Oil, gas producers continue to ramp up capital spending in 2023

Capital spending by oil and gas companies will continue growing in 2023, driven by a sustained favorable commodity price environment, strong cash flows, and cost inflation. However, the growth rate will not be as rapid as in 2022. Capital discipline remains a key word, with the industry reiterating its commitment to reducing debt, increasing shareholder returns and increasing share buybacks. Still, spending in 2023 will be flat or slightly below the pre-pandemic level.

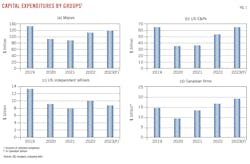

Combined capital expenditures by major oil companies including ExxonMobil Corp., Chevron Corp., Shell PLC, bp PLC, Eni SPA, Equinor ASA, and TotalEnergies SE will rise 7% year-on-year (y-o-y) to $119.7 billion in 2023, following a 27% rise in 2022. Spending by this group remains below the pre-pandemic level of $132 billion in 2019.

Majors are continuing to increase spending on renewable energy and low-carbon projects as they set targets to become net-zero emissions companies by 2050. European majors have invested heavily in solar and wind, while US giants like ExxonMobil and Chevron are focusing more on renewable fuels and carbon capture and storage (CCS). It is worth noting that some have slowed their shift away from oil and gas in view of tighter traditional energy markets.

A group of 26 US-listed exploration and production (E&P) companies plan to spend approximately $63.7 billion in total capital expenditures in 2023, up 21.5% from a year ago and flat with the 2019 level of $64 billion. This however compares with a 48% growth in capital spending last year. The group’s oil production in 2023 is expected to rise 6% y-o-y.

In addition to ambitious US E&P companies, Chevron’s US upstream spending is expected to reach $8 billion in 2023, up from $6.85 billion a year ago. ExxonMobil is expecting strong production growth in the Permian basin in 2023. Based on current capital guidance from US E&P companies and majors’ US upstream plans, US upstream capital spending is expected to increase more than 20% this year from a year earlier.

The refining environment was quite favorable in 2022, thanks to strong demand, capacity closures, and low product inventories. Capital spending of US independent refiners increased by 26% in 2022, following sequential drops of 31% and 12% in 2020 and 2021. The product market remains tight in 2023 as Chinese demand is ramping up and restrictions could remove Russian barrels from the market. However, in 2023, US independent refiners’ capital spending will drop 15%, with their focus switching to turnaround and maintenance activity. More maintenance is expected in 2023 after pandemic-era delays and the refining system has been operating at maximum utilization for nearly a year.

A group of leading Canadian oil & gas producers increased their capital spending by about 24.5% in 2022. They will continue to increase capital spending in 2023 versus 2022, by an estimated 13.7%.

Majors’ spending plans

ExxonMobil’s capital spending in 2023 is expected to be $23-$25 billion, up from $22.7 billion in 2022 and $16.6 billion in 2021 but lower than the 2019 level of $31 billion. The company remains on track to deliver a total of about $9 billion in structural cost reductions by year-end 2023 versus 2019.

ExxonMobil also announced its corporate plan for the next 5 years through 2027. The corporate plan through 2027 maintains annual capital expenditures at $20-$25 billion, while growing lower-emissions investments to approximately $17 billion.

Assuming a $60/bbl Brent price, ExxonMobil forecasts 2023 upstream production of 3.7 million boe/d, level with its 2022 projection. The 2023 number incorporates recent divestitures as well as the company’s departure from Russia. Together, those two elements accounted for about 260,000 boe/d of production.

Looking out to 2027, more than 70% of ExxonMobil’s capital investments will be deployed in strategic developments in the US Permian basin, Guyana, Brazil, and in LNG projects around the world. By 2027, upstream production is expected to grow by 500,000 boe/d to 4.2 million boe/d with more than 50% of the total to come from the mentioned key growth areas. Roughly 90% of upstream investments that bring on new oil and gas production are expected to have returns greater than 10% at prices less than or equal to $35/bbl, while also reducing operated greenhouse gas emissions intensity by 40-50% through 2030, compared with 2016 levels.

