Moody’s: Energy industry outlook stable amid firm fundamentals

The outlook for the global energy industry is stable over the next 12-18 months, with earnings remaining elevated as the industry steps down from exceptionally high gains in 2022, according to recent analysis from Moody’s Investors Service.

“The deceleration is led by lower average oil and natural gas prices. Lower prices and heightened volatility do not point to a resolute weakness in fundamental conditions in the energy industry, as prices should remain above our medium-term price ranges and companies have improved operating and financial resilience,” Moody’s said in a report.

Risks to the stable outlook include an abrupt decline in oil prices as a result of financial developments, along with lower demand, potentially caused by the risk of broader financial and economic disruption from weakness in the banking sector, Moody’s noted. Rising societal concerns over the longer term around climate change also translate to increased risks for the industry from energy transition, greater regulation, and reduced investor demand.

E&P sector

Moody’s expects low-to-mid single-digit volume growth for exploration and production (E&P) companies in 2023 amid higher but still restrained level of capital spending and ongoing shareholder payouts. Natural gas pricing will remain elevated in Europe and Asia, but will struggle in North America.

“Most E&P companies should have sufficient operating cash flow for reinvestment, shareholder returns and even reducing debt in 2023, despite the threats from rising breakeven costs, weak North American natural gas prices, and potentially softer energy demand. E&P companies are more resilient to lower prices today after significantly reducing debt and improving capital efficiency during 2021-22,” Moody’s said.

Specifically, according to Moody’s, virtually all investment-grade and even high-quality speculative-grade oil producers can generate free cash flow if WTI averages $65/bbl or higher in 2023. But higher interest rates and choppy capital market conditions will affect a small group of E&P companies that have significant near-term refinancing or external funding needs.

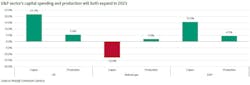

Moody's also expects E&P capital spending to rise by about 15% and production to grow by 5% in 2023, based on preliminary guidance from the largest 43 North American E&P companies. But total spending and production will not match early 2020 pre-pandemic levels.

“Unlike previous upcycles, producers have continued to exercise capital discipline, even with prolonged high oil prices, for several reasons. Investors are demanding that public companies prioritize returns over growth, and producers are wary of runaway cost inflation; an uncertain outlook for demand; and tight markets for materials, equipment, and labor in general. Increasing regulations and costs to reduce the world's fossil fuel dependence and shift toward cleaner and more sustainable energy consumption also make it harder for companies to make long-term capital-investment commitments,” Mood’s said.

Refining

The refining and marketing (R&M) sector will continue to generate solid EBITDA in 2023, above mid-cycle levels, though EBITDA will decline by double-digit percentages from the extraordinarily high levels of 2022 amid lower refining margins, Moody's said. Refiners' margins will ease in 2023 on increasing production and slowing growth in demand for gasoline and distillates, but distillate margins will remain stronger than gasoline margins on tighter supply and demand dynamics.

Global fuel demand will increase slightly in 2023 but uncertain economic conditions pose risks to refining margins if they suppress consumption. Although aggregate EBITDA for the R&M sector will be lower in 2023, it will still remain at a multiyear high, Moody’s said.