Oil and gas companies’ capital expenditures are expected to rebound significantly in 2022, driven by a favorable commodity price environment and record cash flow. Notably, spending remains well below 2019 pre-pandemic levels. Meanwhile, capital discipline remains key, with the industry reaffirming its commitment to reducing debt, increasing shareholder returns, and increasing share buybacks.

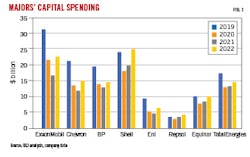

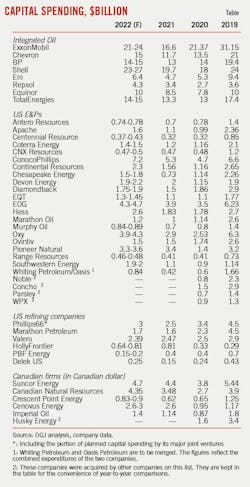

Total capital spending by major oil companies, including ExxonMobil, Chevron, Shell, BP, Eni, Equinor and TotalEnergies, will rebound 24% in 2022 to $112.7 billion, but still below 2019 the pre-pandemic level of $136 billion.

Majors, especially those in Europe, are increasing spending on renewable energy and low-carbon projects, as they all have set targets of becoming net-zero companies by 2050. European oil majors (some now prefer to be known as energy companies) have invested heavily in solar and wind power, while US giants ExxonMobil and Chevron differ from European rivals, with a focus on renewable fuels and carbon capture and storage (CCS). LNG-oriented gas projects are also seeing increased investment.

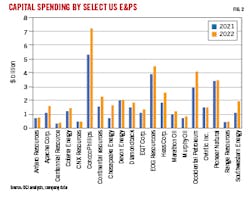

A group of 21 publicly traded US-based exploration and production (E&P) companies plan to spend $42.8 billion in total capital expenditures in 2022, up 29% from a year ago but still below 2019 levels. Most producers expect oil production growth in 2022. The companies are also prioritizing higher dividends and share buybacks when distributing cash flow.

In addition to the ambitious E&P companies, Chevron’s spending on US upstream is expected to be $6.4 billion in 2022, up 36% from a year ago. Exxon is also expected to increase US upstream spending, with strong production growth expected in the Permian basin.

Based on current capital guidance from US E&P companies and majors’ upstream plans, US upstream capital spending is expected to increase 32% this year from a year earlier, with most of it going to land assets, especially the Permian basin. Importantly, this could prove conservative, as the private E&P sector is likely to push spending even higher. The private E&P companies are the most price sensitive and likely to increase spending in a supportive commodity price environment. Moreover, a Louisiana court lifted the Biden administration’s moratorium last June, allowing federal lands and waters to be available for lease for oil production, which could prompt companies to do more exploration for drilling.

The refining environment is expected to continue improving in 2022, thanks to strong demand, capacity closures and low product inventories. However, capital expenditures by US independent refiners remain prudent, reflecting a continuous strategic breathing from heavy investments in the past and a focus on increasing cash flows. Capital spending of US independent refiners examined in this report fell 31% and 12% sequentially in 2020 and 2021, respectively, and will increase by 4% in 2022. Importantly, budgets for renewable diesel have been increasing and represent a significant portion of total capital expenditures.

A group of leading Canadian oil and gas producers increased capital spending by about 15.8% in 2021. They will continue to increase capital spending this year versus 2021 by an estimated 15.3%. Capital expenditures on oil sands are expected to increase 33% this year, according to an estimate from the Canadian Association of Petroleum Producers (CAPP). Alberta will see the fastest growth in investment.

National oil companies (NOCs) play an important role in global capital expenditure growth. Many of them plan to significantly increase capital spending in 2022 and target more exploration and development.

Majors’ spending plans

ExxonMobil’s capital spending is expected to be $21-24 billion in 2022, up nearly 40% from the company’s capital spending in 2021. The company also is targeting annual capital expenditures of $20-25 billion through 2027, allocating funds to low-carbon projects and extending its previously projected investment rate by 2 years.

Cash flow and earnings from upstream operations are expected to increase, thanks to aggressive cost reductions and favorable investments in low-cost supply projects in Guyana, Brazil, and the Permian basin. Permian production growth is to be accelerated, guided to grow 25% in 2022.

According to ExxonMobil, more than 90% of upstream planned capital investments through 2027 are expected to generate returns of greater than 10% at prices less than or equal to $35/boe, while reducing upstream greenhouse gas (GHG) emissions intensity by 40-50% through 2030, compared to 2016 levels. As part of its plan, ExxonMobil has committed $15 billion for lower-emission investments through 2027.

