EIA: Henry Hub spot gas prices to reach $3.4/MMbtu in January

Henry Hub spot prices are expected to rise to a monthly average of $3.42/MMbtu in January 2021 because of rising domestic demand for natural gas for space heating, rising US LNG exports, and reduced production, the US Energy Information Administration noted in its the latest Short-Term Energy Outlook. EIA expects that monthly average spot prices will remain higher than $3.00/MMbtu throughout 2021, averaging $3.14/MMbtu for the year, up from a forecast average of $2.14/MMbtu in 2020.

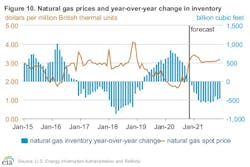

In October, the Henry Hub natural gas spot price averaged $2.39/MMbtu, up from an average of $1.92/MMbtu in September. Higher natural gas spot prices reflected stronger demand for LNG exports as LNG terminals increased liquefaction following hurricane-related disruptions in August and September.

EIA estimates that total US working natural gas in storage ended October at almost 4.0 tcf, 5% more than the 5-year (2015–19) average and the second highest end-of-October level on record. However, because EIA forecasts less US natural gas production this winter than last winter, EIA forecasts that inventory draws will outpace the 5-year average during the heating season (October–March) and end March 2021 at 1.5 tcf, which would be 16% lower than the 2016–20 average.

EIA expects that total US consumption of natural gas will average 83.7 bcf/d in 2020, down 1.7% from 2019. The decline in total consumption reflects less heating demand in early 2020, contributing to residential demand in 2020 averaging 13.2 bcf/d (down 0.6 bcf/d from 2019) and commercial demand in 2020 averaging 8.8 bcf/d (down 0.9 bcf/d from 2019). EIA forecasts industrial consumption will average 22.5 bcf/d in 2020, down 0.6 bcf/d from 2019 as a result of reduced manufacturing activity. EIA expects total US natural gas consumption will average 79.4 bcf/d in 2021, a 5.2% decline from 2020. The expected decline in 2021 is the result of rising natural gas prices that will reduce demand for natural gas in the electric power sector.

According EIA’s forecasts, US dry natural gas production will average 91.0 bcf/d in 2020, down from an average of 93.1 bcf/d in 2019. In the forecast, monthly average production falls from a record 97.0 bcf/d in December 2019 to 87.0 bcf/d in April 2021 before increasing slightly. EIA forecasts dry natural gas production in US to average 87.9 bcf/d in 2021. EIA expects production to begin rising in second-quarter 2021 in response to higher natural gas and crude oil prices. The increase in crude oil prices is expected to raise associated gas production from oil-directed wells in late-2021, especially in the Permian region.

EIA estimates that US exported 7.2 bcf/d of LNG in October, an increase of 2.3 bcf/d from September—the largest month-on-month increase since US LNG exports began in 2016. Cameron LNG resumed LNG exports in October after being shut down following Hurricane Laura and Hurricane Delta. Cove Point LNG completed its scheduled three-week annual maintenance and resumed LNG exports in mid-October. Higher global forward prices for LNG indicate improving netbacks for buyers of US LNG in European and Asian markets for the upcoming winter season. The increased prices come amid expectations of natural gas demand recovery in those markets and potential LNG supply reductions because of outages at several LNG export facilities in the Pacific Basin and Atlantic Basin. EIA forecasts that US LNG exports will be above pre-COVID levels in November 2020, averaging 8.5 bcf/d, and will average 8.4 bcf/d in 2021, a 31% increase from 2020.