Morgan Stanley: A new cycle begins for global gas, LNG

After hitting historic lows mid-2020, global gas prices staged a rally, up 4-10 times. Elevated spot prices should moderate, but Morgan Stanley reiterates its call for a multiyear LNG recovery with a supply shortfall by 2023. Volatility has led to dislocations, creating global cross-asset opportunities.

In-line with Morgan Stanley’s outlook set forth in 2019, growing trade of LNG has created a globally interconnected gas market and a wave of oversupply through much of the last 2 years.

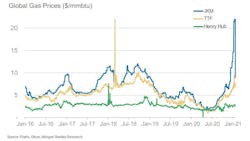

After a 50% price decline in 2019 and a further 60% collapse through the beginning of 2020, key global gas benchmarks achieved parity for the first time in decades last May at around $2/MMbtu. Since then, gas prices have staged a significant rally. European prices (TTF) have increased more than four times while spot Asian LNG (JKM) have increased more than 10 times, reaching a record high of over $25/MMbtu.

According to Morgan Stanley, demand is growing two times faster than supply, supporting a multiyear recovery. COVID-19 drastically altered many commodity markets, resetting the outlook across many parts of the energy value chain. For LNG, it broke a trend of record project sanctioning and persistent oversupply.

“Over the past year, our expectations for total supply have fallen by 15% through 2025, while demand has been strikingly resilient - down only 3% and still exhibiting strong structural growth. While the recent price spike has left summer 2021 prices over-extended, creating some near-term price risk to the downside, a new multiyear up-cycle has likely begun. The market is set to return to balance by 2022 before shifting into a supply shortfall by 2023, driving a 2-time increase in LNG prices 2020-23 and implying above 20% upside to out-year futures prices.”