China's demand for imported LNG is one of the biggest uncertainties in 2023, not only for the global LNG market, but also for gas supply availability in Europe in the face of severely reduced pipeline gas flows to the continent from Russia, the International Energy Agency (IEA) said.

China's net LNG imports fell by an unprecedented 21%, or 22 billion cu m (bcm), in 2022, compared with an increase of 17% (16 bcm) in the previous year. This reduction played a crucial role in enabling a 63% (65 bcm) increase in LNG inflows into Europe to compensate for the lost Russian volumes.

However, the collapse in Chinese LNG demand in 2022 was driven by a unique set of factors – namely high spot LNG prices, slowing economic growth, and lockdowns under China’s strict zero-COVID policy – that are unlikely to be repeated in precisely the same combination in 2023, IEA said.

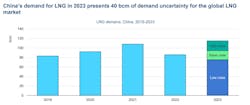

IEA’s analysis suggests that a set of only moderately bearish assumptions on China’s total gas consumption, domestic production and pipeline gas imports could push China's LNG demand down by another 12% (10 bcm) in 2023, whereas a confluence of moderately bullish conditions could boost China’s LNG intake by 35% (30 bcm) to well above the previous peak in 2021.

“The total uncertainty range is around 40 bcm, with China's 2023 net imports reaching 75 bcm at the low end and 115 bcm at the high end. This range is greater than the uncertainty associated with the potential loss of all remaining pipeline gas flows from Russia to Europe, which have averaged around 28 bcm per year since the indefinite cutoff of delivery through the Nord Stream 1 pipeline in late August 2022,” IEA said.

IEA’s latest forecast sees Chinese LNG demand reaching 94 bcm in 2023. This would be up 10% (8 bcm) from 2022, but closer to the lower end of the uncertainty range.

Nevertheless, China's growing portfolio of LNG contracts means that Chinese LNG demand in 2023 is likely to be more resilient and less affected by spot market pricing and volatility than before 2022. With about 1.3 bcm of new LNG contracts to start delivering in 2023, China's contracted LNG volumes are on track to reach almost 11 bcm this year, well above all but the most optimistic scenarios for expected LNG demand. This means that by 2023, China could increase its LNG imports to 2021 levels without increasing spot LNG purchases. According to price data from S&P Global Commodity Insights, China's contracted LNG supply in 2022 is nearly 30% cheaper than spot LNG imports at a price of just under $15/MMbtu.