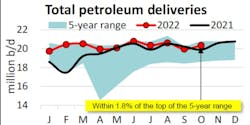

According to the latest monthly statistical report by the American Petroleum Institute (API), US petroleum demand, as measured by total domestic petroleum deliveries, was 20.3 million b/d in October, an increase of 1.9% month-on-month (m/m) from September but was down 0.2% year-on-year (y/y). The 20.3 million b/d was also 1.8% less than October 2019, which was the top of the 5-year range.

Consumer gasoline demand, measured by motor gasoline deliveries, was 8.7 million b/d in October. This reflected decreases of 1.4% from September and 3.5% compared with October 2021. A return towards urban commuting was evident. Deliveries of reformulated-type gasoline (consumed primarily in urban areas) rose by 8.5% y/y to 3 million b/d, while those of conventional gasoline (consumed mainly in rural areas) decreased by 8.8% y/y to 5.7 million b/d.

Distillate deliveries of 4.2 million b/d increased by 12% from September and by 4.6% compared with October 2021. This was the largest monthly percentage increase since January 2018 despite weaker freight trucking activities.

Kerosene-type jet fuel deliveries of 1.5 million b/d in October fell by 2.2% from September but were up by 1.6% versus October 2021 to their highest for the month since 2019. Flight-frequency data showed that the total numbers of flights and air passengers increased by 7.4% y/y and 19.1% y/y, respectively. The International Air Transport Association (IATA) reported mixed news with solid passenger demand but softened air cargo.

Deliveries of residual fuel oil were 300,000 b/d in October, which reflected decreases of 22.8% from September and 22.4% versus October 2021. This was consistent with reports of weaker container shipping and easing supply chain constraints.

Deliveries of refinery and petrochemical liquid feedstocks – that is, naphtha, gasoil, and propane-propylene (“other oils”) – were 5.5 million b/d in October, the second highest reading for the month of October since 1965. The increases of 3% m/m and 4.8% y/y reflected continued solid demand for films, packaging, and medical plastics.

Production, trade

US crude oil production of 12.1 million b/d in October increased by 1.4% from September and by 4.2% compared with October 2021. It was the second highest production for any month since March 2020.

Baker Hughes reported 609 active oil-directed rigs in October, a 1.7% m/m (10 rig) increase from September but 13.5% lower than the 704 rigs that ran in October 2019. Natural gas-directed drilling by 157 rigs in October fell from September by 5 rigs.

NGL extraction depends on the relative values of ethane, propane, and butane, which historically have tended to correspond with those of crude oil. NGL production increased by 2.7% m/m to 6.1 million b/d, its second highest level on record for any month since 1973.

US petroleum exports – crude oil (4 million b/d) and refined products (6 million b/d) – of 10.1 million b/d for October were the second highest on record for any month since 1947. Total exports increased by 22.2% y/y at the same time total imports fell by 2.0% y/y. Consequently, the US was a petroleum net exporter of 2.1 million b/d in October, the highest monthly petroleum net exports on record since 1947, according to API.

Refining, stocks

In October, US refinery throughput, measured by gross inputs into crude distillation units, was 16.2 million b/d and implied a capacity utilization rate of 89.9%. The throughput decreased seasonally by 1.8% m/m but remained at its highest for the month of October since 2018. The capacity utilization rate similarly fell by 1.7 percentage points from September but remained up by 3.8 percentage points compared with October 2021.

US commercial crude oil inventories were 438.2 million bbl in October, which increased by 6.4 million bbl (1.5% m/m) from September and by 1.6 million bbl (0.4% y/y) versus October 2021. By contrast, crude oil in the US Strategic Petroleum Reserve (SPR) fell by 23.1 million bbl (5.4% m/m) to its lowest level since 1984 and continued to fall with drawdowns through mid-November. Combined commercial and SPR crude oil inventories of 841 million bbl were at their lowest level since 2001.