EIA: Omicron variant raises uncertainty about energy consumption

The US Energy Information Administration (EIA)’s December Short-Term Energy Outlook (STEO) remains subject to heightened levels of uncertainty related to the ongoing recovery from the COVID-19 pandemic. Notably, the emergence of the Omicron variant raises uncertainty about the level of energy consumption throughout the world compared with last month’s forecast.

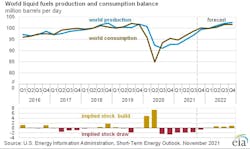

Brent crude oil spot prices averaged $81/bbl in November, a $3/bbl decrease from October 2021 but a $38/bbl increase from November 2020. Crude oil prices have risen over the past year as result of steady draws on global oil inventories, which averaged 1.4 million b/d during the first three quarters of 2021.

However, following the identification of the new COVID-19 Omicron variant, which raised the possibility that petroleum demand could decline in the near term, crude oil prices fell significantly on Nov. 26, and the Brent spot price began December below $70/bbl. High COVID-19 case counts in November have prompted renewed mobility restrictions in Austria, work-from-home mandates in Ireland and the Netherlands, and several other guidelines in the rest of Europe.

Crude oil prices have also experienced downward pressures in early November because of expectations that the US and other countries would release strategic oil reserves. The US announced the release of 50 million bbl of crude oil from the Strategic Petroleum Reserve (SPR) on Nov. 23, and other nations also agreed to release reserves.

In this STEO, EIA expects Brent prices will average $71/bbl in December and $73/bbl in first-quarter 2022. For 2022 as a whole, growth in production from OPEC+, of US tight oil, and from other non-OPEC countries will outpace slowing growth in global oil consumption, especially in light of renewed concerns about COVID-19 variants, according to EIA. Brent prices will remain near current levels in 2022, averaging $70/bbl.

According to EIA’s estimate, 99.7 million b/d of petroleum and liquid fuels was consumed globally in November, a 4.9 million b/d increase from November 2020, but 1.1 million b/d less than in November 2019.

Meantime, EIA revised down its forecast of consumption of petroleum and liquid fuels for fourth-quarter 2021 and first-quarter 2022, partly because of recently announced travel restrictions following reported outbreaks of the Omicron variant of COVID-19. “It is not yet clear how Omicron will affect oil markets and the broader economy. One of the most likely markets to be affected is jet fuel, and some flights have already been canceled because of the variant,” EIA said.

For all of 2021, EIA forecasts global consumption of petroleum and liquid fuels will average 96.9 million b/d, which is a 5.1 million b/d increase from 2020. EIA also forecasts that global consumption will increase by 3.5 million b/d in 2022 to average 100.5 million b/d. However, the forecast is subject to significant revisions.

Total US crude oil production was an estimated 11.7 million b/d in November. EIA forecasts that it will rise to an average of 11.8 million b/d in 2022 and to an average of 12.1 million b/d in fourth-quarter 2022.

Historical data updates

The December STEO forecast incorporates the latest updates to EIA’s International Energy Statistics, including historical petroleum consumption and production data for all non-OECD countries for 2019 and updated 2020 petroleum consumption data for several of the largest consuming countries. These historical data updates resulted in EIA lowering supply and consumption data for 2019 and 2020 and lowering total supply and consumption forecasts through 2022.