API: US petroleum demand in February highest since late 2022

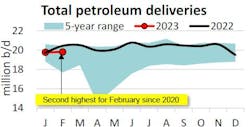

US petroleum demand, as measured by total domestic petroleum deliveries, was 19.8 million b/d in February, an increase of 45,000 b/d from demand in January to its highest reading since November 2022, according to the latest monthly statistical report by the American Petroleum Institute (API).

However, compared to February 2022, it was a decrease of 3.1% year-over-year (y-o-y). On a yearly basis, reduced petroleum demand was a result of distillates falling 500,000 b/d y-o-y.

Though motor gasoline demand, measured by motor gasoline deliveries, had the smallest y-o-y increase for the month since 2011, gasoline demand (8.6 million b/d) in February reflected an increase of 4.8% month-on-month (m-o-m) from January, compared with an average increase of 3.6% for the same period for the past decade.

Distillate deliveries of 3.7 million b/d in February fell by 4.4% m-o-m from January and 12% y-o-y compared with February 2022 to their lowest for the month since 1999. DAT industry trendlines showed that the quantity of spot trucks decreased by 9.7% m-o-m, while the number of spot loads decreased by 17.4% m-o-m, which together showed that the relative number of loads to be shipped decreased by more than that of trucks available in February, which was consistent with reports that US freight volumes fell.

Kerosene-type jet fuel deliveries of 1.4 million b/d in February fell by 0.8% m-o-m from January, compared with an average seasonal increase of 0.2% m-o-m between January and February over the past decade. However, jet fuel demand of 1.4 million b/d represented an increase of 2.6% y-o-y and was at its highest monthly point versus pre-pandemic levels. High-frequency data from Flightradar24 and TSA showed that the total numbers of flights and air passengers increased by 7.5% y-o-y and 18.3% y-o-y, respectively.

Deliveries of refinery and petrochemical liquid feedstocks--naphtha, gasoil, and propane/propylene (other oils)—were 5.5 million b/d in February, which was a decrease of 3.9% m-o-m from January and a fall of 1% compared with February 2022. A slow-down in US manufacturing activity underlies these data; petrochemical demand remains resilient.

Macroeconomy

The Institute for Supply Management’s manufacturing Purchasing Managers Index (PMI) had a reading of 47.7 in February–0.3 percentage points lower than in January. Index values below 50.0 suggest a contraction in the overall economy, and the manufacturing PMI fell below that threshold in February for the third straight month after a 30-month period of expansion.

The University of Michigan’s consumer sentiment index showed readings of 67 in February (preliminary) and 63.4 in March, up from 64.9 in January. The preliminary survey noted that, despite the index having improved by more than 6% versus its reading a year ago, the overall index worsened “primarily on the basis of persistently higher prices, creating downward momentum for sentiment leading into the financial turmoil.”

According to the Bureau of Labor Statistics (BLS), the unemployment rate increased to 3.6% in February from 3.4% in January.

US oil, gas production

US crude oil production of 12.3 million b/d in February improved by 0.5% from January. Compared with February 2022, crude oil production was up by 1.0 million b/d.

A day-weighted average of active oil-directed rigs from Baker Hughes reflected 603 rigs in February, a 1.8% m-o-m (11 rigs) decrease from January.

While a day-weighted average of natural gas directed drilling of 152 rigs in February fell by 2% m-o-m (3 rigs) from January.

NGL production of 5.9 million b/d in February–its highest for the month on record since 1973–increased by 8.6% y-o-y from February 2022. However, levels declined 2.6% m-o-m from January, which is the third largest monthly decline for the month since 2013.

International trade, refining

US petroleum exports of 10 million b/d in February, including 4.2 million b/d of crude oil and 5.8 million b/d of refined products, increased by 400,000 b/d m-o-m from January. Petroleum net exports were at the highest level for the month of February and at the second highest level for all months on record since 1947. At the same time, US petroleum imports rose by only 28,000 b/d m-o-m in February. In sum, the US was a petroleum net exporter of 1.1 million b/d in February.

In February, US refinery throughput was 15.5 million b/d and implied a capacity utilization rate of 85.8%. The throughput fell by 0.1% m-o-m and by 2.7% y-o-y to its lowest point for any month since March 2021.

Oil inventory

US commercial crude oil inventories of 478.8 million bbl in February grew by 5.7% m-o-m (26 million bbl) from January and by 17% y-o-y (69.7 million bbl) from February 2022. This was the largest monthly rise in inventories for any given month since April 2020.

US Strategic Petroleum Reserve (SPR) inventories remained stable in February at 371.6 million bbl, their lowest since December 1983. Consequently, the US ending stocks of crude oil (including commercial and SPR) decreased by 13.9% y-o-y in February to 850.6 million bbl.

Distillate inventories have been closely monitored amid a global shortage. US distillate inventories remained below their historical 5-year range in February. In terms of days of supply, distillate inventories were at approximately 32.4 days of supply as of February 28, compared with 33.5 days of supply in February 2019.