IEA: World oil demand scaling to record highs

World oil demand is increasing to record highs, boosted by robust summer air travel, increased utilization of oil in power generation, and surging Chinese petrochemical activity, the International Energy Agency (IEA) said its August Oil Market Report.

Global oil demand reached an all-time high of 103 million b/d in June, and there is potential for another peak in August. Following a period of subdued performance, demand from OECD countries was adjusted upwards for both May and June with overall consumption returning to growth in second-quarter 2023 after two quarters of contraction. Chinese demand was also stronger than expected, reaching new highs despite persistent concerns over the state of its economy.

According to IEA’s latest forecast, global oil demand is set to expand by 2.2 million b/d to 102.2 million b/d in 2023, with China accounting for more than 70% of growth. With the post-pandemic rebound slowing, and as lackluster economic conditions, tighter efficiency standards, and new electric vehicles weigh on use, growth is forecast to slow to 1 million b/d in 2024.

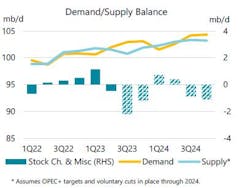

Meantime, global oil supply plunged by 910,000 b/d to 100.9 million b/d in July. This contraction was primarily attributed to a substantial decrease in Saudi Arabian production during the month. Consequently, the OPEC+ alliance's combined output fell by 1.2 million b/d to reach 50.7 million b/d, whereas non-OPEC+ production increased by 310,000 b/d, totaling 50.2 million b/d.

IEA expects global oil production to grow by 1.5 million b/d, reaching a record of 101.5 million b/d in 2023. This expansion will be chiefly driven by a rise of 1.9 million b/d in non-OPEC+ output, with the US being a major contributor to these gains. Non-OPEC+ supply is projected to continue dominating the growth of global oil supply next year, increasing by 1.3 million b/d, while OPEC+ could add just 160,000 b/d.

Russian oil exports held steady at around 7.3 million b/d in July, as a 200,000 b/d decline in crude oil loadings was offset by higher product flows. Crude exports to China and India eased month-on-month but accounted for 80% of Russian shipments. Higher oil prices, combined with narrowing discounts for Russian grades, pushed estimated export revenues up by $2.5 billion to $15.3 billion, $4.1 billion below the year-ago level.

Refining, inventory

Refinery throughputs are set to reach a summer peak of 83.9 million b/d in August, up 2.4 million b/d since May and 2.6 million b/d higher than a year ago. The increase in refined product output has failed to ease product market tightness, pushing gasoline and middle distillate cracks to near record-highs. High sulphur fuel oil cracks provided further support to margins, which pushed above 2022 levels in July.

Global observed oil inventories declined by 17.3 million bbl in June, led by OECD. Non-OECD stocks and oil on water were largely unchanged. OECD industry stocks fell by 14.7 million bbl, in line with the seasonal trend, to 2,787 million bbl. Industry stocks were 115.4 million bbl below the 5-year average, with product inventories particularly tight. Preliminary data suggest global inventories drew further in July and August.

“Market balances are set to tighten further into the autumn as Saudi Arabia and Russia extend supply cuts at least through September. An ample OPEC+ spare capacity cushion of 5.7 million b/d means there is significant scope for the alliance to raise output later in the year. Additional supplies of heavy sour crude would allow refiners to boost activity and help ease product market tensions. But if the bloc’s current targets are maintained, oil inventories could draw by 2.2 million b/d in third-quarter 2023 and 1.2 million b/d in the fourth quarter, with a risk of driving prices still higher,” IEA said.