WoodMac: Exploration sector posts strongest year in over a decade

The global oil and gas exploration sector in 2022 had its strongest year in more than a decade. In its work to improve portfolios by adding lower-carbon, lower-cost advantaged hydrocarbons, the sector created at least $33 billion of value and achieved full-cycle returns of 22%, at $60/bbl Brent, according to a recent report from Wood Mackenzie.

Exploration well numbers were less than that of pre-pandemic years, yet the total volume of 20 billion boe matched the average annual volumes of 2013-2019, the report said.

The highest volume, she said, came from “world-class discoveries in a new deepwater play in Namibia, as well as resource additions in Algeria and several new deepwater discoveries in Guyana and Brazil, where the latest wave of pre-salt exploration finally met with success.” The average discovery in 2022 was over 150 MMboe, more than double the average of the previous decade,” she said.

Liquids lead

For only the third time in 20 years, liquids (60%) accounted for the majority of new discoveries, the report said.

“There is a lot of uncertainty in future long-term demand scenarios for oil,” said Wilson. “Explorers are accelerating oil exploration to meet near and mid-term demand, while gas exploration was focused in geographies that can supply the gas-hungry European market. In some cases, major leases are approaching expiration of the exploration term and companies are pushing to optimize their value.

“By 2030, fast-tracked development of these new discoveries could deliver 1 million b/d in oil and 0.5 million boe/d gas production, generating $15 billion in free cash flow.”

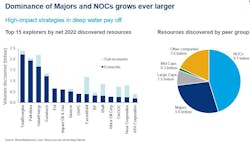

Majors, NOCs dominate

The exploration sector continues to be dominated by national oil companies (NOCs) and Majors, with TotalEnergies, QatarEnergy, and Petrobras leading net-new discovered resources in 2022. In total, NOCs and Majors accounted for almost three quarters of new resources discovered, according to Wood Mackenzie.

“Overall, we saw a year of continued discipline from explorers with exploration and appraisal well numbers largely flat from 2021. However, spend per well increased due to inflationary pressures. Appraisal well numbers increased as companies push towards final investment decisions in this short-term window of opportunity,” Wilson concluded.