IEA raises 2023 oil demand forecast as China rebounds strongly

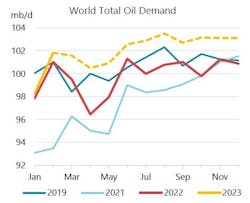

In the May Oil Market Report, the International Energy Agency (IEA) raised its forecast for world oil demand growth in 2023 to 2.2 million b/d, with China’s rebound even stronger than previously expected.

According to IEA, China, the world’s second biggest oil user after the US, will account for nearly 60% of global growth in 2023. Record demand in China, India, and the Middle East at the start of the year more than offset lackluster industrial activity and oil use in the OECD region. The latter accounts for just 15% of growth this year, supported by consumer spending and personal mobility. Overall, world oil demand is set to average 102 million b/d in 2023, 1.3 million b/d more than 2019.

On the supply side, massive losses in the Kurdish region of northern Iraq following the shutdown of the Iraq-Turkey export pipeline since end-March, wildfire disruptions in Canada, worker protests in Nigeria, and maintenance-related cutbacks in Brazil have dominated recent news. So far, however, these outages have neither triggered a spike in prices nor a significant drawdown in inventories.

Meanwhile, Russian oil supply remained resilient. In April, Russian oil exports hit a post-invasion high of 8.3 million b/d. By IEA’s estimates, Moscow did not fully realize the 500,000 b/d supply cut it announced. In fact, Russia may be boosting volumes to make up for lost revenue. The country's oil export revenue rose by $1.7 billion to $15 billion last month, but was down 27% from a year ago, while tax receipts from its oil and gas sector were down 64% from a year earlier.

“Russia seems to have few problems finding willing buyers for its crude and oil products, frequently at the expense of fellow OPEC+ members in the two-tier market that has emerged since the embargoes came into force. New refining capacity is driving a continued shift east in forecast crude runs for the remainder of the year, mirroring regional demand strength. Record runs from refiners with access to discounted feedstock along with sustained Russian product exports and lackluster global diesel demand have undermined product cracks, margins, and crude price premiums,” IEA said.

According to IEA, global oil inventories could come under pressure again as world oil supply is set to fall further this month as new OPEC+ production cuts take effect. The record release of IEA government inventories over the past year has reduced the industry inventory deficit to less than 90 million bbl compared with the 5-year average from more than 300 million bbl a year ago. Preliminary data for April show an increase in on land product stocks. Those builds could help soften price volatility in the coming months if supply falls short of seasonal rise in world oil demand, IEA said.