AEO2021: Petroleum remains most-consumed fuel in US before 2050

In its latest Annual Energy Outlook 2021 (AEO2021), the US Energy Information Administration (EIA) forecasts that, in the reference case, petroleum and other liquids remains the most-consumed fuel in the US before 2050.

Projections in the Annual Energy Outlook 2021 (AEO2021) are modeled projections of what may happen given certain assumptions and methodologies. The reference case generally assumes that current laws and regulations that affect the energy sector, including laws that have end dates, remain unchanged throughout the projection period. The reference case serves as a reasonable baseline case that can be compared with the side cases that include alternative assumptions.

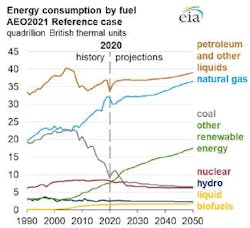

Energy consumption by fuel

According to AEO2021, petroleum and other liquids remain the most-consumed fuel in the AEO2021 reference case. The transportation sector is the largest consumer of petroleum and other liquids, particularly motor gasoline, and distillate fuel oil.

In the Reference Case, EIA assumes that current fuel economy standards stop requiring additional efficiency increases in 2026 for light-duty vehicles and in 2027 for heavy-duty vehicles. As travel continues to increase, consumption of petroleum and other liquids increases later in the projection period. For industrial uses, petroleum remains the primary fuel for refining processes and for agriculture.

In the Reference case, consumption of natural gas will keep growing as well, driven by expectations that natural gas prices will remain low compared with historical levels. Natural gas consumption growth between 2020 and 2050 is concentrated in two areas: exports and industrial use. The industrial sector becomes the largest consumer of natural gas starting in the early 2020s. This sector will expand the use of natural gas as a feedstock in the chemical industries, as well as for industrial heat and power.

In all cases, consumption of non-hydroelectric renewable energy is projected to be the fastest growing energy source. Policies at the state and federal level have encouraged significant investment in renewable resources for electricity generation and transportation fuels. New technologies have driven down the cost to install wind and solar generation, further increasing their competitiveness in the electricity market even as policy effects moderate over time. Federal regulation continues to encourage the use of biofuels, primarily ethanol, in the projection period. However, relatively modest increases in overall electricity and liquid fuel demand slow the projected growth of renewable energy in the Reference case.

Motor gasoline demand

Spurred by rising incomes, increases in employment rates, and population growth, total annual sales of new light-duty vehicles (LDVs) in the US in the Reference Case increase after the 2020 economic downturn before leveling off after 2025. EIA projects fewer sales of new LDVs in every year in the projection period than in 2019, although the market continues to grow for alternative technologies, particularly battery electric vehicles (BEVs).

Gasoline and flex-fuel vehicles—which may use gasoline blended with up to 85% ethanol—accounted for 95% of the new LDV market in 2020, but their share of new-vehicle sales decreases to 79% in 2050. Both BEVs and electric hybrids increase their market shares of annual new LDV sales.

Because most light-duty vehicles have internal combustion engines, motor gasoline remains the major transportation fuel through 2050 as personal travel returns to pre-pandemic per-driver levels in the longer term. After pandemic response-related demand losses in 2020, consumption of motor gasoline in transportation peaks in about 2023 as fuel economy improvements partially offset travel growth.

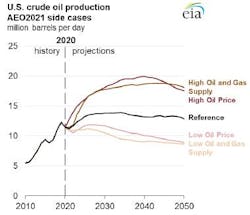

Production

According to AEO2021, starting in 2023, oil and natural gas production in the reference case remains at historically high levels through 2050. The US continues to be an integral part of global oil and natural gas markets and a significant source of global supply.

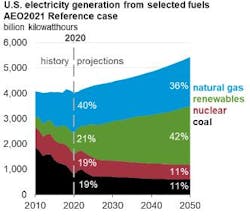

Electricity

Electricity generating capacity increases 52% to 84% across AEO cases; additions come mostly from solar, wind, and natural gas.

Renewable electric generating technologies account for almost 60% of the approximately 1,000 g of cumulative capacity additions projected in the AEO2021 reference case from 2020 to 2050. The large share is a result of declining capital costs but is also a result of increasing renewable portfolio standard (RPS) targets and tax credits.

Although the greatest potential for increased electricity demand is within the transportation sector, electricity demand from this sector remains less than 3% of economy-wide electricity demand throughout the projection period.

Despite continuing improvements in electric vehicles (EVs) through evolutionary market developments, both vehicle sales and utilization (miles driven) would need to increase substantially for EVs to raise electric power demand growth rates by more than a fraction of a percentage point per year.