Chevron announced 2023 organic capital expenditure budgets of $14 billion for consolidated subsidiaries and $2.9 billion for equity affiliates.

In 2023, Chevron plans to spend $8 billion in US upstream and $3.5 billion in international upstream. In 2022, 2021, and 2020, US upstream expenditures were $6.85 billion, $4.55 billion, and $4.93 billion, respectively. Over the years, international upstream expenditures were $2.72 billion, $2.22 billion, and $2.55 billion, respectively.

Upstream capital expenditures in 2023 include more than $4 billion for Permian basin development and roughly $2 billion for other shale-tight assets. About 20% of upstream spending is for projects in the Gulf of Mexico.

Worldwide downstream spending in 2023 is projected to be $1.9 billion, including capital targeted to grow renewable fuels and products businesses. Chevron’s downstream spending was $2 billion in 2022, $1.1 billion in 2021, $1.28 billion in 2020.

Chevron’s lower-carbon capital expenditures across all segments total around $2 billion, including about $500 million to lower the carbon intensity of Chevron’s traditional operations and about $1 billion to increase renewable fuels production capacity.

In 2022, bp’s capital expenditure was $16.3 billion. The company expects capital expenditure to be $16-18 billion in 2023 and $14-18 billion per year between 2024-30. This includes investments on inorganic opportunities.

Within the ranges, bp plans to allocate $6-8 billion in 2025, rising to $7-9 billion in 2030, to its transition growth projects, including bioenergy, convenience, electric vehicle (EV) charging, renewables, and hydrogen. This equates to more than 40% of 2025 capital expenditure, rising to around 50% of 2030 capital expenditure. BP’s cumulative investment in these transition growth engines is expected to be $55-65 billion between 2023 and 2030.

Acknowledging investor concerns on the impact on portfolio returns from an accelerated transition, as well as sustained tightness in oil and gas markets, bp announced a shift to its strategic outlook to 2030, increasing the focus on higher rate-of-return businesses. Key changes include increased capital spending on both transition businesses and oil and gas. Oil and gas production is expected to be 2.3 million boe/d in 2025 and 2 million boe/d in 2030 (down 25%), compared with a prior outlook of 2 million boe/d in 2025 and 1.5 million boe/d in 2030 (down 40%).

Shell’s capital expenditure for the full year 2023 is expected to be at the lower end of the $23-$27 billion range. The company’s capital expenditure was $24.8 billion in 2022, $19.7 billion in 2021 and $17.8 billion in 2020.

In 2023, about $8 billion is allocated to upstream businesses. Integrated gas receives $5 billion each. Chemicals/products receive $3-4 billion. Somewhere between $2 billion and $4 billion is for renewables and energy solutions. $6 billion is aimed for marketing.

Shell plans to distribute at least 20-30% of cash flow from operations to shareholders. Subject to board approval, bp aims to grow its dividend per share by around 4% every year.

TotalEnergies expects capital investments of $16-$18 billion in 2023, of which $5 billion will be allocated to further strengthening renewable operations and electricity. In 2022, TotalEnergies’ capital spending was $16.3 billion.

Equinor’s organic capital expenditure is estimated at $10-11 billion for 2023, up from $8.7 billion in 2022, and at an annual average of about $13 billion for 2024-26. Production in 2023 is expected to be 3% above 2022. Equinor is targeting more than half of its gross capital expenditure to renewables and low-carbon solutions by 2030.

Eni’s capital expenditures are forecast to be €9.5 billion for 2023 and € 37 billion from 2023-26, a 15% increase in US dollar terms versus the outlook the company provided last year. Eni’s average upstream capital spending over the next 4 years will be still be more than 10% lower than its spend in 2019. Eni continues to raise ambition around low- and zero-carbon energy, expecting to spend in excess of 25% of total capital in this area over the next 4 years.

US E&Ps’ spending plans

A group of 26 leading public US E&P companies plans total capital expenditures of approximately $63.7 billion in 2023, a 21.5% increase from the 2022 level.

