IEA: Global energy markets at crossroads amid record supply crisis

Global energy markets are at a crossroads in the face of what could turn into the biggest supply crisis in decades, the International Energy Agency (IEA) said in its latest Oil Market Report.

“Russia’s invasion of Ukraine has brought energy security back to the forefront of political agendas as commodity prices surge to new heights. While it is still too early to know how events will unfold, the crisis may result in lasting changes to energy markets,” IEA said.

Russia is the world's largest oil exporter, shipping 8 million b/d of crude and refined products to customers around the world. Unprecedented sanctions on Russia have so far ruled out energy trade for the most part, but major oil companies, trading houses, shipping firms and banks have backed away from doing business with the country.

Russian oil continues to flow for the time being due to term deals and trades made before Moscow sent troops into Ukraine, but new business has all but dried up, according to IEA. Urals crude is being offered at record discounts, with limited uptake so far. Some Asian oil importers have shown interest in the much cheaper barrels but are for the most part sticking to traditional suppliers in the Middle East, Latin America, and Africa for the bulk of their purchases.

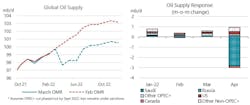

“For now, we see the potential for a shut-in of 3 million b/d of Russian oil supply starting from April, but losses could increase should restrictions or public condemnation escalate,” IEA said.

If this level of disruption is sustained, scheduled monthly OPEC+ increases from Saudi Arabia and other Middle East members along with non-OPEC+ gains driven by the US would leave world oil markets undersupplied in this year’s second and third quarters, according to IEA.

“Refiners, particularly in Europe, are scrambling to source alternative supplies and risk having to reduce activity just as very tight oil product markets hit consumers. There are scant signs of increased supplies coming from the Middle East, or of a significant reallocation of trade flows. The OPEC+ alliance agreed on 2 March to stick with a modest, scheduled output rise of 400,000 b/d for April, insisting no supply shortage exists. Saudi Arabia and the UAE – the only producers with substantial spare capacity – are, so far, showing no willingness to tap into their reserves. Prospects of any additional supplies from Iran could be months off. Talks over a nuclear deal that paves the way for sanction relief have apparently stalled just before the finish line. Should an agreement be reached, exports could ramp up by around 1 million b/d over a 6-month period. Outside of the OPEC+ alliance, growth will come from the US, Canada, Brazil, and Guyana, but any near-term upside potential is limited,” IEA said.

In the absence of a faster rise in production, oil inventories will have to balance the market in the coming months. But even before Russia attacked Ukraine, oil inventories were depleting rapidly. At end-January, OECD inventories were 335 million bbl below the 5-year average and at an 8-year low. IEA's emergency stocks will provide a buffer, with members standing ready to release more oil from strategic reserves if and when needed, on top of the 62.7 million bbl of crude and products already pledged.

Revised economy, demand forecasts

If oil and commodity prices continue to rise, the increase will have a significant impact on inflation and economic growth. While the situation remains in flux, IEA has lowered its expectations for GDP and oil demand.

World GDP growth measured in constant US dollar purchasing power parity (PPP) for the rest of the year has been revised down by 0.9 percentage points to 3.4%.

IEA now sees oil demand growing by 2.1 million b/d on average in 2022, a downgrade of around 1 million b/d from the February forecast. There are actions governments and consumers can take to cut short-term demand for oil more rapidly to ease the strains and the IEA will publish these recommendations later this week.

Global refinery throughput estimates for 2022 have been revised down by 860,000 b/d since IEA’s February report as a 1.1 million b/d reduction in Russian runs is not expected to be fully offset by increases elsewhere. In 2022, refinery intake globally is projected to rise by 2.9 million b/d year-on-year to 80.8 million b/d. Despite a downgrade to demand, product markets remain tight with further stock draws expected throughout the year.