IEA: oil demand finds support from strong gasoil use

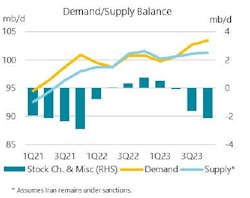

In its December issue oil market report, the International Energy Agency (IEA) said global oil demand is set to contract by 110,000 b/d year-on-year (y-o-y) in fourth-quarter 2022, reaching 100.8 million b/d, which is up by 130,000 b/d compared with last month’s report.

“Strong gasoil use in key consuming countries outweighs weak European and Asian petrochemical deliveries. Oil demand growth has been increased to 2.3 million b/d (+140,000 b/d) for 2022 as a whole and to 1.7 million b/d next year (+100,000 b/d), when it will reach 101.6 million b/d,” IEA said.

Global refinery throughputs surged 2.2 million b/d in November to the highest since January 2020, resulting in sharply lower diesel and gasoline cracks and refinery margins. After ten consecutive quarters of estimated stock draws, refined product balances are expected to be back in positive territory in first-half 2023, according to IEA.

Russian oil exports increased by 270,000 b/d to 8.1 million b/d, the highest since April as diesel exports rose by 300,000 b/d to 1.1 million b/d. Crude oil loadings were largely unchanged month-on-month (m-o-m), even as shipments to the EU fell by 430,000 b/d to 1.1 million b/d. Loadings to India reached a new high of 1.3 million b/d. Export revenues, however, dropped by $0.7 billion to $15.8 billion on lower prices and wider discounts for Russian-origin products.

According to IEA data, global observed inventories fell by 23.2 million bbl in October as product stocks fell for the first time since March and crude oil saw a smaller build. OECD industry stocks increased by 17.3 million bbl, to 2,765 million bbl, narrowing the deficit versus the 5-year average to 150.2 million bbl, but OECD government stocks fell by 19.9 million bbl. Preliminary data for the US, Europe, and Japan show industry stocks increased by 3.1 million bbl in November.

Benchmark crude oil futures plunged by around $8-9/bbl over the course of November and a further $5/bbl in early December, as macro-economic headwinds took center-stage and apprehension about OPEC+ cuts and EU embargoes faded.