ConocoPhillips Co.’s total capital guidance for 2023 is $10.7-$11.3 billion, which includes base capital of $9.1-9.3 billion and expected major project spending of $1.6-2 billion. This compares with $10.16 billion in total capital expenditure and $8.1 billion in base capital in 2022.

According to ConocoPhillips, the current year’s base capital spending growth is driven by inflation of $550 million and increased activity of $450 million. Major project spending this year will come from Willow spending of $100-$400 million and LNG spending of $1.5-1.6 billion.

ConocoPhillips’s 2023 production guidance is 1.76-1.80 million boe/d, compared with 1.74 million boe/d produced in 2022.

In February 2023, ConocoPhillips announced 2023 planned return of capital to shareholders of $11 billion.

Occidental Petroleum Corp.’s total planned 2023 capital expenditures are between $5.4 billion and $6.2 billion. That’s dramatically up from $4.5 billion in 2022 and $2.9 billion in 2021. The company said it is facing higher costs across its oil, chemicals, and new energy businesses.

Occidental plans to spend $4.3-$4.7 billion to develop its oil and gas properties in 2023, compared with 3.8 billion in 2022. Occidental plans to spend about $4.6 billion/year over the next 5 years to develop its proven undeveloped (PUD) reserves in the Permian basin.

Occidental expects its global oil and gas production to retreat this year from 2022 as it focuses on “promoting additional capital efficiency” in its Permian basin operations while continuing to pay down debt and return capital to investors. The company plans to produce an average of 1.18 million boe/d this year, down nearly 4% from fourth-quarter 2022.

EOG Resources Inc.’s capital expenditure for 2023 is expected to range between $5.8 billion and $6.2 billion. About $4.4 billion of the capital program is allocated to its existing and emerging premium areas. The company expects a 3% growth in its oil production and a 9% growth in total oil-equivalent production.

Pioneer Natural Resources Co. expects its 2023 capital budget to range between $4.45 billion and $4.75 billion, compared with capital expenditures of $3.8 billion in 2022. Pioneer expects its capital program to be funded from 2023 cash flow. The company also introduced 2023 oil and total production guidance of 357,000-372,000 b/d and 670,000-700,000 boe/d.

Hess Corp. announced a 2023 E&P capital and exploratory budget of $3.7 billion, of which more than 80% will be allocated to Guyana and Bakken. Net production is forecast to average between 355,000 boe/d and 365,000 boe/d in 2023.

For the full-year 2023, Devon Energy Corp. expects to sustain production of 643,000 to 663,000 boe/d. Total capital investment for the year is expected to range from $3.6 billion to $3.8 billion. These capital requirements in 2023 are estimated to be self-funded at pricing levels as low as a $40/bbl WTI oil price.

Marathon Oil Corp. expects a capital budget of $1.9-$2 billion for 2023. The 2023 plan is expected to provide adjusted free cash flow (FCF) of $2.6 billion, assuming a WTI price of $80/bbl. Marathon Oil plans to return at least $1.8 billion to shareholders.

Marathon Oil expects to deliver maintenance-level total oil production of 190,000 b/d at the midpoint of its 2023 guidance range. Total oil equivalent production is expected to be 395,000 boe/d at the midpoint of guidance.

Range Resources Corp. announced an all-in 2023 capital budget of $570-615 million and plans to maintain production at 2.12-2.16 bcfd. The company plans to bring on 61 net wells and maintain liquids at 30% of production.

US independent refiners

For US refiners, there may be more “catch-up” maintenance activity in 2023, following the pandemic-era deferrals, and the refining system having already operated at maximum utilization for almost a year. Meantime, investments to increase renewable fuels production continue to account for a significant part of growth capital.

Phillips 66 Co. announced a 2023 capital program of $2 billion, including $865 million for sustaining capital and $1.1 billion for growth capital. About 50% of growth capital supports lower-carbon opportunities.

