The US Energy Information Administration (EIA) adjusted its forecast for the Brent and WTI crude oil price spread in its August issue Short-Term Energy Outlook (STEO). Changes to sources of Europe’s crude oil imports following Russia’s full-scale invasion of Ukraine and the EU’s subsequent petroleum import ban have contributed to redirections in oil trade flows.

European countries are importing more crude oil from the US and exporting less crude oil to countries in Asia, contributing to the development of a crude oil import price premium in Europe. As a result, EIA anticipates this trend will maintain a wider price spread between Brent and WTI crude oil of $6/bbl in 2023, which is $2/bbl wider than in the July STEO.

Although supply disruptions have kept crude oil prices around $100/bbl, crude oil prices have come down slightly in July as concerns of slower economic growth or a recession become more prevalent. These concerns are reflected in the University of Michigan’s survey of consumer sentiment, which recorded its lowest reading on record in June, with data going back to November 1952. Likewise, consumer sentiment in the Euro Area has decreased, reaching record lows in July.

The price of WTI decreased by more than Brent. The price spread between Brent and WTI increased to a high of $13.26/bbl on July 29, the highest price spread since Jan. 14, 2014. This wide Brent-WTI spread, which reflects supply and demand dynamics in Northwest Europe, has come down in the first few trading days of August but remains high.

EIA forecast the spot price of Brent crude oil will average $105/bbl in 2022 and $95/bbl in 2023. US crude oil production in the forecast averages 11.9 million b/d in 2022 and 12.7 million b/d in 2023, which would set a record for most US crude oil production in a year. The current record is 12.3 million b/d, set in 2019.

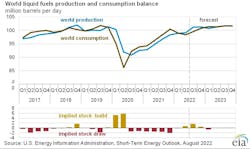

EIA estimates that 98.8 million b/d of petroleum and liquid fuels was consumed globally in July 2022, an increase of 0.9 million b/d from July 2021. Global consumption of petroleum and liquid fuels will average 99.4 million b/d for all of 2022, which is a 2.1 million b/d increase from 2021. Global consumption of petroleum and liquid fuels will increase by another 2.1 million b/d in 2023 to average 101.5 million b/d.

The US retail price for regular grade gasoline averaged $4.56/gal in July, and the average retail diesel price was $5.49/gal. EIA expect retail gasoline prices to average $4.29/gal in third-quarter 2022 and fall to an average of $3.78/gal in fourth-quarter 2022.

US refineries average 93% utilization in third-quarter 2022 in EIA’s forecast, a result of high wholesale product margins. Elevated prices for gasoline and diesel reflect refining margins for those products that are at or near record highs amid low inventory levels.