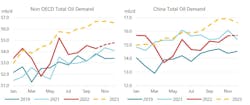

In its January monthly Oil Market Report (OMR), the International Energy Agency (IEA) raised its non-OECD demand forecast for 2023 by 140,000 b/d to 55.3 million b/d compared to last month’s report, as robust Middle Eastern and Indian consumption is complemented by China’s post-lockdowns res recovery.

“The upgrade builds on the momentum of recent months. Non-OECD demand was 270,000 b/d higher year-on-year (y-o-y) during November, driven by firmer gasoil, LPG and naphtha use. Average non-OECD demand is estimated 490,000 b/d higher y-o-y during fourth-quarter 2022, compared to expectations of 270,000 b/d in last month’s report. Total non-OECD demand for 2022 is estimated at 53.9 million b/d (+1.1 million b/d y-o-y),” IEA said.

China’s apparent oil demand in November rose by 470,000 b/d month-on-month (m-o-m) (-410,000 b/d y-o-y), maintaining the relative strength of recent months. All key products except gasoline (-260,000 b/d m-o-m) recorded monthly gains, with the biggest contribution once more coming from petrochemicals (naphtha and LPG +230,000 b/d m-o-m), where naphtha use set a new all-time high of 2.1 million b/d. For 2022 as a whole, Chinese oil demand fell by 390,000 b/d on average, its biggest ever annual decline and the first since 1990.

“Having already loosened quarantine and testing measures in November, Beijing abruptly abandoned its zero-tolerance Covid regime in early December. This U-turn was reflected in our weighted average of provincial restrictions from Oxford University’s Blavatnik School of Government (BSG), which collapsed by almost 20 points m-o-m in December, to 53%. The index is bound to fall further in January, when mainland borders will reopen to international travelers,” IEA said.

Relentlessly bleak economic data readings demonstrated the urgency behind Beijing’s U-turn. China's official manufacturing PMI fell 1 point to 47 in December, the lowest level since the early days of the pandemic. The non-manufacturing PMI, which covers the services and construction sectors, fared even worse, falling by 5 points to 41.6, deep in contraction territory. Meanwhile, the downturn in the country's housing market continued to worsen as the decline in property investment and home sales intensified in November.

As China faces a challenging winter, its exit path will unquestionably be bumpy and drawn-out, IEA noted. “Still, the accelerated re-opening has improved medium-term economic prospects - evidenced by the 30% rally in the Hang Seng stock market index in the past two months. Mobility is bound to recover after the initial wave of infections dissipates, buttressing gasoline and jet/kerosene consumption, with three years of pent-up travel demand potentially waiting be released.”

IEA has moderately increased its forecast for China’s oil demand growth in 2023, by 40,000 b/d to 850,000 b/d y-o-y, with adjustments focused on transport fuels and petrochemicals. Oil demand will return to positive y-o-y growth during second-quarter 2023 - as gasoline’s post-lockdown recovery reaches critical mass - before growing by an average of 1.3 million b/d during second half 2023. Gasoil, gasoline, LPG, naphtha and jet/kerosene will each contribute roughly 200,000 b/d y-o-y to average 2023 growth. The latter will see the biggest relative gains by far during 2023 (+44% y-o-y) as air traffic recovers, but will remain some 20% below pre-pandemic levels on average.