Chevron’s capital and exploratory spending for 2022 is set at $15 billion, up from $11.7 billion in 2021 and $13.5 billion in 2020. The 2022 capital program includes about $800 million in lower carbon spending.

In 2022, Chevron plans to spend $6.4 billion in US upstream and $6.2 billion in international upstream, respectively. In 2021, 2020, and 2019, US upstream spending was $4.7 billion, $5.1 billion, and $8.2 billion, respectively. Over the years, international upstream spending was $4.9 billion, $5.8 billion, and $9.6 billion, respectively.

Of the upstream business this year, about $8 billion is allocated to currently producing assets, with about $3 billion for Permian basin unconventional development and about $1.5 billion for other shale and tight assets around the world. In addition, $3 billion of the upstream program is planned for ongoing major capital projects, of which about $2 billion is related to projects at Tengiz field in Kazakhstan. Finally, some $1.5 billion is set for exploration, early-stage development projects, midstream activities, and carbon reduction opportunities.

Worldwide downstream spending in 2022 is estimated to be $2.3 billion, including capital targeted to grow renewable fuels and products businesses. Chevron’s downstream spending was $1.86 billion in 2021, $2.34 billion in 2020, and $2.8 billion in 2019. In particular, the company’s downstream spending in the US was $1.23 billion in 2021, $1 billion in 2020, and $1.87 billion in 2019, and will be $1.7 billion in 2022.

The large European companies have been much more aggressive in their investments in renewable energy and service than their US counterparts.

BP expects capital expenditure of $14-15 billion in 2022 and a range of $14-16 billion annually through 2025. BP also plans to increase the proportion of its capital expenditure in transition growth businesses to more than 40% by 2025 and is aiming for around 50% by 2030. It aims to generate earnings of $9-10 billion from these businesses by 2030, driven by five transition growth sectors – bioenergy, convenience, electric vehicle (EV) charging, renewables, and hydrogen.

BP now expects to sustain EBITDA from low break-even hydrocarbons at around $33 billion/year to 2025 and aims to maintain it in a $30-35 billion range to 2030, even while oil and gas production is expected to decline 40% from 2019 levels by 2030. BP’s plan to invest around $7.5 billion/year in oil and gas through 2025 remains unchanged, a level that reflects their plans to deepen bioenergy.

Shell’s capital expenditure for full year 2022 is expected to be at the lower end of the $23-27 billion range, back to its pre-pandemic level of $24 billion in 2019. The company’s capital expenditure was $20 billion in 2021 and $18 billion in 2020.

In 2022, about $8 billion is allocated to upstream businesses, up from $6 billion last year. Integrated Gas and Chemicals/Products are set to receive $4-5 billion each. About $3 billion is for renewable energy and energy solutions. Beyond 2025, Shell plans to spend 35-40% of its annual capital expenditures on renewables and energy solutions, 30-40% on integrated gas and chemicals and products, and 25-30% on upstream.

TotalEnergies expects net investments of $14-15 billion in 2022, compared with $13.3 billion in 2021, $13 billion in 2020, and $17.4 billion in 2019. Of this year’s total capital expenditures, 50% will be spent on growth and 50% on maintaining the base of its activity.

The company’s oil production in 2022 is expected to grow by 2% year-on-year, with start-ups in Brazil, Nigeria, and elsewhere. LNG sales are expected to grow by 5%, following a 10% increase in 2021. TotalEnergies also plans to invest $3.5 billion, or about 25% of total capital expenditures, on renewable energy and electricity.

Equinor’s organic capital expenditures are set to average about $10 billion/year in 2022-2023 and about $12 billion/year in 2024-2025. Production in 2022 is expected to be about 2% higher than 2021 levels. Equinor is also targeting more than 50% of gross capital expenditures to renewables and low-carbon solutions by 2030.

Spanish integrated energy company Repsol SA expects to increase capital expenditures to pre-pandemic levels of $4.3 billion in 2022. Roughly $1.9 billion is slated for the upstream, $1.13 billion goes the industrial segment, and another $1 billion for the “customer-centric and renewables” businesses. Specifically, the company announced an increase in investment in the 2021-2025 period to around $22 billion, with additional investments aimed at renewable electricity generation and emission-free hydrogen production and to promote other low-carbon initiatives. Thus, 35% of the investments made by Repsol between 2021 and 2025 will be allocated to low-emission initiatives.US E&Ps’ spending plansA group of 21 leading public US E&P companies plans total capital expenditures of $42.8 billion in 2022, a 29% increase from 2021 levels.

