Rystad: Claims of global upstream underinvestment overblown amid efficiency gains

Claims of chronic underinvestment in the global oil and gas industry are overblown, according to Rystad Energy research and analysis.

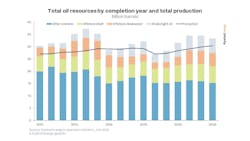

Investments in the upstream sector have declined since reaching a peak of $887 billion in 2014. The projected investment for this year stands at about $580 billion. The number of completed wells has also decreased to 59,000 this year from 88,000 in 2014.

Despite these figures, Rystad Energy's modeling and analysis present a different perspective. The industry's enhanced efficiency, driven by lower unit prices, improved productivity, efficiency gains, and evolving portfolio strategies, has boosted efficiency of the upstream sector. The industry can do the same as before, but at a much lower cost, Rystad said. While investments have contracted, activity and production remain robust and comparable to levels observed between 2010 and 2014.

“Contrary to popular opinion, the world is investing appropriate amounts of money in fossil fuel production to satisfy demand. Cost savings mean operators can produce the same amount of oil at a lower cost, and we don’t foresee an oil supply crisis due to underinvestment on the immediate horizon,” said Espen Erlingsen, head of upstream research at Rystad Energy.

To paint a more accurate picture of upstream activity, Rystad evaluates the expected resources from the wells across their lifetime, about 30 years. This metric excludes the impact of cost inflation or deflation, and includes efficiency gains and portfolio changes, as observed recently with drilling moving to areas with more productive wells.

Wells completed in 2014 have a total oil production potential of around 37 billion bbl. This was a year of overinvestment, and a sharp drop in oil prices followed in the proceeding years. From 2014 to 2016, developed resources dropped but much more slowly than investments and well counts, showing that the most productive wells were still drilled during this period.

The oil resource potential for all the wells completed in 2022 was almost 32 billion bbl, or just 15% lower than in 2014. For 2023, this value is expected to grow further and reach nearly 35 billion bbl. The recent growth in developed resources is driven mainly by US tight oil and deepwater fields.

The total resources by completion year can then be compared to total annual production to show the trajectory and sentiment of the market, according to Rystad. In an expanding oil market with growing demand, newly developed resources should outweigh total production as the volumes from new wells will be produced across a 30-year period.

“New resources will exceed total production annually until at least 2025, demonstrating the positive trajectory of the global oil industry and supporting our conclusion that an underinvestment-triggered supply shortage is unlikely in the short term,” said Espen.