API: US petroleum demand up 2.2% month-over-month in August

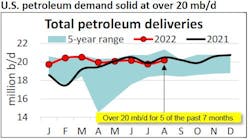

US petroleum demand, as measured by total domestic petroleum deliveries, was 20.2 million b/d in August, according to the latest monthly statistical report by the American Petroleum Institute (API). This reflected a seasonal increase of 2.2% from July but down by 1.8% year-over-year compared with August 2021. Year-to-date through the first 8 months of 2022, US petroleum demand averaged 2.9% higher year-over-year than that of the same period a year ago.

Consumer gasoline demand, measured by motor gasoline deliveries, was 8.8 million b/d in August. This

reflected an increase of 1.1% from July but 3.7% lower compared with August 2021 – and the second lowest demand for the month of August in 23 years, which suggests that historically high gasoline prices impacted consumer driving behavior.

Distillate deliveries of 3.8 million b/d increased by 3.6% month-over-month from July and but were down by 4.9% year-over-year compared with August 2021. The monthly increase was less than the 4.4% average monthly increase seen over the past decade between July and August. DAT iQ industry trendlines showed that the quantity of spot loads available for transport in August fell by 4.7% month-over-month from July, and the number of spot trucks available for hire rose by 15% month-over-month, which together indicated a slower freight market in August.

Kerosene-type jet fuel deliveries of 1.6 million b/d in August rose by 1.3% month-over-month from July and 5.2% year-over-year versus August 2021 to their highest for the month since 2019. High-frequency data from Flightradar24 and TSA showed that the total numbers of flights and air passengers increased by 14.2% year-over-year and 18.7% year-over-year, respectively. The International Air Transport

Association (IATA) also reported passenger demand remained strong this summer and that air cargo neared its pre-COVID levels. Accordingly, some of the slowing seen in freight trucking could have reflected a substitution for freight by air, according to API.

Deliveries of residual fuel oil, which is used as a marine bunker fuel and internationally in electric power production, space heating, and industrial applications, were 350,000 b/d in August, which reflected increases of 17.5% month-over-month from July and of 1.5% year-over-year versus August 2021. The increases appeared to reflect a continuation of supply chain issues and congestion in marine shipping.

US production

US crude oil production of 11.9 million b/d in August decreased by 0.3% month-over-month from July but was up by 5.6% year-over-year compared with August 2021. This reflected the second highest production for the month of August on record since 1973 but remained 1 million b/d below the all-time high of 13 million b/d in November 2019.

Baker Hughes reported 601 active oil-directed rigs in August, a 0.2% month-over-month (1 rig) decrease from July and 20.7% lower than the 758 rigs running in August 2019.

The 160 natural gas-directed rigs drilling in August was an increase of 5 rigs from July. The extraction of natural gas liquids (NGLs) is dependent upon the relative values of ethane, propane, and butane, which have historically tended to correspond with those of crude oil. NGL production increased by 0.6% month-over-month to 6 million b/d, its highest level on record since 1973.

Trade, refining

US petroleum exports – crude oil and refined products – of 10.1 million b/d in August were the highest

on record for any month since 1947. Combined with a 3.3% month-over-month (300,000 b/d) decrease in petroleum imports, the US was a petroleum net exporter of 1.8 million b/d in August, also the highest monthly petroleum net exports on record since 1947.

In August, US refinery throughput, measured by gross inputs into crude distillation units, was 16.7 million b/d and implied a capacity utilization rate of 93.1%. The throughput increased by 0.1% month-over-month and remained over 16 million b/d for a sixth straight month. Capacity utilization rose by 0.1 percentage point from July and was over 92% for a fourth straight month.

Inventory

US commercial crude oil inventories fell by 0.7% month-over-month from July but were up 0.9% year-over-year versus August 2021 to 425.4 million bbl. Crude oil in the US Strategic Petroleum Reserve (SPR), however, fell by 4.8% month-over-month to its lowest level since 1984. Consequently, the combined commercial and SPR crude oil inventories of 879 million bbl were at their lowest level since 2003.