Bankruptcy-hit US operators set to lose a quarter of oil production in 2021

As Chapter 11 filings by US exploration and production companies (E&Ps) continue, onshore oil production from companies that filed in the last 2 years is set to decrease by about 25% by end-2021, or about 200,000 b/d compared to current output levels, according to Rystad Energy analysis. The loss puts the projected nationwide production growth for 2021 at risk of being offset.

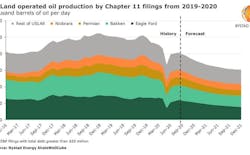

Operated oil production from the recent filings is heavily weighted in the Eagle Ford and Bakken regions, at almost 400,000 b/d. Permian-focused operators currently going through restructuring only produce 80,000 b/d in the basin.

Across the US onshore industry, about 800,000 b/d is operated by E&Ps that have filed for bankruptcy protection in 2019-2020. With limited capex and completion activity, it is anticipated that production from this group will decline further to 600,000 b/d by late-2021.

The same peer group lifted around 8.5 bcfd of gross US land gas production. While some is associated gas, which will track oil output from the different oil basins, Rystad does not expect any significant production declines in the Appalachia and Haynesville regions as operators who have filed Chapter 11 are maintaining adequate activity levels in the regions.

The preliminary 2021 guidance summary, based on US companies' third-quarter earnings reports, shows that public tight-oil focused producers still active are targeting to simply maintain activity levels next year.

“We may see sequential production growth somewhere in the 80,000-120,000 b/d range between the last 3 months of this year and the fourth quarter of next year. In addition, the supermajors and private companies will also post marginal production increases,” said Artem Abramov, head of shale research at Rystad Energy.

“Chapter 11 filings affect the whole industry. Most of the growth in US tight oil which was expected towards the end of 2021 is at risk to be offset by the decline in output from companies that have filed for restructuring in the last two years, as most of them are currently in their base decline phase with limited new well activity,” he said.

The group of operators that filed for bankruptcy in 2019 (many have completed restructuring) has spudded just 7 US onshore wells since second-quarter 2020. The slow post-restructuring recovery is largely related to the market downturn, but regardless of the price environment, the Chapter 11 group of operators is unlikely to come back with significant capex increases before second-half 2021, Rystad said.

While E&Ps that filed for bankruptcy this year have drilled 15-30 wells/month since August, just two operators were responsible for the majority: Chesapeake and Extraction. Excluding Chesapeake and Extraction, the current spud rate is negligible compared to the 100-140 wells/month delivered by the peer group in 2017-2018.