In its May issue Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts the Brent crude oil spot price to average $74/bbl in 2024, $7/bbl lower than forecast in last month’s STEO.

Brent crude oil spot prices fell to close at $73/bbl on May 4 from an average of $85/bbl in April. In early April, OPEC and partner countries (OPEC+) announced production cuts of 1.2 million b/d through end-2023, and crude oil prices rose on expectations of tighter oil supplies. However, continued concerns about weaker global economic conditions, risks to the global banking sector, and persistent inflation outweighed the initial rise in oil prices, sending oil prices lower.

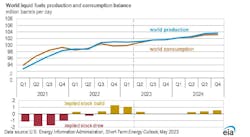

Global liquid fuels consumption in EIA’s forecast increased by 1.6 million b/d in 2023 and by 1.7 million b/d in 2024, and most expected liquid fuels demand growth is in non-OECD Asia, led by China and India. EIA expects this demand growth will bring the global oil market into balance between third-quarter 2023 and first-quarter 2024 and push the Brent price from current levels to $75-80/bbl.

Beginning in second-quarter 2024, EIA expects consistent global oil inventory builds over the rest of the forecast period as global oil production outpaces global oil demand, putting downward pressure on crude oil prices. EIA forecasts global oil inventories will grow by 300,000 b/d in 2024.

EIA forecasts that global liquid fuels production will increase by 1.5 million b/d in 2023 compared with 2022, mainly due to growth in non-OPEC producers. Excluding Russian production, EIA expects non-OPEC liquid fuels production to increase by 2.2 million b/d in 2023 and by another 1.1 million b/d in 2024.

EIA forecasts Russian production to decline by 300,000 b/d in 2023. Russia's crude oil and other liquids production is expected to decline from 10.9 million b/d in 2022 to 10.6 million b/d in 2023 and 10.5 million b/d in 2024.

“The decline in Russian production in March and April was partly due to the announcement of 500,000 b/d of Russian refinery cuts and maintenance, which we expect to end in June. We assume that a return to near-normal operations at refineries helps Russia's liquid fuels production increase slightly from 10.4 million b/d in second-quarter 2023 to 10.5 million b/d in 2024,” EIA said.

EIA forecasts total OPEC crude oil production to fall by 300,000 b/d in 2023, largely due to the cuts announced by OPEC+ on Apr. 3. In addition to expected compliance with voluntary production cuts, recent force majeure disruptions in Iraqi crude oil exports and restrictions on Nigerian crude oil exports have also reduced EIA’s near-term OPEC forecasts for 2023. EIA forecasts total OPEC liquids production to increase by 600,000 b/d by 2024, driven by the end of OPEC+ production cuts in 2023.