The US Energy Information Administration (EIA)’s January Short-Term Energy Outlook (STEO) remains subject to heightened levels of uncertainty related to the ongoing COVID-19 pandemic as the Omicron variant raises questions about the global economy and energy consumption. Supply uncertainty in the forecast also stems from uncertainty about OPEC+ production decisions and the rate at which US producers will increase drilling.

“Uncertainty in global oil markets has increased heading into 2022. The way in which the Omicron variant of COVID-19 will affect economic activity and oil consumption this year is still unknown. In late 2021, some restrictions to mitigate the spread of COVID-19 began to return in many regions, notably Europe, even before the Omicron variant surfaced. These restrictions, in combination with increased measures to combat the Omicron variant, raised the possibility that global oil consumption could decline in the coming months and added downward pressure to oil prices,” EIA said.

Based on preliminary data and estimates, global consumption of petroleum and other liquid fuels grew by 5 million b/d in 2021. This growth followed a decline of 8.4 million b/d in 2020. EIA forecasts global oil consumption will grow by 3.6 million b/d in 2022 and by 1.8 million b/d in 2023, reaching 100.5 million b/d in 2022 and 102.3 million b/d in 2023. If realized, the 2022 global liquid fuels consumption level would surpass the pre-pandemic 2019 level and represent a new record for world liquid fuels consumption.

Non-OPEC oil supply

EIA estimates that in 2021, non-OPEC production increased by 700,000 b/d compared with 2020. Most of this increase came from the three largest non-OPEC producers: the US, Russia, and Canada. EIA expects non-OPEC production to increase by 2.8 million b/d in 2022 and by an additional 1.6 million b/d in 2023. The US and Russia lead production growth among non-OPEC countries in EIA’s forecast during both 2022 and 2023. Brazil, Norway, and Canada also contribute significantly to growth in the forecast.

US crude oil production averaged 11.2 million b/d in 2021, down 100,000 b/d from 2020 as a result of well freeze-offs during extreme cold in February and well shut-ins during Hurricane Ida in late August and early September. Production in 2021 was still 1.1 million b/d lower than the annual record of 12.3 million b/d set in 2019. EIA expects annual average US crude oil production to increase to 11.8 million b/d in 2022 and to 12.4 million b/d in 2023, which would set a new record.

EIA expects WTI prices to average $71/bbl in 2022, which is up $3/bbl from the 2021 average and is sufficient for producers to realize positive cash flows in many areas, particularly the more productive areas of the Permian basin.

“Producers saw increased cash flow in 2021, having held back on capital investments and cut costs, as crude oil prices rose significantly. Restrained investment led to fewer rig additions than what we have observed at similar crude oil price levels in previous years. With financial conditions among operators improved, we expect development to proceed at a modest pace,” EIA said.

OPEC supply

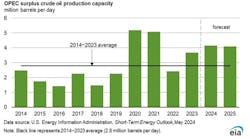

OPEC crude oil production averaged 26.3 million b/d in 2021, up 700,000 b/d from 2020. EIA forecasts that average OPEC crude oil production will increase by an additional 2.5 million b/d to average 28.8 million b/d in 2022 and then average 28.9 million b/d in 2023. However, OPEC crude oil production forecast is subject to considerable uncertainty, driven both by country compliance with existing production targets and uncertain future global demand.

“OPEC+ has indicated that it will adjust production targets in response to changes in global oil demand, but the path of global oil demand in the coming months remains uncertain. Even with increased OPEC crude oil production, remaining surplus production capacity will be more than sufficient to meet additional demand even if consumption exceeds our expectations,” EIA said.

The STEO forecast assumes current US sanctions remain in place for Iran and Venezuela for the entire forecast period. EIA also expects that OPEC+ will not implement further production cuts to accommodate any potential increases in oil output from Iran or Venezuela.

EIA’s forecast assumes generally stable production in Libya in 2022 and 2023. However, the forecast of Libya’s crude oil production is subject to heightened uncertainty as a result of the tentative political and security situation in Libya and the lack of a budget to support oil and natural gas infrastructure maintenance and repair.

Oil inventory, oil prices

EIA forecasts that global oil production will outpace global oil consumption during both 2022 and 2023, resulting in rising global oil inventories. Global oil inventories will rise by an average of 500,000 b/d in 2022 and by 600,000 b/d in 2023 and that these inventory builds will generally put downward pressure on crude oil prices.

Brent prices average $75/bbl in 2022 and $68/bbl in 2023 in EIA’s forecast. However, as EIA noted, oil market balances are subject to significant uncertainties during the forecast period, notably, the way in which the ongoing pandemic affects economic growth, oil demand, and the production decisions of OPEC+ members. These factors, among others, could keep oil prices volatile.

Supply uncertainty in the forecast stems from uncertainty about OPEC+ production decisions and the rate at which US oil and natural gas producers will increase drilling.

Brent crude oil spot prices averaged $71/bbl in 2021, and EIA forecasts Brent prices will average $75/bbl in 2022 and $68/bbl in 2023.