Moody’s: US LNG growth trajectory depends on pipeline additions

Rising global demand for natural gas is a growth opportunity for US LNG producers but delivering on the opportunity will depend on timely construction of natural gas pipeline infrastructure to support new US LNG supplies, and on continued availability of long-term offtake commitments to back financing for LNG infrastructure, Moody’s said in a research note.

Europe's energy crisis should keep the LNG market tight until 2025-26, supporting cash flow generation for US LNG producers. Europe's 2022 LNG imports increased by 50 billion cu m (bcm) from 75 bcm in 2021, according to the International Energy Agency (IEA), as Russia's piped natural gas exports to the EU shut down. Meanwhile, China's reduced domestic demand in 2022 allowed Chinese importers to redirect their contracted LNG volumes to the high-priced European spot market and help Europe to avoid major shortages. A potential recovery in Chinese domestic demand in 2023 will bring back the risk of natural gas supply in Europe, especially after the EU in December 2022 capped regional market prices, Moody's said.

“European demand might accelerate LNG capacity expansion in the US, but that would require long-term offtake commitments from European buyers, even as they are working to reconcile new energy security needs and Europe's commitments to accelerating its carbon-transition efforts,” said Amol Joshi, a senior credit officer at Moody’s.

Most of the announced US LNG growth projects through 2025-26 have long-term commitments from Asian buyers, the original source of the US LNG boom since the mid-2010s, and international commodity traders stepped up their LNG purchases in 2022. But LNG producers require long-term offtake commitments to underpin financing of new LNG infrastructure projects. LNG projects should in turn spur further capital allocation for constructing new pipeline capacity to connect the largest US gas producing regions and new export infrastructure.

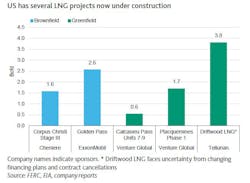

These new pipeline projects will need to win permitting approvals from the US Federal Energy Regulatory Commission (FERC), and overcome likely court challenges. Today's peak nameplate capacity of nearly 14 bcfd reflects only about one-quarter of the capacity of all announced LNG projects, including several with partial or full FERC approval and 10 bcfd under construction.

Appalachia’s Marcellus and Utica basins together contribute roughly one-third of US dry gas production, but limited takeaway capacity has constrained growth for those regions. In fourth-quarter 2022, US dry natural gas production stood at 100 bcfd exceeding year-earlier production by 3%, largely due to increased drilling and pipeline expansions in the Haynesville region and rising volumes of associated natural gas delivered by oil producers in the Permian region, Moody's said.

US LNG capacity is likely to almost double over the next 10 years, even if some of today's proposed projects do not reach completion, boosting medium-term midstream growth opportunities. But new LNG projects planned for starting service in 2025-26 and beyond must demonstrate access to long term natural gas supplies, according to Moody’s.

Several companies have already announced US midstream projects that will supply gas to LNG infrastructure, including DT Midstream’s LEAP expansion, Williams’ Louisiana Energy Gateway, Energy Transfer’s Gulf Run, Kinder Morgan’s Permian Highway expansion, and WhiteWater's Matterhorn pipeline project.