EIA forecasts higher oil prices for remainder of 2021

In its October Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) expects Brent prices will average $81/bbl during fourth-quarter 2021, which is $10/bbl higher than its previous forecast.

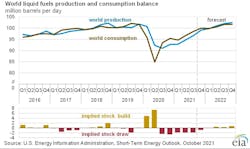

The higher forecast reflects EIA’s expectation that global oil inventories will fall at a faster rate than the agency had previously expected, owing largely to lower global oil supply in late 2021 across a range of producers.

Brent crude oil spot prices averaged $74/bbl in September, up $4/bbl from August and up $34/bbl from September 2020. Brent spot prices have risen from their September average to more than $80/bbl in early October. Oil prices have increased over the past year as result of steady draws on global oil inventories, which averaged 1.9 million b/d during the first 3 quarters of 2021. In addition to sustained inventory draws, prices increased after the Oct. 4 announcement by OPEC+ that the group would keep current production targets unchanged.

In 2022, EIA expects that growth in production from OPEC+, US tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption and contribute to Brent prices declining from current levels to an annual average of $72/bbl.

US oil

Total US crude oil production averaged 11.3 million b/d in July—the most recent monthly historical data point. EIA estimates that domestic production fell to 10.6 million b/d in September because of disruptions from Hurricane Ida. EIA then forecasts production will be 11.0 million b/d in October and rise to 11.3 million b/d in December.

Production in 2021 is forecast to average 11.0 million b/d, increasing to 11.7 million b/d in 2022 as tight oil production rises. Growth will come as a result of operators increasing rig counts, which will offset production decline rates.

US regular gasoline retail prices averaged $3.18/gal in September, up 2¢/gal from August and almost $1/gal higher than in September 2020. Recent gasoline price increases reflect increasing crude oil prices outweighing falling gasoline wholesale margins. EIA forecasts that retail gasoline prices will average $3.21/gal in October before falling to $3.05/gal in December.

US natural gas

In September, the natural gas spot price at Henry Hub averaged $5.16/MMbtu, which was up from the August average of $4.07/MMbtu and up from an average of $3.25/MMbtu in first-half 2021. The rising prices in recent months reflect US natural gas inventory levels that are below the 5-year average and continuing demand for natural gas for power generation use at relatively high prices.

EIA expects the Henry Hub spot price will average $5.80/MMbtu in fourth-quarter 2021, which is $1.80/MMbtu higher than the forecast in the September STEO. In the current forecast, Henry Hub prices reach a monthly average peak of $5.90/MMbtu in January and generally decline through 2022, averaging $4.01/MMbtu for the year amid rising US natural gas production and slowing growth in LNG exports.

EIA also forecasts that US inventory draws will be slightly more than the 5-year average this winter, and that factor, along with rising US natural gas exports and relatively flat production through January will keep US natural gas prices near recent levels before downward pressures emerge.

Given low natural gas inventories in both US and European natural gas storage facilities and uncertainty around seasonal demand, EIA expects natural gas prices to remain volatile over the coming months, with winter temperatures being a key driver of demand and prices.

EIA estimate that US LNG exports averaged 9.3 bcfd in September 2021, down 4% from August. Despite the recent monthly decline, these were the most US LNG exports for September since the US began exporting LNG from the Lower 48 states in February 2016. Even though September exports were a record for the month, they were limited by weather conditions, which led to the suspension of piloting services for several days at Sabine Pass, Cameron, and Corpus Christi.

EIA expects that LNG exports will average 9.1 bcfd in October and then increase in the coming months. Cove Point LNG terminal is scheduled to complete its annual maintenance by mid-October and resume exports month. Through this winter, LNG exports in the forecast average 10.7 bcfd as global natural gas demand remains high and several new LNG export trains–the sixth train at Sabine Pass LNG and the first trains at the new LNG export facility Calcasieu Pass LNG–enter service.

EIA estimates dry natural gas production averaged 93.3 bcfd in the US during third-quarter 2021–up from 91.6 bcfd in first-half 2021. Production in the forecast rises to an average of 94.0 bcfd during the winter, and averages 96.4 bcfd during 2022, driven by natural gas and crude oil prices, which are expected to remain at levels that will support enough drilling to sustain production growth.