Rystad: US oil & gas employment to recover in 2022

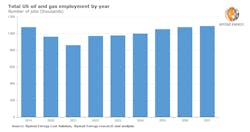

US oil and gas employment is set to expand by 12.5% this year, rising to 971,000 total jobs by end 2022 from around 863,000, according to Rystad Energy research. The total number of jobs in 2027 is expected to hit 1.09 million, a marginal increase from the 1.07 million in the sector pre-COVID in 2019, the company said in a May 18 release.

This employment forecast is based on Rystad Energy’s oil price scenario in which WTI oil price averages $106/bbl this year, $70/bbl in 2023, and $50/bbl towards 2025.

Shortly after the pandemic hit and demand dropped to previously unseen levels, the US oil and gas labor market suffered one of its most harrowing periods of job loss, Rystad noted. Between June 2020 and May 2021, over 100,000 jobs were lost, primarily in the drilling tools and services segment. Over 20,000 jobs – 20% of the segment’s workforce – were cut as drilling activity stopped, operators doubled down on remote drilling initiatives, and shelved or delayed new initiatives. Operational support and construction and installation segments were also impacted and lost more than 68,000 jobs combined, accounting for more than 68% of all job losses. The maintenance segment remained largely unaffected as operators prioritized maintenance over other segments.

However, since May 2021, on the back of high oil prices and bullish market sentiment, almost half of the jobs lost have been recovered, according to Rystad. As of late April 2022, the industry has regained over 100,000 jobs compared to pre-pandemic levels, and by end 2027, Rystad expects the number of oil and gas jobs (1.09 million) to marginally surpass pre-COVID employment levels.

Labor market

“Fueled by a rapid rise in oil prices amid a better-than-expected demand recovery and the supply constraints brought on by Russia’s invasion of Ukraine, the US labor market seems poised to benefit and continue on a growth trajectory,” said Sumit Yadav, an analyst with Rystad Energy.

The primary growth factor behind the steady job gains is the oil price rebound, which is expected to motivate US operators to ramp up investments to more than $90 billion annually by 2027, representing a growth of nearly 40% compared to the lows of 2020. In addition, the optimism of operators is fueled by positive developments in government policies. The most prominent is the Biden administration’s announcement that it will lease out more than 145,000 acres of public land across nine states for drilling. The policy is aimed at increasing oil and gas production to boost national energy security and drive exports to help Europe reduce its reliance on Russian energy.

However, complete recovery of the US labor market hinges on operators navigating significant challenges, including securing financing for expansions. Having been burned in the previous shale boom, many shale creditors are adopting a more cautious approach before committing to new projects, putting a damper on expansion plans of many operators. Exploration and production companies have recently seen record free cash flows, which will provide better optionality to fund work independently, but some will still require external funding, especially mid- to small-sized players, Rystad noted.

The lack of financing is further exacerbated by rampant inflation and the inevitable spike in interest rates. The US Federal Reserve is looking to curb inflation by reducing business spending, which could dampen continuous recovery in the labor market. Additionally, an acceleration of retirements across the economy, permanent employee relocation, competition from the renewable energy sector, and a limited pool of highly skilled workers, will challenge industry players looking to boost hiring activity.

Amid a combination of these factors – and spearheaded by historically high inflation – Rystad expects the US oil and gas industry to add nearly 120,000 jobs between 2022 and 2027, meaning a compound annual growth rate (CAGR) of 2.3%, taking the total employment above pre-pandemic levels.

Wages

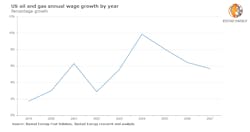

Inflation also is taking a toll on budgets. The average wage across the industry increased by nearly 6.3% in 2021 compared to only a 2.9% increase in 2020. However, wage growth in 2021 was primarily concentrated in low-skilled trades with a lower starting salary. Wage growth remained elusive for highly skilled oil and gas roles, such as petroleum engineers and geoscientists.

However, wages are forecast to rebound as the talent pool tightens. The supply of petroleum engineers has declined by more than 10,000 since 2019 as many workers became frustrated by frequent boom and bust cycles and moved into other industries. Young graduates are increasingly reluctant to join oil and gas trades, instead opting for renewables. Based on figures from end 2021, the oil and gas industry requires an additional 8,000 petroleum engineers to capitalize on the current high oil prices. Consequently, it will need to shell out a premium to lure young graduates and existing engineers alike. The lack of highly skilled labor combined with high inflation and an increasingly demanding workforce in terms of better working conditions, flexible hours, and perks is expected to usher in high wages, which are expected to grow at a CAGR of 7.13% between 2022 and 2027.