IEA: Global short-term gas demand growth comes to a halt

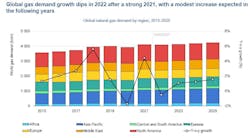

Global natural gas consumption is expected to grow at an annual average rate of 0.8% from 2022 to 2025, reaching around 4,240 billion cu m (bcm) by the end of this forecast, a limited 3.4% increase (140 bcm) compared with 2021, the International Energy Agency (IEA) said in its quarterly Gas Market Report.

This is a strong downward revision of IEA’s forecast in last year’s edition, where the agency anticipated an increase of close to 210 bcm for 2021-2024 (compound average growth rate [CAGR] of 1.7%), against around 75 bcm (CAGR of 0.6%) for the same period in this year’s edition.

“The current high price and tight supply environment that built up in the second half of 2021, and further intensified after Russia’s invasion of Ukraine in February 2022, is putting natural gas demand under strong pressure. It is expected to result in slightly negative growth for 2022, followed by meagre consumption increases in the following years. Thus, global gas demand declines by 0.5% in 2022 and then grows progressively over the following years to reach 1.5% in 2025,” IEA explained.

Gas consumption in the industrial sector remains the strongest component in global growth, and accounts for about 60% of the total increase in gas demand during the 2021-2025 period, according to IEA.

“Uncertainty remains high, however, as industrial activity is particularly vulnerable to high energy and raw material prices. Demand growth is geographically concentrated, with two regions responsible for close to 80% of the increase. The Asia Pacific region as a whole account for almost half of global gas consumption gains to 2025, followed by the Middle East at one-third, North America and Africa provide more modest contributions, while gas consumption is expected to broadly stagnate in Central and South America and Eurasia, and to decline more significantly in Europe,” IEA said.

“The risks to this forecast, in the form of lower economic activity and resulting natural gas consumption, are heavily dependent on the evolution of the war. Beyond the threat of further potential gas supply disruptions, uncertainty relating to additional problems in commodity and manufacturing supply chains and further inflationary pressure on commodities could result in a situation of stagflation (low growth and rising prices).”

“The COVID-19 situation remains a risk factor, as shown in the first half of 2022 with the return of lockdowns in China. Our forecast’s lower gas demand growth compared to last year does not guarantee an accelerated transition to net zero emissions, as the bulk of the revision comes from lower GDP and fuel switching rather than by faster gas-to-electricity conversion and efficiency gains,” IEA said.

Regional demand

The Asia Pacific region remains the main source of natural gas consumption growth between 2021 and 2025, contributing close to half of global consumption gains (nearly 70% of the net demand increase) during the outlook period. However, the region’s annual average growth rate, at 2.6% during 2021-2025, is well below that of the 2017-2021 period when it was 4.3%. High prices and a softening economic outlook weigh on the region’s demand prospects.

China, India, and emerging Asia remain the primary growth markets throughout the forecast period—although each faces considerable downside risks in today’s uncertain market environment—while Japan and Korea lead the declining markets on falling gas use for power generation in both countries.

China—driven by the industrial sector—is the single biggest contributor to consumption growth, accounting for more than 75% of the region’s increase in gas demand during the 2021-2025 period. India industry also maintains its leading role in gas demand growth, complemented by the residential and transport sectors in the country’s fast-growing city gas segment.

Emerging Asia’s growth is mainly driven by growing electricity requirements and continuing additions to gas-fired generation capacity.

Gas consumption in the North American region is expected to grow at an average annual rate of 0.7% during the forecast period. 2022 sees 2.3% growth despite high prices, due to the combination of constraints on US coal supply and stocks, which support gas-fired power generation, and temperature-sensitive demand in the initial months of the year.

US gas consumption is then expected to stagnate between 2023 and 2025. Canada’s natural gas demand grows at an average rate of 1.1% during the forecast, which is principally supported by the power generation sector on the completion of the coal phase-out in Alberta. Gas use in Mexico grows at an average of 1.4%, with a progressive slowdown in demand from the power sector and limited contributions from the industrial and retail sectors that are partly balanced by declining use in the energy sector.

Europe’s gas demand rose by over 5% in 2021, driven by recovery in economic activity and colder spring and winter temperatures supporting higher space heating requirements. In 2022, European gas demand is expected to decline by close to 9%, as record high gas prices are weighing on gas demand in the industrial and power sectors. The return to average weather conditions is assumed to reduce gas demand in the residential and commercial sectors. Russia’s invasion is leading to direct demand destruction in Ukraine, primarily in the industrial sector. Ukraine’s gas demand is set to decline by 25-30% in 2022. The strong deployment of renewables, together with the gradual implementation of energy efficiency measures, is set to weigh on European gas demand, declining at a rate of 3% per year over the forecast.