EIA revises global oil consumption forecast for 2022

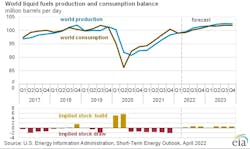

In the April Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts that global consumption of petroleum and liquid fuels will average 99.8 million b/d for all of 2022, which is down by 800,000 b/d from last month’s forecast.

The effects on oil consumption and on economic growth in Russia and surrounding countries contributed to most of the downward revision. EIA’s forecast for world GDP growth in 2022 from Oxford Economics is 4.0%, down from 4.3% in the March STEO. Other revisions to the global liquid fuels consumption forecast stemmed from an increase in mobility restrictions in China because of recent increases in COVID-19 cases.

EIA forecasts that global consumption of petroleum and liquid fuels will rise by 1.9 million b/d in 2023 to average 101.7 million b/d. The outlook for economic growth and oil consumption in Russia and surrounding countries continues to be highly uncertain.

Oil supply

EIA forecast production of crude oil and other liquids in Russia will average 10.1 million b/d from second-quarter 2022 through fourth-quarter 2022, which would be down from 11.3 million b/d in first-quarter 2022 and 600,000 b/d less than EIA’s forecast in the March STEO.

Meantime, EIA forecasts Russia’s production will average 9.8 million b/d in 2023, which is 1 million b/d lower than the forecast in the March STEO. The lower forecast reflects EIA’s assumption that sanctions and independent corporate actions will limit crude oil production in Russia more than it expected last month.

US crude oil production in the forecast averages 12.0 million b/d in 2022, up 800,000 b/d from 2021. EIA forecasts production to increase another 900,000 b/d in 2023 to average almost 13 million b/d, surpassing the previous annual average record of 12.3 million b/d set in 2019.

In the April outlook, EIA has also updated its assumptions to include the announced release of 1 million b/d of crude oil from the US Strategic Petroleum Reserve (SPR) from May through October. EIA’s assumption that SPR inventories will fall by 1 million b/d from May through October is changed from its assumption in the last STEO that SPR inventories would fall by 100,000 b/d over the same period.

Oil prices, inventory

The Brent crude oil spot price averaged $117/bbl in March, a $20/bbl increase from February. Crude oil prices increased following the further invasion of Ukraine by Russia. Sanctions on Russia and other actions contributed to falling oil production in Russia and created significant market uncertainties about the potential for further oil supply disruptions. These events occurred against a backdrop of low oil inventories and persistent upward oil price pressures. Global oil inventory draws averaged 1.7 million b/d from third-quarter 2020 through end 2021. EIA estimates that commercial oil inventories in the OECD ended first-quarter 2022 at 2.61 billion bbl, up slightly from February, which was the lowest level since April 2014.

Although EIA reduced Russia’s oil production in its forecast, the agency still expects that global oil inventories will build at an average rate of 500,000 b/d from second-quarter 2022 through end 2023, which EIA expects will put downward pressure on crude oil prices. However, if production disruptions—in Russia or elsewhere—are more than this forecast, the resulting crude oil prices would be higher than EIA’s current forecast.

EIA expects Brent price will average $108/bbl in second-quarter 2022 and $102/bbl in second-half 2022. EIA also expects the average price to fall to $93/bbl in 2023.

However, this price forecast is highly uncertain. “Actual price outcomes will depend on the degree to which existing sanctions imposed on Russia, any potential future sanctions, and independent corporate actions affect Russia’s oil production or the sale of Russia’s oil in the global market. In addition, the degree to which other oil producers respond to current oil prices, as well as the effects macroeconomic developments might have on global oil demand, will be important for oil price formation in the coming months,” EIA said.