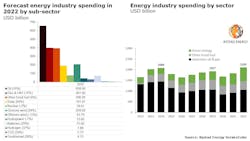

Rystad: 2022 global energy spending to reach $2 trillion

Soaring oil, gas and power prices—combined with the European Union (EU) reducing its reliance on Russian supplies and post-COVID-19 pandemic inflation—will push global energy spending to $2.1 trillion this year, according Rystad Energy research.

Upstream oil and gas spending is expected to rise 16%, or $142 billion, from last year, as oil and gas producers around the world ramp up investment budgets to increase production.

For 'green' energy in 2022, based on the current pipeline of projects, global capacity will grow at 250 gigawatts (Gw) within wind and solar, and lead sector spending to grow by 24%, or $125 billion.

There is concern in energy markets that the war in Ukraine will derail the energy transition, but the latest figures suggest green energy spending will grow faster than the fossil fuel sector. Without the invasion, however, growth in oil and gas investment would have been reduced, and green energy's share of global energy spending would have been slightly higher than today's 31%, the research shows.

Another factor pushing energy spending to new highs is the global inflation of material prices, labor costs, and shipping rates caused by the pandemic and sanctions imposed on Russia. Compared to 2020 levels, oil and gas project costs have increased by 10-20%, due largely to steel price rises and a tighter market among suppliers. Within renewables, lithium, nickel, copper, and polysilicon—all part of battery and solar PV manufacture—have sent renewable project costs up 10-35% within the same timeframe.

“The world is now spending more on energy than ever before. The year 2014 was the last time we saw similar numbers. One can see a major shift in the amount of spending on green energy, which has increased, with a drop in expenditure on oil and gas. However, expenditure on other fossil fuels, such as coal, has remained constant,” said Audun Martinsen, head of energy service research at Rystad Energy.

Breaking down the spending, capital and operational expenditures in 2022 by sub-sector reveals upstream oil still dominates the energy landscape, with $658 billion in spending and a growth of 16% to produce 99.6 million b/d in liquids supply. The gas and LNG sector also see strong growth, with a 15% increase in spending, increasing output to 396 MMcfd from 390 MMcfd. Within green energies, it is solar, carbon capture and storage (CCS), hydrogen, and geothermal that are growing the most, with an increase of 40-60%.