Rystad: Discovered conventional volumes slump despite rising exploration investments

Conventional oil and gas exploration investments are rising and are projected to exceed $50 billion this year, the highest since 2019, but expected results are yet to materialize. Despite increased investments, discovered volumes are falling to new lows, according to Rystad Energy research.

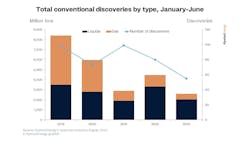

In first-half 2023, explorers found 2.6 billion barrels of oil equivalent (boe), Rystad estimates, a 42% drop compared with the same period in 2022, which saw 4.5 billion boe. Only 55 discoveries were made, compared with 80 in first-half 2022, resulting in an average discovery of 47 MMboe per discovery for 2023, lower than the 56 MMboe per discovery for the same period in 2022.

“The exploration and production (E&P) industry is in a transitionary period, with many companies exercising increased caution and shifting their strategies to target more profitable and geologically better-understood regions. This strategic shift and the failure of several critical high-potential wells are contributing to the precipitous drop,” Rystad Energy said.

Exploration companies are prioritizing the offshore sector, aiming to unlock new volumes through high-risk, higher-cost offshore developments in underexplored or frontier areas. Although the offshore industry accounts for about 95% of exploration spending year-to-date in 2023, it only contributes to around two-thirds of discovered volumes.

“Upstream companies are facing a period of uncertainty. They are eager to capitalize on the increased demand for fossil fuels and find additional resources, but recent results have been lackluster. If exploration efforts continue to yield unimpressive results for the remainder of the year, 2023 could be a record-breaker for the wrong reasons,” said Aatisha Mahajan, vice-president of upstream research, Rystad Energy.

Guyana's Stabroek offshore block leads in discovered volumes, with 603 MMboe in 2023, followed by Turkey with 380 MMboe, Nigeria with 296 MMboe, and Namibia with 287 MMboe.

“Offshore discoveries are spread relatively evenly between ultra-deepwater, deepwater and shelf finds. However, we expect increased activity in the remainder of 2023, especially in the ultra-deepwater market, with projected growth of 27% versus 2022 in terms of spud wells,” Mahajan continued.

High-impact wells are facing challenges. “Our research shows that 31 high-impact wells – designated using our tiering system based on the project’s significance and production potential – are expected to be drilled this year. So far, 13 have been completed, six are ongoing and 12 remain in the pipeline. Only four of the 13 completed wells encountered hydrocarbons, a measly 31% success rate. The results of three wells are not yet disclosed, while the remaining six failed to find any reserves. These failures significantly impact the total discovered resources and greatly contribute to the falling discoveries.”

The six majors – ExxonMobil, BP, Shell, TotalEnergies, Eni, and Chevron – continue to play a critical role in global exploration, with a prominent share of exploration spending and global conventional discovered volumes. The six companies are expected to spend about $7 billion this year on exploration, about 10% higher than in 2022. Second-half 2023 is likely to see increased exploration activity, with major players planning crucial exploration wells.

The spending and activity profiles of the majors position them firmly in the market, but national oil companies (NOC) have the most extensive subsurface resource base at their collective disposal. More than half of the projected exploration spending in 2023 will come from NOCs and NOCs with international portfolios (INOC).

“However, there may yet be some success to come this year, as only 30% of anticipated wells have been completed, highlighting the magnitude of the remaining activity. Only 23 of the remaining 56 exploration wells are either drilled or are expected to be drilled this year, meaning about 60% are likely to be drilled or postponed until 2024. So, even if 2023 proves unsuccessful, a rebound could be on the cards next year,” Mahajan said.