EIA: Oil market subject to heightened uncertainty related to COVID-19

The US Energy Information Administration’s October Short-Term Energy Outlook (STEO) remains subject to heightened levels of uncertainty because mitigation and reopening efforts related to COVID-19 continue to evolve. Reduced economic activity related to the COVID-19 pandemic has caused changes in energy demand and supply patterns in 2020 and will continue to affect these patterns in the future.

EIA estimates the rate of global oil demand growth slowed in August and September compared with the initial recovery from June and July. June and July’s global oil demand increased by 6.0 million b/d and 3.1 million b/d, respectively, whereas EIA estimates August and September demand increased by 600,000 b/d and 1.3 million b/d, respectively. Recent increases in cases of COVID-19 in some countries have led to some renewed government-imposed restrictions, albeit to a much lesser extent than in March and April 2020, which could also be contributing to some downward pressure on crude oil prices.

In addition, as Libya is excluded from the current production agreement among members of the Organization of the Petroleum Exporting Countries and partner countries (OPEC+), an increase in crude oil production from the country could significantly affect crude oil supply and inventories in the coming months.

Global oil inventory, prices

Brent crude oil spot prices averaged $41/bbl in September, down $4 from the average in August. The decrease in oil prices coincided with slowing increases in global oil demand.

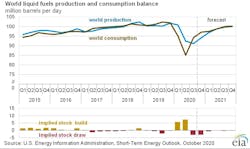

EIA estimates that global oil markets have shifted from global liquid fuels inventories building at a rate of 7.3 million b/d in the second quarter of 2020 to drawing at a rate of 3.1 million b/d in the third quarter. Inventory draws in the fourth quarter is expected to be 3.0 million b/d before markets become more balanced, with inventory draws of 300,000 b/d on average in 2021.

Despite expected inventory draws in the coming months, EIA expects high inventory levels and surplus crude oil production capacity will limit upward pressure on oil prices. EIA forecasts monthly Brent spot prices will average $42/bbl during fourth-quarter 2020 and will rise to an average of $47/bbl in 2021.

US crude oil production

In May, US crude oil production reached a 2 1/2-year low of 10 million b/d, resulting from curtailed production amid low oil prices. Since then, US production has increased mainly because tight oil operators have brought wells back online in response to rising prices. US crude oil production averaged 11.0 million b/d in July (the most recent month for which historical data are available), up 500,000 b/d from June.

EIA estimates that production rose to 11.2 million b/d in September. However, EIA expects US crude oil production to generally decline to average of 11.0 million b/d in second-quarter 2021 because new drilling activity will not generate enough production to offset declines from existing wells. Drilling activity will rise later in 2021, contributing to US crude oil production returning to 11.2 million b/d in fourth-quarter 2021.

On an annual average basis, EIA expects US crude oil production to fall from 12.2 million b/d in 2019 to 11.5 million b/d in 2020 and 11.1 million b/d in 2021.