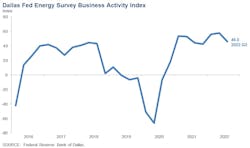

Activity in the oil and gas industry expanded at a robust pace in the third quarter, according to oil and gas executives surveyed by the Dallas Fed Energy. The business activity index—the survey's broadest measure of conditions facing energy companies in Eleventh District—remained at a high of 46 but was down from a record 57.7 in the previous quarter. This indicates that the pace of expansion has slowed slightly but remains solid.

Exploration and production (E&P) company executives said oil and gas production rose at a similar pace compared to the previous quarter. The oil production index was steady at 31.7 in the third quarter. The natural gas production index was little changed at 35.6.

Costs increased for the seventh straight quarter, with the index near record highs. Among oilfield services companies, the input cost index remained high but slipped to 83.9 from a series high. None of the 58 responding oilfield services companies reported lower input costs. Among E&P companies, the index for finding and development costs was 64.7, down slightly from its high last quarter of 70.6. Additionally, the index for lease operating expenses was 70.2, easing slightly from the high last quarter of 74.1.

It is taking longer for firms to receive materials and equipment. The supplier delivery time index remained elevated at 28.4 in the third quarter, down slightly from a series high of 31.9 in the second quarter. Among oilfield service firms, the measure of lag time in delivery of services declined to 21.1 from 36 but remained well above average.

Oilfield services firms reported broad-based improvement, with key indicators remaining in solidly positive territory. The equipment utilization index remained elevated but fell to 55.2 in the third quarter from 66.7 in the second quarter. The operating margin index remained positive but declined to 25.4 from 32.7. The index of prices received for services inched to a record high 64.9 from 62.7.

All labor market indexes in the third quarter remained elevated, pointing to strong growth in employment, hours, and wages. The aggregate employment index posted a seventh consecutive positive reading, increasing to a record 30 from 22.6 in the second quarter. The aggregate employee hours index was 33.3, close to its historical high. The aggregate wages and benefits index remained elevated and was largely unchanged at 47.3.

Optimism waned somewhat this quarter as the company outlook index posted a ninth consecutive positive reading but fell 33 points to 33.1. The overall outlook uncertainty index jumped to 35.7 from 12.4, suggesting uncertainty became much more pronounced this quarter, especially among E&P firms. The uncertainty index was 17.8 for services firms versus 45.2 for E&P firms, with 53% of E&P firms reporting an increase in uncertainty.

On average, respondents expect a WTI oil price of $89/bbl by yearend 2022; responses ranged from $65 to $122/bbl. Survey participants expect Henry Hub natural gas prices of $7.97/MMbtu at yearend. For reference, WTI spot prices averaged $85.49/bbl during the survey collection period, and Henry Hub spot prices averaged $8.16/MMbtu.