IEA sees definitive peak in global demand for fossil fuels

The global energy crisis triggered by Russia’s invasion of Ukraine could become a historic turning point towards a cleaner, more affordable, and more secure energy system as outlined in the International Energy Agency (IEA)’s latest World Energy Outlook (WEO). The Stated Policies Scenario (STEPS) in the outlook is the first WEO scenario based on prevailing policy settings that sees a definitive peak in global demand for fossil fuels.

As IEA noted, alongside short-term measures to try to shield consumers from the impacts of the crisis, more governments are now taking longer-term steps. Some are seeking to increase or diversify oil and gas supplies, and many are looking to accelerate structural changes. The most notable responses include the US Inflation Reduction Act, the EU’s ‘Fit for 55’ package and REPowerEU plan, Japan’s Green Transformation (GX) program, Korea’s aim to increase the share of nuclear and renewables in its energy mix, and ambitious clean energy targets in China and India.

Scenarios

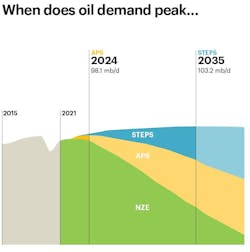

The WEO examines energy market developments under three scenarios, which differ primarily by the assumptions made on government policies. STEPS shows the trajectory implied by today’s policy settings. The Announced Pledges Scenario (APS) assumes that all aspirational targets announced by governments are met on time and in full, including their long-term net zero and energy access goals. The Net Zero Emissions by 2050 (NZE) Scenario maps out a way to achieve a 1.5 °C stabilization in the rise in global average temperatures, alongside universal access to modern energy by 2030.

Oil

In the STEPS, IEA projects that global oil demand will 2019 levels by 2023, undeterred by high oil prices. Demand peaks in the mid-2030s at 103 million b/d and then declines slightly to 2050.

“There is continued growth in the use of oil for aviation and shipping, as a petrochemical feedstock, and as fuel in heavy trucks, but from the mid‐2030s this is more than offset by declining oil use in other sectors, especially in passenger cars, buildings, and power generation,” IEA said.

IEA assumes production from Russia in the near-term falls by 2 million b/d due to European and US sanctions, and that long term it remains well below projections made prior to its invasion of Ukraine. The largest increases in production to 2030 come from the US, Middle East members of OPEC, Guyana, and Brazil. The OPEC share of oil production rises from 35% in 2021 to 36% in 2030, and 43% in 2050. The supply of liquid biofuels more than doubles to 2050, and there is a small increase in low‐emissions hydrogen-based fuels.

IEA also forecasts that upstream oil investment will rise from current levels to offset losses in supply and meet rising demand and, as markets rebalance, the oil price falls from the high levels in 2022 to around $82/bbl in 2030.

In the APS, stronger policy action leads global oil demand to peak in the mid‐2020s, just above 2019 demand levels, before dropping to 93 million b/d in 2030. Demand then falls by around 40% between 2030 and 2050, with passenger cars, road freight, and industry responsible for the largest reductions. Lower demand eases the task of offsetting the near‐term reductions in Russian oil production, but from 2030 onwards it leads inexorably to falls in production in nearly all producer countries. Oil price falls to just under $65/bbl in 2030 and continues to decline slowly thereafter as demand falls.

In the NZE Scenario, oil demand never returns to its 2019 level. Demand falls by 2.5% each year on average between 2021 and 2030, and by just under 6% each year from 2030 to 2050. The oil price is increasingly set by the operating cost of the marginal project and it falls to around $35/bbl in 2030 and to $24/bbl in 2050.

Gas

In the STEPS, IEA forecasts that natural gas demand will rise at an average rate of 0.4% per year between 2021 and 2030, well below the 2.2% average rate of growth seen between 2010 and 2021. Demand reaches 4 400 bcm in 2030 and stays at that level to 2050.

Global natural gas demand in 2050 in this year’s version of the STEPS is 750 bcm lower than projected in last year’s version. Half of this downward revision comes from more rapid moves away from unabated natural gas consumption in advanced economies. The US alone accounts for one‐third of the total downward revision: its recent Inflation Reduction Act is set to speed up the deployment of renewables in the power sector and to provide stronger support for efficiency and heat pumps in buildings. The other major downward revision comes from price‐sensitive emerging market and developing economies, where high natural gas prices mean that prospects for coal‐to‐gas switching are now more muted.

Europe’s drive to reduce reliance on Russian imports and a dearth of new gas export projects mean that natural gas prices in importing regions remain high over the next few years in the STEPS and APS, especially in Europe. In the NZE Scenario, rapid demand reductions in all regions ease the strains on global supplies, and gas import prices fall quickly. Prices come down more gradually in the STEPS and APS from the mid‐2020s as gas demand flattens and new supply projects currently under construction come onstream. Declines in domestic demand in the US open opportunities for higher LNG exports; in both the STEPS and APS, the US soon overtakes Russia to become the world’s largest natural gas exporter.