Moody’s: Global upstream spending to rise 10-15% in 2023

The upstream oil and gas sector will have another strong year based on favorable supply/demand fundamentals, although average energy prices will not reach 2022 levels, according to Moody’s. Most producers will generate solid free cash flow and will have the financial capacity to reduce leverage, boost or maintain shareholder returns, reinvest or make acquisitions, it said. Larger, lower-cost exploration and production (E&P) companies and large integrated oil companies will deliver the strongest free cash flow and have the most flexibility.

“While we expect average prices to stay above mid-cycle levels in 2023, we also anticipate a high degree of price volatility in a delicately balanced global energy market. Various factors will constrain oil and natural gas supplies, while demand growth will waver because of increased recession risks and shifting policies in the largest energy-consuming nations. Sharp price swings will remain a norm, making large or long-term capital investment decisions difficult for companies,” said Sajjad Alam, vice-president at Moody’s.

Meantime, “higher taxes on oil and gas profits in a growing number of countries will also discourage incremental investments. Most producers will try to follow the same playbook in 2023 that yielded strong financial results in 2022. Companies will look to exercise capital discipline, invest strategically, and maximize free cash flow to strengthen balance sheets, maintain high levels of shareholder distributions, and better position their asset portfolios and production levels for long-term energy transition risks. While energy security has taken center stage for many nations following Russia’s invasion of Ukraine, companies will continue to take incremental measures to reduce their emission intensity as policymakers globally press forward with their goals to transition to cleaner energy sources,” Alam said.

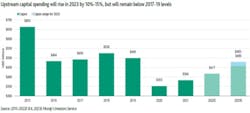

Aggregate upstream spending will rise sequentially this year, by about 10-15%. But overall spending will still fall below 2016-19 levels. More than half of the incremental spending in 2023 will go just to cover cost inflation, leaving relatively little capital for volume growth. Rising costs for oilfield services (OFS) globally, a tight labor market in the US, and lingering supply-chain delays will all limit any E&P company efforts to expand production capacity quickly in 2023.

“Each dollar reinvested will generate fewer volumes, lower margins, and less return on invested capital in 2023. Breakeven costs have been rising across all geographies, and producers focused on US shale basins are gradually exhausting their top drilling locations over time. Yet, reinvestment rates will remain low by historical standards with most companies planning to dedicate only 50-70% of their operating cash flow to maintain productive capacity. Stronger companies will likely favor acquisition and consolidation opportunities over increasing their drilling programs, to minimize the risks of cost inflation, excess supply and shareholder backlash,” said Sajjad Alam.

Sustained high commodity prices allowed many companies to reduce debt substantially in 2022, improving the sector's overall credit quality while rewarding shareholders with high dividends and record levels of share buybacks. After repairing balance sheets in 2021-22, upstream companies will have greater capacity to return capital to investors in 2023. According to Moody’s, most large companies have signaled that they will pay out 50-75% of free cash flow to shareholders through additional variable dividends and share buybacks.

“While high shareholder returns are sustainable during periods of high commodity prices, companies will have to pare these activities quickly or lever up if prices fall precipitously, which may not be welcomed by equity investors after getting accustomed to recent high returns. But the likelihood of a sustained steep price collapse is low, that should allow companies to sustain their elevated distributions,” Alam said.