EIA: Global oil production returns to within 1% of pre-pandemic levels

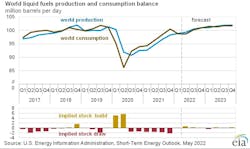

Although crude oil prices remain high because of low oil inventories and significant geopolitical uncertainty, the US Energy Information Administration (EIA) estimates that world production of petroleum and other liquids averaged 99.5 million b/d in May, which has returned to within 1% of its pre-pandemic level in March 2020.

In its June Short-Term Energy Outlook (STEO), EIA estimates that US production of crude oil and other liquids averaged 19.9 million b/d in May, which was within 3% of January 2020’s record high production of 20.5 million b/d. EIA also estimates that the Organization of the Petroleum Exporting Countries (OPEC) crude oil and other liquids production has returned to pre-pandemic levels. May OPEC production was 33.7 million b/d, 1% higher than OPEC production of 33.4 million b/d in the first quarter of 2020.

Furthermore, OPEC+ announced on June 2 that it will increase crude oil production targets by 50% for July and August (OGJ Online, June 2, 2022). EIA then forecasts that OPEC crude oil and total liquid fuels production will increase to 34.6 million b/d in 2022 third quarter, the highest since 2019 second quarter.

However, in response to the European Union (EU) ban on seaborne imports of crude oil from Russia and previous sanctions on Russia, in this issue’s STEO, EIA now forecasts that Russia’s oil production will decrease from 11.3 million b/d in 2022 first quarter to 9.3 million b/d in 2023 fourth quarter.

“Our forecast reflects the EU’s announcement that that it will impose its crude oil import ban in 6 months. We assume that about 80% of the crude oil subject to the EU import ban will find alternative buyers, mainly in Asia. Our forecast does not reflect restrictions on shipping insurance, as details regarding such restrictions were not available when we finalized this forecast on June 2. The possibility that these sanctions or other potential future sanctions reduce Russia’s oil production by more than expected creates upward risks for crude oil prices during the forecast period,” EIA explained.

After seven consecutive quarters of global oil inventory draws from third-quarter 2020 to first-quarter 2022, EIA forecasts that oil stocks in Organization for Economic Cooperation and Development (OECD) countries will generally increase but remain below 5-year average levels until fourth-quarter 2023.

Brent crude oil spot prices averaged $113/bbl in May. EIA expects the Brent price will average $108/bbl in second-half 2022 and then fall to $97/bbl in 2023.

“Current oil inventory levels are low, which amplifies the potential for oil price volatility. Actual price outcomes will largely depend on the degree to which existing sanctions imposed on Russia, any potential future sanctions, and independent corporate actions affect Russia’s oil production or the sale of Russia’s oil in the global market,” EIA said.

US petroleum products

The US average retail price for regular grade gasoline averaged $4.44/gal in May, and the average retail diesel price was $5.57/gal. Rising prices for gasoline and diesel reflect refining margins for those products that are at or near record highs amid low inventory levels.

EIA expects the gasoline wholesale margins (the difference between the wholesale gasoline price and Brent crude oil price) to fall from $1.17/gal in May to average $0.81/gal in third-quarter 2022, and expects retail gasoline prices to average $4.27/gal in third-quarter 2022. Diesel wholesale margins in the forecast fall from $1.53/gal in May to $1.07/gal in third-quarter 2022, and retail diesel averages $4.78/gal in third-quarter 2022.

EIA forecasts US refinery utilization to average 94% in third-quarter 2022, up from 89.5% in first-quarter 2022 and 93% in second quarter, as a result of high wholesale product margins.

“Despite our expectation that refinery utilization will be at or near the highest levels in the past 5 years, operable refinery capacity is about 900,000 b/d less than at the end of 2019, and as a result, we do not expect total refinery output of products to reach its highest level in the past 5 years. Although we expect high refinery utilization will help bring wholesale margins down from record levels,” EIA said.