In refining, Phillips 66 plans to invest $1.1 billion, including $389 million for reliability, safety, and environmental projects. Refining growth capital of $729 million includes the continuing conversion of the San Francisco refinery in Rodeo, California, into a 50,000 b/d renewable fuels plant, one of the world’s largest. Refining growth capital will also support opportunities for high-return, low-capital projects to improve asset reliability and market capture.

The midstream capital plan of $639 million comprises $329 million for sustaining projects and $310 million for growth projects. Growth capital will be directed toward enhancing the company’s integrated NGL value chain from wellhead to market.

Including Phillips 66’s proportionate share of capital spending associated with joint ventures Chevron Phillips Chemical Co. and WRB Refining LP, the company’s total 2023 capital program is projected to be $3.1 billion.

Marathon Petroleum Corp.’s (MPC) standalone capital spending program for 2023 is $1.3 billion. About 70% of overall spending is focused on growth capital and 30% on sustaining capital. Of the $900 million of growth capital, roughly 40% is allocated to low-carbon opportunities.

MPC’s Refining & Marketing (R&M) segment expects capital expenditures of about $1.25 billion in 2023. This amount includes roughly $350 million of growth capital for low-carbon projects, primarily the Martinez refinery conversion and an emissions reduction project at its Los Angeles refinery. There is also $550 million of growth capital focused on traditional projects such as the South Texas Asset Repositioning project and projects expected to help reduce future operating costs. Maintenance capital is expected to be about $350 million.

Marathon Petroleum guidance forecast a lower utilization rate of 89% in first-quarter 2023, compared with 93% in fourth-quarter 2022 and 92% in first-quarter 2022.

MPLX, a master limited partnership by MPC, announced a capital outlook of $950 million, which includes roughlyly $800 million of growth capital and $150 million of maintenance capital. The capital spending plan focuses on expansions and debottlenecking of MPLX’s existing Logistics & Storage segment assets, and increasing its Gathering & Processing segment’s capacity.

Valero Energy Corp.’s consolidated capital expenditure for 2023 is $2 billion, down from $2.74 billion in 2022. Turnarounds are expected to be heavy. Sustaining capital investment will be $1.59 billion in 2023, up from $1.37 billion in 2022 and $1.13 billion in 2021, while growth capital will be $425 million in 2023, down sharply from $1.37 billion in 2022 and $1.34 billion in 2021.

Valero’s refining unit will get $1.57 billion in 2023, down from $1.76 billion in 2022. The renewable diesel segment will get $280 million, down from $879 million in 2022 and $1 billion in 2021.

In January 2023, Valero announced that Diamond Green Diesel (DGD) approved a $315 million project to produce sustainable aviation fuels (SAF). The project is expected to be completed in 2025 and is also expected to make DGD one of the largest SAF manufacturers in the world. Meantime, the Port Arthur Coker project is expected to be completed in second-quarter 2023 and to increase the refinery’s throughput capacity, while also improving turnaround efficiency.

HF Sinclair, formed in 2022 with HollyFrontier Corp. acquiring most of Sinclair Oil Corp.’s.’ assets, plans to spend $910 million-1.1 billion across its business (excluding Holly Energy Partners LP) in 2023, which will skew heavily toward turnaround and catalyst work. Spending on turnaround and catalyst programs is expected to be $530-630 million, more than 57% of the total capital budget.

Delek US Holdings Inc. announced its 2023 capital spending budget of $350 million, primarily focused on a significant y-o-y increase in turnaround-maintenance expenses, particularly a turnaround at its 75,000-b/d Tyler refinery planned in first-half 2023.

PBF Energy Inc. expects full-year 2023 refining capital expenditures, excluding capital expenditures related to the St. Bernard Renewables (SBR) project, to be in the $700-$750 million range. PBF’s SBR project remains under construction and is expected to be producing renewable diesel and other products first-half 2023. PBF anticipates remaining capital expenditures to complete the project will range from $200 million to$250 million in 2023. Total projected capital costs for SBR and related infrastructure are expected to be $600-650 million.

Canadian spending

Financial data for the Canadian segment are presented in Canadian dollars unless otherwise stated.

