EIA sharply reduces 2023 US natural gas price forecast

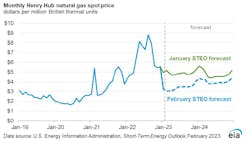

In its February 2023 Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts that the Henry Hub natural gas spot price will average $3.4/MMbtu in 2023, down almost 50% from last year and about 30% from its January STEO forecast. EIA’s forecast in the January STEO was for Henry Hub prices to average almost $5/MMbtu in 2023.

EIA revised down its outlook for Henry Hub prices as a result of significantly warmer-than-normal weather in January that led to less-than-normal consumption of natural gas for space heating and pushed inventories above the 5-year average.

“Temperatures across the US in January were the mildest since 2006, which reduced consumption of natural gas for space heating and significantly changed our forecast for natural gas markets in the coming months,” EIA said.

The Henry Hub spot price averaged $3.27/MMbtu in January, down more than $2/MMbtu from December. In the US, there were 16% fewer heating degree days (HDDs) in January than the 10-year average and 9% fewer than forecast in the January STEO.

As a result of less-than-normal natural gas consumption in January, natural gas inventories ended the month above their 5-year (2018–2022) average. EIA now expects inventories will close the withdrawal season at the end of March at more than 1.8 tcf, 16% more than the 5-year average.

“Natural gas prices remain very volatile. Extreme weather events and production freeze-offs could still potentially cause price spikes at both the Henry Hub and in regional markets, but that potential diminishes as spring approaches, particularly now that inventories have moved back above the 5-year (2018–2022) average. Although we expect close-to-normal weather for February and March, colder temperatures than expected could put upward pressure on prices,” EIA said.

2023 outlook

Overall, EIA expects US dry natural gas production to average 100-101 bcfd in 2023. EIA expects less demand for natural gas than last year for most of 2023 due to decreased demand in the electric power sector as more renewable electric generation sources come online throughout the year and due to decreased demand in the industrial sector as a result of an expected drop in manufacturing activity.

EIA also expects utilization at US LNG export plants to be slightly lower in the next few months compared with its previous forecast because of high natural gas stock levels in Europe. But US LNG exports in its forecast rise once the Freeport plant is back online, and LNG exports increase by 11% (1.2 bcfd) on an annual basis in 2023 compared with 2022.

The Freeport LNG export plant, forced offline in June due to fire, is expected back online in this year’s first quarter and will likely add over 2 bcfd of natural gas demand to the US market once fully operational.