&A wells.