Rystad: China to spend over $120 billion on services, drill 118,000 wells through 2025

China hopes to increase oil and natural gas production in the next few years to meet rising domestic demand and reduce the record-high share of imports in its oil consumption. Rystad Energy projects a surge in spending until 2025, which will be accompanied by a drilling spree totaling 118,000 wells that will create opportunities for suppliers.

China’s national oil companies (NOCs) are expected to spend more than $120 billion on drilling and well services in 2021-2025, seeking to meet the rising oil and gas demand. At the same time, the country aims to supply more of its oil demand from domestic sources, after the share of imported crude oil has risen steadily from 2014 to a high of almost 75% last year.

CNPC, CNOOC, and Sinopec together are expected to spend about $123 billion on drilling and well services in the coming 5-year period, up from a total $96 billion between 2016 and 2020.

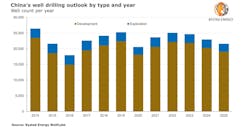

As a result of China’s oil and gas demand growth, drilling activity in the country is expected to remain intense in years to come, with the cumulative number of development and exploration wells drilled between 2021 and 2025 expected to reach 118,000. Development wells will account for 88% of the total and exploration wells will make up the remaining 12%.

“Despite a strong policy push to electrify transport, China is still expected to use oil products to fuel its hundreds of millions of cars, buses and trucks for the next five years at least. Although the country’s electric vehicle market is projected to achieve a 20% market share by 2025, internal combustion engine vehicles are expected to account for most of China’s transport needs and to provide a backbone for oil demand through 2025,” said Peng Li, energy research analyst at Rystad Energy.

Chinese oil production has fallen to 1.43 billion bbl in 2020 from 1.55 billion bbl in 2014. Domestic oil production met just over a quarter of China’s domestic oil needs in 2020, with the remaining 74% met by imports, the highest level on record. As only 2.4% of the world’s proven oil reserves are in China, the scope for increased domestic production is limited. China’s reliance on imports—and associated energy supply security concerns—has led the government to push its domestic E&P companies to find new reserves and increase domestic output.

On the natural gas side, domestic production remains modest compared to overall demand, but has grown to around 190 billoin cu m (bcm) in 2020 from about 120 bcm in 2014. Still short of 2020’s total demand of 330 bcm, the nation remains reliant on imported piped gas and shipped liquefied natural gas (LNG) for over 40% of its needs.

With gas consumption on the rise, especially as China looks to use more gas in place of coal in power generation to reduce short-term emissions, the pressure to boost domestic gas production is an overarching imperative, Rystad said. This will also provide a stimulus to the E&P sector, especially if international LNG prices continue to track higher, as seems likely due to anticipated global supply constraints, the report continued.

While the transition to a low-carbon economy is a priority for China, balancing this with the nation’s transitional oil and gas needs is still an important consideration. China’s 14th 5-year plan for 2021-2025, emphasizes the importance of identifying new hydrocarbon reserves and increasing oil and gas production alongside increasing the share of non-fossil fuels to 20% by 2025.

“As state-owned entities, China’s major operators are not solely profit-driven. They also play an important and integrated role in social economics. So even in a less-favorable oil price environment, we expect Chinese NOCs to perform in line with government expectations and to continue to make an effort to shore up domestic supply,” Li said.

China has managed to maintain overall oil production while increasing gas production, despite drilling notably fewer wells in 2020, notable considering China was the first country to be seriously impacted by the pandemic, Rystad said. One factor has been advances in drilling and well services techniques, enabling China to drill an increasing number of deep and horizontal wells.

Improved well planning and advanced enhanced oil recovery (EOR) methods are also helping China increase its recovery rate, even at giant mature fields such as Daqing, Rystad said. Another factor over the past decade has been the rising use of fracturing services, which has boosted development of unconventional oil and gas resources.

With China focused on maintaining or increasing production levels, service companies that can offer innovative technology solutions are likely welcome in the Chinese drilling and well services market in the years to come, whether the field developments are conventional or unconventional, onshore, or offshore, Rystad said.