EIA forecasts lower global oil inventories, higher crude oil prices

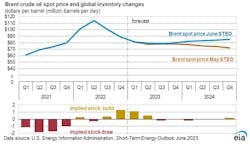

Following the OPEC+ decision June 4 to extend crude oil production cuts through 2024, the US Energy Information Administration (EIA), in its June issue Short-Term Energy Outlook (STEO), now forecasts global oil inventories to decline slightly in each of the next 5 quarters. EIA expects these withdrawals to put some upward pressure on crude oil prices, especially in late 2023 and early 2024. The agency now forecasts Brent spot prices to average $79.50/bbl in 2023 and $83.50/bbl in 2024, compared with its previous forecasts of $78.60/bbl in 2023 and $74.50/bbl in 2024.

EIA forecasts lower global oil production through 2024 compared with its assessment last month, following recent announcements from OPEC+ and Saudi Arabia. On June 4, OPEC+ members agreed to extend crude oil production cuts through end-2024. The cuts had been set to expire by yearend 2023. Following the June 4 meeting, Saudi Arabia set a new voluntary oil production cut of 1 million b/d for July 2023 (OGJ Online, June 6, 2023).

Despite the OPEC+ production cut extension, EIA forecasts global liquid fuels production will increase by 1.5 million b/d in 2023 and by 1.3 million b/d in 2024, primarily due to growth from non-OPEC producers, notably US, Norway, Canada, Brazil, and Guyana. EIA forecasts that OPEC crude oil production will fall by 600,000 b/d in 2023 and then increase by 300,000 b/d in 2024, lower than EIA's previous forecast of an increase of 600,000 b/d next year.

In the June STEO, EIA forecasts global liquid fuel consumption to rise by 1.6 million b/d in 2023 from an average of 99.4 million b/d last year. According to EIA’s forecast, consumption in 2024 will increase by 1.7 million b/d. Most of this growth comes from non-OECD countries.

EIA assumes US GDP growth of 1.3% in 2023 and 1% in 2024, which is down from last month’s forecast of 1.6% in 2023 and 1.8% in 2024, based on the S&P Global macroeconomic model for the US economy and EIA’s energy price forecasts. Lower GDP growth reduces total US energy consumption in both years compared with last month’s forecast.

The downward revision to the GDP growth forecast lowers EIA’s forecast for distillate (mainly diesel) consumption. EIA now expects US distillate consumption to decline in 2024, which differs from its forecast last month for growth in distillate consumption next year.

Overall, EIA expects US liquid fuel consumption to increase in both 2023 and 2024, driven primarily by factors unrelated to economic growth forecasts. Consumption growth in 2023 is led by gasoline and jet fuel, which continue to grow from a pandemic-related demand decline. Propane and ethane consumption are the main drivers of growth in 2024.

US natural gas

According to EIA’s forecasts, US dry natural gas production will average almost 103 bcfd in second-half 2023, slightly below its estimate of an average of about 104 bcfd in April and May. The decline reflects a reduction in directional drilling for natural gas, as Henry Hub natural gas spot prices have fallen by more than 75% from their recent peak in August 2022. However, EIA expects growth in associated natural gas production in the Permian basin to mostly offset declines in dry gas output.

EIA expects natural gas prices to rise over the summer as production declines slightly and demand for air conditioning increases the use of gas in the power sector. EIA forecasts Henry Hub spot prices to average nearly $2.90/MMbtu in second-half 2023, up from the average realized price of $2.15/MMbtu in May. Based on EIA’s forecasts, natural gas prices at Henry Hub will increase by almost 30% in 2024 from 2023 levels, to average $3.4/MMbtu.