In 2023, Suncor Energy Inc. expects capital expenditures of $5.4-5.8 billion, up from $4.82 billion in 2022. Total upstream spending is pegged at $4.35-4.65 billion. Upstream E&P capital is set at $725-$775 million in 2023, up from $440 million in 2022. Capital expenditure for upstream oil sands ranges from $3.62 billion to $3.87 billion in 2023, up from $3.54 billion in 2022. Downstream capital expenditure will be $1-$1.1 billion in 2023, up from $816 million in 2022.

Suncor expects full-year 2023 production to be in the range of 740,000-770,000 boe/d, with oil sands production of 385,000-425,000 b/d.

Canadian Natural Resources Ltd.’s 2023 budget is targeted at $5.2 billion, consisting of about $4.2 billion in base capital and roughly $1 billion in strategic growth capital. In 2023, Canadian Natural Resources targets y-o-y production growth of about 56,000 boe/d, or 4%, more than 2022 targeted levels, based on the midpoint of the 2023 production guidance range of 1.33-1.37 million boe/d.

Cenovus Energy Inc. plans to invest $4-$4.5 billion in 2023, including about $2.8 billion of sustaining capital to maintain base production and support continued safe and reliable operations. A range of $1.2-1.7 billion will be directed towards optimization and growth, including construction of the West White Rose offshore project in Atlantic Canada, continued optimization of Cenovus’s oil sands assets, and opportunities in the downstream business to improve reliability and increase margin capture.

Cenovus’ total upstream production target in 2023 is 800,000-840,000 boe/d, an increase of more than 3% y-o-y. The target for total throughput of downstream crude oil is 610,000-660,000 b/d, a y-o-y increase of nearly 28%.

Imperial Oil Ltd.’s capital expenditures for 2023 are expected to be $1.7 billion, up from $1.49 billion in 2022 and $1.14 billion in 2021. Spending for 2023 includes a planned ramp-up of the Strathcona renewable diesel project, application of solvent technologies at Cold Lake and ongoing investment on the in-pit tailings project at the Kearl oil sands site.

Imperial has included about $200 million in incremental capital in its 2023 plans, predominantly due to accelerating the start-up of the first phase of Cold Lake Grand Rapids by about 1 year, to year-end 2023, as well as adding incremental and accretive rail transportation scope to the Strathcona project to increase access to high-value markets. A final investment decision for the renewable diesel project is expected in 2023.

International upstream spending

Evercore ISI expects global upstream spending to grow 14% in 2023, down from 20% in 2022, with total investment expected to approach $500 billion. The annual Barclays E&P Spending Survey, which surveyed 160 companies, estimates that capital spending will rise 13% to $412 billion by 2023. In percentage terms, Latin America is expected to see the largest increase in spending (+30%), due to aggressive Petróleo Brasileiro SA (Petrobras) plans. This is followed by Africa (+22%), the Middle East (+17%), and North America (+17%).

Petrobras plans to invest more than $78 billion in capital expenditures to meet targets outlined in its new 2023-27 strategic plan. Petrobras said the amount is higher than the average of its most recent 6 strategic plans, indicating a return to pre-COVID levels of investment.

Saudi Aramco’s 2022 capital expenditure was $37.6 billion, an 18% increase from 2021. Aramco expects capital spending of about $45-55 billion in 2023, including external investments.

China National Offshore Oil Corp. (CNOOC) raised its production target and capital expenditure budget for 2023. Its net production target is 650-660 million boe, of which, production from China and overseas accounts for roughly 70% and 30%, respectively. Net production is expected to reach 690-700 million boe in 2024 and 730-740 million boe in 2025. The company’s total capital expenditure for 2023 is budgeted at RMB 100-110 billion, of which, capital expenditures for exploration, development, production and others will account for about 18%, 59%, 21%, and 2% of total capital expenditure, respectively. To promote low-carbon development and expand its new energy business, CNOOC said it will advance onshore power projects for offshore platforms to reduce greenhouse gas emissions.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.