EIA raises near term oil price forecast, warns of downward pressures

In its June Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) raised its Brent price forecast for the coming months. EIA now expects Brent prices to average $69/bbl in June and $68/bbl in third-quarter 2021, $4/bbl and $5/bbl higher, respectively, than last month’s forecast. But larger downward oil price pressures are expected to emerge later in 2021 and into 2022 as forecast global oil supply outpaces slowing oil demand growth.

This forecast keeps prices near or slightly below current levels through the third quarter and incorporates recent price increases and EIA’s forecast of mostly balanced oil markets in the coming months.

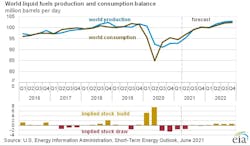

Given announced increases in production from the Organization of the Petroleum Exporting Countries (OPEC), EIA expects production to grow more rapidly in second-half 2021 to keep pace with rising demand. In the forecast, global oil consumption rises by 2.8 million b/d from second-quarter to second-half 2021 while global oil production rises 4.3 million b/d during the same period, balancing the 1.5 million b/d of global oil inventory draws during the second quarter.

EIA noted, however, that the forecast “remains subject to heightened levels of uncertainty related to the ongoing economic recovery from the COVID-19 pandemic.”

Global oil consumption, supply

Despite rising COVID-19 case counts in some countries, particularly India, global oil demand remained higher than supply in May, contributing to continued global withdrawals from inventories of crude oil and petroleum products. However, EIA estimates withdrawals fell to 1.2 million b/d in May, compared with average monthly withdrawals of 2.1 million b/d since June 2020.

EIA estimates that 96.2 million b/d of petroleum and liquid fuels was consumed globally in May, an increase of 11.9 million b/d from May 2020 but 3.7 million b/d less than in May 2019.

Scheduled increases in production targets contributed to OPEC crude oil production reaching 25.5 million b/d in May, its highest level since April 2020. This increase brought global supply to an estimated 95 million b/d compared with consumption of 96.2 million b/d. EIA expects OPEC crude oil production will increase to an average of 28 million b/d in third-quarter 2021.

In this STEO, EIA forecasts that global consumption of petroleum and liquid fuels will average 97.7 million b/d for all of 2021, a 5.4-million b/d increase from 2020. Global consumption of petroleum and liquid fuels will increase by 3.6 million b/d in 2022 to average 101.3 million b/d.

EIA expects that OPEC crude oil production will average 26.9 million b/d in 2021 and 28.7 million b/d in 2022. OPEC crude oil production in the forecast rises from 25 million b/d in April to an average of 28 million b/d in third-quarter 2021.

The expectation of rising OPEC production is primarily based on the assumption that OPEC will raise production by about 1 million b/d in both June and in July in response to rising global oil demand and seasonal increases in oil consumption for power generation for some OPEC members. It also reflects an assumption that Iran’s crude oil production will continue to increase this year. Although sanctions that target Iran’s crude oil exports remain in place, crude oil exports—according to ClipperData LLC—and production from Iran are up from most of 2020.

US oil market

The US economy continues to recover after reaching multiyear lows in second-quarter 2020. The increase in economic activity and easing of the COVID-19 pandemic have contributed to rising energy use. US gross domestic product declined by 3.5% in 2020 from 2019 levels. This STEO assumes US GDP will grow by 6.7% in 2021 and by 4.9% in 2022.

EIA expects US gasoline consumption will average 9.1 million b/d this summer (April–September), which is 1.3 million b/d more than last summer but still more than 400,000 b/d less than summer 2019. Weekly consumption data reflect the Colonial Pipeline outage and subsequent increase in gasoline demand, but consumption both before and after this event indicate more gasoline demand than EIA had previously forecast. EIA expects US gasoline consumption to average 8.7 million b/d in for all of 2021 and 9.0 million b/d in 2022.

According to EIA’s most recent data, US crude oil production averaged 11.2 million b/d in March 2021, an increase of 1.4 million b/d from February. The March rise indicates that the production outages caused by the February winter freeze were temporary and that production came back onlinew quickly. Because prices of West Texas Intermediate crude oil remain above $60/bbl during 2021 in the current forecast, EIA expects that producers will drill and complete enough wells to raise 2022 production from 2021. EIA estimates that 2022 production will average 11.8 million b/d, up from a forecast average of 11.1 million b/d in 2021.