API: US petroleum demand fell year-over-year for fifth consecutive month in April

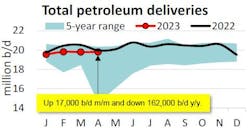

US petroleum demand, as measured by total domestic petroleum deliveries, rose by only 17,000 b/d in April month-over-month to 19.8 million b/d, according to the latest monthly statistical report from the American Petroleum Institute. Compared with April 2022, petroleum demand fell 0.8%, the fifth straight month of year-on-year (y/y) declines averaging -2.6%.

The small monthly increase in petroleum demand was a result of increases in motor gasoline, Kerosene-type jet fuel, and residual fuel, which were partially offset by the decreases in other oils (70,000 b/d m/m) and distillate fuel (37,000 b/d m/m). Declines in distillate fuel, other oils, and residual fuel resulted in a y/y decrease for the month.

Consumer motor gasoline demand, measured by motor gasoline deliveries, rose 32,000 b/d m/m in April to 8.9 million b/d and rose 156,000 b/d y/y from April 2022. Though the m/m increase of 0.4%, compared with an average increase of 0.8% for the March to April period for the past decade, reflects a comparably weaker demand, US gasoline demand has added roughly 150,000 b/d from January to April compared with the same period a year ago. Year-to-date, levels have not been this high since 2019.

Distillate demand at 3.8 million b/d was at its second lowest for April since 2017. Distillate deliveries in April fell by 1% m/m and fell 0.1% y/y compared with April 2022, marking 6 months of y/y year declines since November 2022.

Kerosene-type jet fuel deliveries of 1.6 million b/d in April rose by 0.2% m/m from March and 3.7% from April 2022. Jet fuel demand for April is the highest for the month since 2019 and has had 3 months of consecutive growth. Reports by the Airlines Reporting Corp. (ARC) show a movement in the return of air passenger demand to pre-pandemic seasonality trends. However, North American air cargo markets show a continued decline against the previous year’s demand since March 2022, slipping back below pre-COVID-19 levels, per the International Air Transport Association (IATA).

Residual fuel oil demand was 300,000 b/d in April, an increase of 42.4% m/m from March to its second highest volume for the month of April on record since 2018. Demand for residual fuel decreased y/y for two straight months, falling by 13.8% and 57.8%, respectively. The y/y decrease was consistent with reports on a sustained slowdown in US freight movement.

According to Reuters, “In the US, the number of shipping containers handled through the nine biggest ports was down 22% in March compared with a year earlier but was broadly in line with the pre-pandemic average for 2015-2019.” Additionally, a slowdown in the US industrial sector has been causing a reduction in industrial electricity consumption.

Oil production

US crude oil production of 12.4 million b/d in April rose by only 2,000 b/d from March. Compared with April 2022, crude oil production was up by 700,000 b/d y/y. A day-weighted average of active oil-directed rigs from Baker Hughes reflected 570 rigs in April, a 3.5% m/m (21 rigs) decrease from March. A day-weighted average of natural gas-directed drilling of 153 rigs in April decreased by 3.4% m/m (5 rigs) from March. NGL production of 6 million b/d in April reached its highest for the month on record since 1973, rising by 198,000 b/d m/m and by 123,000 b/d y/y.

Trade, refining

US petroleum exports of 10.2 million b/d in April—including 4.1 million b/d of crude oil and 6.1 million b/d of refined products—fell by more than 800,000 b/d m/m from March. Petroleum net exports (1.6 million b/d) contracted 46.6% from the record peak set last month. At the same time, US petroleum imports rose by 7.1% m/m in April, making it the largest m/m increase since June 2021. Product imports rose 22.7% m/m, marking the largest m/m increase since February 2022.

In April, US refinery throughput, measured by gross inputs into crude distillation units, leaped to 16.4 million b/d with an implied capacity utilization rate of 91%. The throughput rose by 2.8% m/m and by 2.1% y/y.

Inventories

US crude oil inventories of 460.8 million bbl in April fell by 2.3% m/m (10.8 million bbl) from March but rose by 9.9% y/y (41.7 million bbl) from 419.1 million bbl in April 2022. This was the largest decline for any month since November 2022. US Strategic Petroleum Reserve (SPR) inventories remained stable in April at 364.9 million bbl, their lowest since September 1983. Consequently, the US ending stocks of crude oil (including commercial and SPR) decreased by 14.7% y/y in April to 824.6 million bbl.

US distillate inventories in April remained 14.1% below their historical 5-year average and additionally, down 4% from March, undoing the previous accumulation from December to February, making it higher than only 5.2% of all months since 2008. In terms of days of supply, distillate inventories stood at about 29.2 days of supply as of Apr. 28, compared with a 5-year average of roughly 34.4 days for April, per Energy Information Administration.