ConocoPhillips expects capital expenditures of $7.2 billion in 2022, up from $5.3 billion in 2021. The increase reflects the addition of Shell’s Permian basin properties and other investments. The capital plan includes funding for ongoing development drilling programs, major projects, exploration and appraisal activities, base maintenance. The plan also includes $200 million for projects to reduce the company’s Scope 1 and 2 emissions intensity and fund investments in several early-stage low-carbon opportunities that address end-use emissions.

ConocoPhillips also has a stock buyback plan of $2.5 billion for this year. The company’s 2022 production guidance is 1.8 MMboe/d, including Libya but excluding impacts from the Indonesia disposition and acquisition of additional APLNG shareholding interest.

Occidental Petroleum plans to spend $3.9-4.3 billion on total capital expenditures in 2022. Oil and gas capital expenditures totaled $3.2-3.4 billion, up from $2.4 billion in 2021. The company allocated $1.7-1.9 billion to the Permian, up from $1.2 billion last year to increase activity in the area. Permian rig count is expected to increase to 14 gross rigs/9 net rigs in 2022, compared to 13 gross rigs/7 net rigs at end 2021. Total wells brought online for 2022 is guided to 315 at the midpoint vs. 227 previously guided for 2021.

In addition to spending in the Permian, there is $500 million for the Gulf of Mexico (GoM), another $500 million for the international segment, and $400 million for the Rockies and other portions of the lower 48 states.

EOG’s total expenditures for 2022 are expected to range from $4.3 to $4.7 billion, up from $3.9 billion in 2021. The capital program is focused on high-return investment in EOG’s double-premium drilling inventory and returns oil production back to pre-pandemic levels of 455,000-467,000 b/d. EOG plans to complete 570 net wells (519 in 2021) in 2022 with an additional 20 net wells in the Dorado natural gas play and 10 additional net wells in exploration areas.

Pioneer Natural Resources expects its 2022 total capital budget to be $3.3-3.6 billion, compared to $3.4 billion in 2021. The operator expects its capital program to be fully funded from forecasted 2022 cash flow.

During 2022, Pioneer plans to operate an average of 22-24 horizontal drilling rigs in the Midland basin, including a 3-rig average program in the southern Midland basin joint venture area. The 2022 capital program is expected to place 475-505 wells on production. Oil production for 2022 is guided at 350,000-365,000 b/d with total production of 623,000-648,000 boe/d.

Hess Corp. has set a $2.6 billion capital and exploration budget for 2022, of which about 80% will be allocated to Guyana and Bakken. The 40% year-on-year increase in capex is mainly driven by development activities in Guyana. Net production in 2022 is expected to average 330,000-340,000 boe/d, excluding Libya.

At Bakken, Hess plans to implement a 3-rig program. Net Bakken production is expected to average 165,000-170,000 boe/d in 2022. In Guyana, the focus in 2022 will be on advancing oil development at Stabroek block, which has a Brent breakeven price of $25-35/bbl, according to Hess, and continuing active exploration and appraisal program.

For 2022, Devon Energy plans to spend $2.25 billion at the midpoint to deliver oil and total production of 285,000-295,000 b/d. Devon Energy plans to allocate 75% of 2022 capital to the Delaware basin.

Continental Resources is projecting a $2.3 billion capital expenditures budget, 47% higher than last year’s capital expenditures. The company is allocating about $1.8 billion to drilling and completion (D&C) activities. The capital budget includes a 15% increase to legacy spending in the Bakken and Anadarko basins combined with an about $500 million increase attributed to the company’s recently acquired positions in the Permian and Powder River basins.

Marathon Oil noted a capital expenditure budget of $1.2 billion for 2022, compared with $1 billion for 2021. At $80/bbl for WTI and $4/MMbtu for Henry Hub, the 2022 program is expected to provide over $3 billion in free cash flow with a reinvestment rate of less than 30%. The company does not intend to deviate from its announced capital budget in the event of continued strong commodity pricing. The operator expects to return at least 40% of its cash flow to equity investors by maintaining discipline and a low reinvestment rate, assuming an oil price of $60/bbl WTI or higher. The company guided 2022 oil and total production of 168,000-176,000 b/d and 340,000-350,000 boe/d, which is in line with the company’s previous message of flat year-over-year volumes.

