IEA: Omicron variant will not upend oil demand recovery

Emergence of the COVID-19 Omicron variant and the surge in new COVID-19 cases is expected to temporarily slow, but not upend, the recovery in oil demand that is under way, the International Energy Agency (IEA) noted in its December Oil Market Report.

“The emergence of the COVID-19 Omicron variant at the end of November sparked a steep sell-off in oil, but initial pessimism has now given way to a more measured response,” IEA said.

“New containment measures put in place to halt the spread of the virus are likely to have a more muted impact on the economy versus previous COVID waves, not least because of widespread vaccination campaigns. As a result, we expect demand for road transport fuels and petrochemical feedstocks to continue to post healthy growth. However, due to new restrictions on international travel, we have revised down our global oil demand forecast for 2021 and 2022 by 100,000 b/d on average, primarily to account for reduced jet fuel use.”

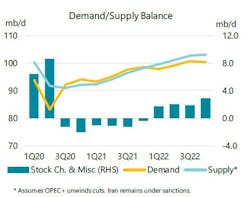

Global oil demand is forecast to grow by 5.4 million b/d in 2021 and a further 3.3 million b/d next year, when it rebounds to pre-COVID levels at 99.5 million b/d.

At the same time, oil supplies are on the rise with world oil output up by a further 970,000 b/d in November. For a second month, the biggest single increase came from the US, where drilling activity is picking up. OPEC+ production rose by 450,000 b/d.

“As the upward supply trend extends into 2022, the US, Canada and Brazil are set to pump at their highest ever annual levels, lifting output from non-OPEC+ by 1.8 million b/d in 2022 overall. Saudi Arabia and Russia could also set records, if remaining OPEC+ cuts are fully unwound. In that case, global supply would soar by 6.4 million b/d next year compared with a 1.5 million b/d rise in 2021,” IEA said.

In the near term, additional supply could come from strategic petroleum reserves (SPRs). The US announced Nov. 23 a release of up to 50 million bbl of oil from its SPR, with parallel actions by China, India, South Korea, Japan, and the UK, in an effort to ease energy prices. While details on volumes and timings are still sparse, the combined SPR releases could potentially amount to as much as 70 million bbl. Those volumes, if taken up by the market, could help replenish depleted industry inventories.

OECD industry stocks fell by 21 million bbl in October to 2,737 million bbl, some 240 million bbl below the most recent 5-year average. Preliminary data point to another 23 million bbl decline in November.

The steady rise in supply combined with easing demand has considerably loosened the balances for first-quarter 2022 compared to last month’s report, IEA noted. Assuming OPEC+ continues to unwind its cuts, a surplus of 1.7 million b/d could materialize in first-quarter 2022 and 2 million b/d in second-quarter 2022.

“If that were to happen, 2022 could indeed shape up to be more comfortable,” IEA said.