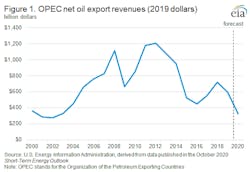

OPEC 2020 net oil export revenues forecast at 18-year low

Members of the Organization of the Petroleum Exporting Countries (OPEC) will earn about $323 billion in net oil export revenues in 2020, the lowest since 2002, according to US Energy Information Administration (EIA) forecasts. Lower crude oil prices and lower export volumes drive the expected decrease in export revenues.

EIA based its OPEC revenues estimate on forecast petroleum liquids production—including crude oil, condensate, and natural gas plant liquids—and forecast values of OPEC petroleum consumption and crude oil prices.

Crude oil prices have fallen as a result of lower global demand for petroleum products because of COVID-19 and associated mitigation efforts. Export volumes have also decreased due to OPEC agreements limiting crude oil output in response to low crude oil prices, record-high production disruptions in Libya, Iran, and to a lesser extent, Venezuela.

OPEC earned an estimated $595 billion in net oil export revenues in 2019, less than half of the estimated record high of $1.2 trillion earned in 2012. Similar to the factors driving the decrease in net oil revenues in 2020, the estimated 2019 revenues fell as a result of lower crude oil prices, higher crude oil production disruptions, and voluntary curtailment of crude oil output among OPEC members.

Per capita net oil export revenues across OPEC averaged $1,201 in 2019, down 19% from 2018. EIA forecasts that 2020 per capita net oil export revenues will fall to $638.

The benchmark Brent crude oil spot price fell from an annual average of $71/bbl in 2018 to $64/bbl in 2019. EIA expects Brent to average $41/bbl in 2020, based on forecasts in EIA’s October 2020 Short-Term Energy Outlook (STEO).

Heavier crude oils are typically priced lower than lighter crude oils. However, as the global slate of crude oil changed with increased light crude oil production, some OPEC members benefited from a narrowing price discount for their heavier crude oils. In 2019, smaller discounts for OPEC members’ heavier crude oil streams contributed to higher spot prices for the OPEC crude oil basket price, which incorporates spot prices for the major crude oil streams from all OPEC members.

OPEC petroleum production averaged 36.6 million b/d in 2018 and fell to 34.5 million b/d in 2019; EIA expects OPEC production to decline a further 3.9 million b/d to average 30.7 million b/d in 2020.

Continued declines in revenue in 2020 could be detrimental to member countries’ fiscal budgets, which rely heavily on revenues from oil sales to import goods, fund social programs, and support public services, EIA said.