Private E&Ps today have about 60% of the US land rig count under their control, and their investments are the most price sensitive. Although our numbers do not reflect private E&Ps estimate, we expect expenditures from private E&Ps to grow over 40% this year.

US independent refiners

The road ahead for US refiners in 2022 will be smoother as the worst of the pandemic’s demand slump has gone. Demand recovery, tight inventories, and smaller capacity size should lead to decade-high refining margins in 2022. However, new capital investments will remain subdued, reflecting the completion of large investments in the past, continued capital discipline, and expensive renewable identification numbers (RINs) obligations.

Meantime, investments to increase renewable diesel business account for a significant part of growth capital, driven by higher state and federal targets for renewable fuel, favorable tax credits, and the conversion of existing petroleum refineries into renewable diesel refineries. US renewable diesel production capacity could increase significantly by 2024, according to projects currently under construction or likely to be developed. If all projects come online as intended, US renewable diesel production would be over 5 billion gal/y by the end of 2024, compared to 600 million gal/y at the end of 2020.

Phillips 66 holds a $1.9 billion capital plan for 2022, compared to $1.86 billion in 2021, $2.9 billion in 2020, and $3.45 billion in 2019. The slowdown of capital spending reflects the absence of heavy midstream investments in 2020 and 2019.

The 2022 capital plan includes $992 million for sustaining capital and $916 million for growth capital. About 45% of growth capital supports low-carbon opportunities. Phillips 66 plans to invest $896 million in its refining business, with $488 million for reliability, safety, and environmental projects.

Refining growth capital of $408 million is primarily for the reconfiguration of the San Francisco Refinery in Rodeo, Calif., as part of the Rodeo Renewed project. Upon expected completion in early 2024, the infrastructure will initially have over 50,000 b/d, or 800 million gal/y, of renewable fuel production capacity, making it one of the world’s largest refineries of its kind.

Phillips 66’s management team said that capital spending is likely to stay below $2 billion for many years. The low carbon business could still grow to $2 billion/year by 2030, but the medium-term focus will be on capital discipline, free cash flow (FCF) generation, debt relief, and shareholder returns.

Phillips 66’s proportionate share of capital spending by joint ventures Chevron Phillips Chemical Co. LLC (CPChem), WRB Refining LP (WRB), and DCP Midstream LLC (DCP Midstream) is expected to total $1.1 billion, up from $650 million last year, and to be self-funded. Including Phillips 66’s proportionate share of capital spending for these large ventures, the company’s total 2022 capital program is projected to be $3 billion.

Marathon Petroleum’s capital budget for 2022 is $1.7 billion, which suggests continued discipline. Some 80% of overall spending is focused on growth capital and 20% on sustaining capital. About 50% of the $1.3 billion growth capital will be used on renewable diesel, mainly for completing the Martinez refinery conversion. Total project cost for Martinez is expected to be $1.2 billion with about $200 million remaining in 2023. The Martinez refinery is expected to produce 260 million gal/y of renewable diesel by second-half 2022, with pretreatment capabilities coming online in 2023. The refinery is expected to be capable of producing 730 million gal/y by end 2023.

HollyFrontier Corp. expects to spend $645-810 million on capital projects in 2022, down from last year, when it spent about $300 million on turnarounds and more than $500 million to build a renewable diesel operation.

The company plans to spend $250-270 million on its conventional refining operations. That’s an increase of $60 million from 2021’s range and comes after HollyFrontier paid $614 million for a Shell refinery in the Seattle area. The company also plans to spend $45-60 million on its lubricants division, a small increase from 2021.

HollyFrontier’s capital spending on renewables will be $225-300 million in 2022, as much as their expenditures on conventional refining. HollyFrontier’s renewables push involves renewable diesel production units in Cheyenne, Wyo., and Artesia, NM, as well as a pretreatment unit at the latter complex. Those three projects will eventually cost the company $800-900 million; 2022 will see the last $225-300 million of that amount put to work.

While PBF Energy’s refining capital expenditures in 2022 are increased over 2021, the company continues to focus on capital discipline, with turnaround and other mandatory spend accounting for over 96% of the total planned refining capital expenses for 2022.

Valero’s consolidated capital expenditures for 2022 is $2.4 billion, largely flat with the year-ago level. Some 50% of growth capital is allocated to renewable diesel.

Canadian spending

Financial figures in this section are presented in Canadian dollars unless noted otherwise.

In 2022, Suncor Energy expects to achieve capital expenditures of $4.7 billion, 6% lower than the previously announced ceiling of $5 billion. The capital program largely focuses on sustaining capital including planned maintenance and tailings optimizations.

