Russia has so far demonstrated high resilience to the unprecedented pressure imposed by Europe and the US – but the worst is yet to come, according to Rystad Energy research. While Russian crude output is expected to remain high for the remainder of the Northern Hemisphere summer, it is expected to decline again due to a sluggish national economy and lower refinery runs and crude exports.

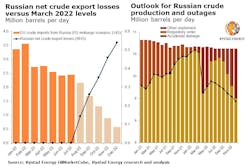

After a sharp drop of 1 million b/d in April, Russia has aggressively ramped up oil production in June and July, with total output in July almost recovering to the level seen before Russia's war with Ukraine began in late February. The significant increase was largely due to higher refinery output, while crude exports contracted after reaching record levels of more than 5 million b/d in April and May. Rystad Energy's new estimate for average Russian crude production in 2022 is 9.6 million b/d, 200,000 b/d higher than expected in June, but the impending European Union (EU) import embargo and domestic economic challenges imply major obstacles lie ahead.

Russian crude exports have been on a downward trajectory this summer, falling to 4.6 million b/d in June and 4.2 million b/d in July, according to Rystad Energy estimates. In June, both Europe and Asia reduced purchases of Russian crude, while July exports to Europe increased slightly as the region prepares for an oil embargo set to take effect in December. At the same time, exports to Asia continued to drop, which could be explained by discounts proposed for Russian blends being less generous than before. The exact reason is hard to determine as trading operations with Russian crude dropped off the radar after February, making it difficult to track the spreads between Russian blends and benchmarks, Rystad Energy said. Price reporting services have been reporting various numbers: Argus had the Urals discount to Brent in July reduced to $15/bbl, while Platts and Reuters did not change their estimates between $30/bbl and $40/bbl.

“Russia’s upstream sector has rebounded but this resilience is short term. Domestic consumption has helped fill the gap during the peak demand season, but overseas demand for Russian blends has dipped spelling trouble further ahead. The upcoming EU embargo remains an unknown factor, when and where it will impact is not yet clear, but it will hasten the decline expected this autumn” said Daria Melnik, senior analyst at Rystad Energy.

Domestic market

Some crude volumes were redirected from exports to the domestic market for refining. Refinery runs demonstrated an outstanding month-over-month growth in June and July of 390,000 b/d and 330,000 b/d, respectively, and reached 5.8 million b/d in July versus 5 million b/d in May. Higher margins coupled with seasonal demand growth inside the country were the main drivers.

EU embargo

The EU embargo on Russian crude is set to come in force by yearend, but it is not possible to ban 90% of crude imports coming from Russia immediately, meaning that the phase-out will be gradual during 2022. At the same time, Rystad Energy sees the possibility of lags in embargo implementation as well as low compliance during the first months of 2023 due to economic woes and the logistics involved in replacing so many barrels. EU imports of Russian crude are expected to dwindle to just 600,000 b/d by December 2022 – a nearly 2.5 million b/d drop from the 3 million b/d before Russia-Ukraine conflict.

Rystad Energy still expects that Russia will be able to redirect a significant portion of crude volumes – or 75% in the base case – to Asia and other markets. It was recently reported that the UK – where the world’s leading insurance market, Lloyd’s of London, is located – decided to postpone the ban on providing Russian vessels with marine insurance, thereby giving Russian producers additional time to better prepare for new sanctions. The new date for the ban has not yet been disclosed. The availability of rerouting options means that the 2.5 million b/d drop in Russian exports to the EU will not have a one-to-one impact on Russian upstream supply – Russian export losses are estimated at only 500,000- 600,000 b/d by December 2022.

Decline

As oil product demand is set to pass its peak, refinery runs are expected to start declining in the autumn. However, Rystad Energy sees a more pronounced drop in refinery runs than in quiet years as a significant fall in economic activity is expected in the third and fourth quarters of 2022 since the effect of financial and sectoral sanctions will begin to be felt. The Central Bank of Russia expects the national economy to collapse by 7.5-8% year-over-year in third-quarter 2022 and by 10-11% in fourth-quarter 2022.

Russia will have to cope with a national economic crisis as well as source new markets for its oil and oil products when the EU embargo comes into force, Rystad said. After the summer ramp-up, crude production is expected to fall again by 1.1 million b/d, but further recovery will be more challenging and will take more time. A major uncertainty in the production forecast is cast by the widely reported initiative to impose a price cap on Russian crude, Rystad concluded.