Rystad: Cost inflation to hit US oil and gas supply chain

Supply chain costs of US oil and gas projects will increase in coming years, Rystad Energy forecasts. Among them, the engineering, procurement, construction, and installation (EPCI) segment is set to be the first to experience double-digit cost growth. EPCI costs, mostly driven by climbing wages and material costs, are set to increase about 10% in 2023 from current levels.

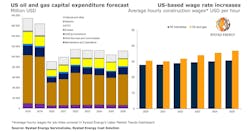

As a result, US capital expenditure on EPCI in 2023 is expected to end at $15.5 billion, some $1.4 billion higher than where it would be under the current cost status quo. Higher expected construction wages account for about $1 billion of that extra cost, with the remaining $400 million coming mostly from the rising cost of bulk materials in addition to engineering labor.

This year’s EPCI capex is estimated at $12.6 billion, which means the segment is poised for a significant spending increase in 2023, irrespective of the cost rise—and the figure will climb even further in 2024 to $18.0 billion.

Other supply segments will also see higher costs in 2023, albeit not at the rate of EPCI. Subsea supply costs are expected to rise by 8% from 2021, maintenance and operations by 7%, drilling contractors by 6% and seismic by 5%.

Overall, Rystad’s projections indicate that US oil and gas capital expenditure will rebound from a COVID-19-induced low of $91.0 billion in 2020 and an expected $99.3 billion this year to over $112.7 billion in 2023 and 2024. Concurrently, EPCI expenditure is expected to experience robust growth, peaking at $18 billion in 2024, up 50% from last year’s $12 billion.

“Although the current trend of high oil prices indicates a more favorable economic outlook, the growth of EPCI costs is a cause for concern in the near term. Costs are expected to rise even further after 2023, with drilling contractor and subsea cost increases becoming the prime headache for oil and gas operators,” said Robert Mathey, analyst and supply chain expert at Rystad Energy.

“If EPCI players fail to adapt to the rising costs, those executing lump-sum contracts and using outdated assumptions for procurement and construction indices will see their margins squeezed. To mitigate the effects of rising costs, contractors will need to be creative with how they source engineering and procurement services,” he continued.