Upstream capital expenditures are set at $3.6-3.8 billion, up from $3.43 billion in 2021. Capital expenditures on upstream oil sands is $3.2-3.35 billion, compared to $3.17 billion in 2021, $2.74 billion in 2020, and $3.52 billion in 2019.

For 2022, plans for economic investment include capital to progress low-carbon power generation to replace the coke fired boilers at oil sands base, which is expected to be in service between 2024 and 2025. Additional investment to maintain production capacity at existing infrastructure includes the continued development of reserves by building new well pads in situ. Capital expenditure for upstream E&P is $400-450 million in 2022, compared to $270 million in 2021, $489 million in 2020, and $1 billion in 2019.

Canadian Natural Resources’ 2022 capital budget is $4.35 billion, including a base capital budget of $3.6 billion and an incremental strategic growth capital of $700 million. This compares to capital expenditures of $3.48 billion in 2021 and $2.7 billion in 2020.

Canadian Natural is targeting the incremental strategic growth capital expenditures of $700 million all in Alberta because of the attractive fiscal and income tax environment. Specifically, strategic growth capital will be allocated to long-life low-decline thermal in situ and oil sands mining and upgrading assets, which targets to add incremental annual production starting in 2023 and beyond.

Cenovus’ 2022 guidance includes capital spending of $2.6-3 billion and total production of about 800,000 boe/d, factoring in major planned turnarounds and production impacts from assets sold in 2021. The company anticipates 2022 downstream throughput of about 555,000 b/d.

Cenovus’ 2022 capital program includes growth capital of $200-250 million for the completion of the Superior refinery rebuild, which the company expects will be largely offset by insurance proceeds, as well as $100-150 million to complete the Terra Nova project and Spruce Lake North thermal project, both of which are expected to start up in fourth-quarter 2022.

Cenovus also released its latest ESG report, which outlines ambitious new targets for the company’s ESG focus areas, including plans for a 35% reduction in absolute greenhouse gas (GHG) emissions by end 2035 and the continuation of its ambition to achieve net zero emissions from operations by 2050.

Imperial Oil’s capital expenditures for 2022 are expected at $1.4 billion, up from $1.14 billion in 2021. Spending for 2022 includes the ramp-up of the tailings project at the Kearl oil sands infrastructure, completion and commissioning of the Sarnia products pipeline in southern Ontario, as well as ongoing investment in Kearl’s autonomous fleet and the application of solvent technologies at Cold Lake. A final investment decision for the Strathcona renewable diesel project is expected in 2022 and will be based on several factors including government support and approvals, market conditions, and economic competitiveness.

NOCs

Capital expenditures by NOCs, led by Middle Eastern companies, are increasing in 2022.

According to a survey conducted by Barclays at end 2021, Kuwait Oil Co. reduced spending by 42% in 2021 and plans to increase capital spending by 30% to $4.6 billion in 2022. Efforts to increase capacity to 3.5 million b/d by 2025 from the current 2.6 million b/d drives the increase in capital expenditures.

Abu Dhabi National Oil Co. (ADNOC) has similar plans to increase production levels to 5 million b/d by 2030 from the current 4.2 million b/, according to the survey. ADNOC expects to increase its capital spending by 11% to $8 billion in 2022.

Saudi Aramco plans to boost its capital spending by 40% in 2022 to $40-50 billion thanks to the development of Jafurah gas field with reserves of 5.7 trillion cu m. Aramco also wants to raise crude oil “maximum sustainable capacity” to 13 million b/d by 2027 and boost gas production by more than 50% by 2030.

In Asia, Chinese NOCs are expected to continue boosting both onshore and offshore investments. China National Offshore Oil Corp. (CNOOC)’s capital budget for 2022 is $14-16 billion, compared to about $14 billion in 2021. CNOOC will invest 73% of its budget in China, while 57% of its capital expenditure would go into upstream development. The company targets to spend 5-10% of its budget in renewable energy businesses by 2025.

Capital expenditures in Latin America are expected to increase by 28% to $24.8 billion in 2022, following an increase of 17% in 2021, according to the Barclays survey. In addition to increased capital spending of Lantin American companies, the majors and North American independents are stepping up development offshore Guyana, Suriname, and Brazil.

Brazil’s Petrobras is raising its 2022-2026 capital spending plan to $60-70 billion from the current $55 billion program for the 2021-2025 period, with a major focus on exploration and production in Brazil’s presalt area. Pemex is also getting a spending jump for 2022, earmarked to boost falling hydrocarbon production.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.